EURUSD remains subdued: the market continues to favour the US dollar

The EURUSD pair starts the week quietly, with the US dollar maintaining its strength. Find out more in our analysis for 18 November 2024.

EURUSD forecast: key trading points

Fundamental analysis

The EURUSD rate is hovering around 1.0531 on Monday morning.

Last week ended with the most substantial weekly gain for the US currency in a month, driven by a global reassessment of expectations regarding future US Federal Reserve interest rate cuts. Investors are factoring in President-elect Donald Trump’s pro-inflationary policies and adjusting their outlook accordingly.

This benefits the US dollar, as heightened inflationary pressures would compel the Fed to maintain higher interest rates than previously anticipated.

Last Thursday, Federal Reserve Chair Jerome Powell noted that the regulator need not rush into cutting rates, causing a widespread revision of expectations for the Federal Reserve’s December decision.

The EURUSD forecast appears minor.

EURUSD technical analysis

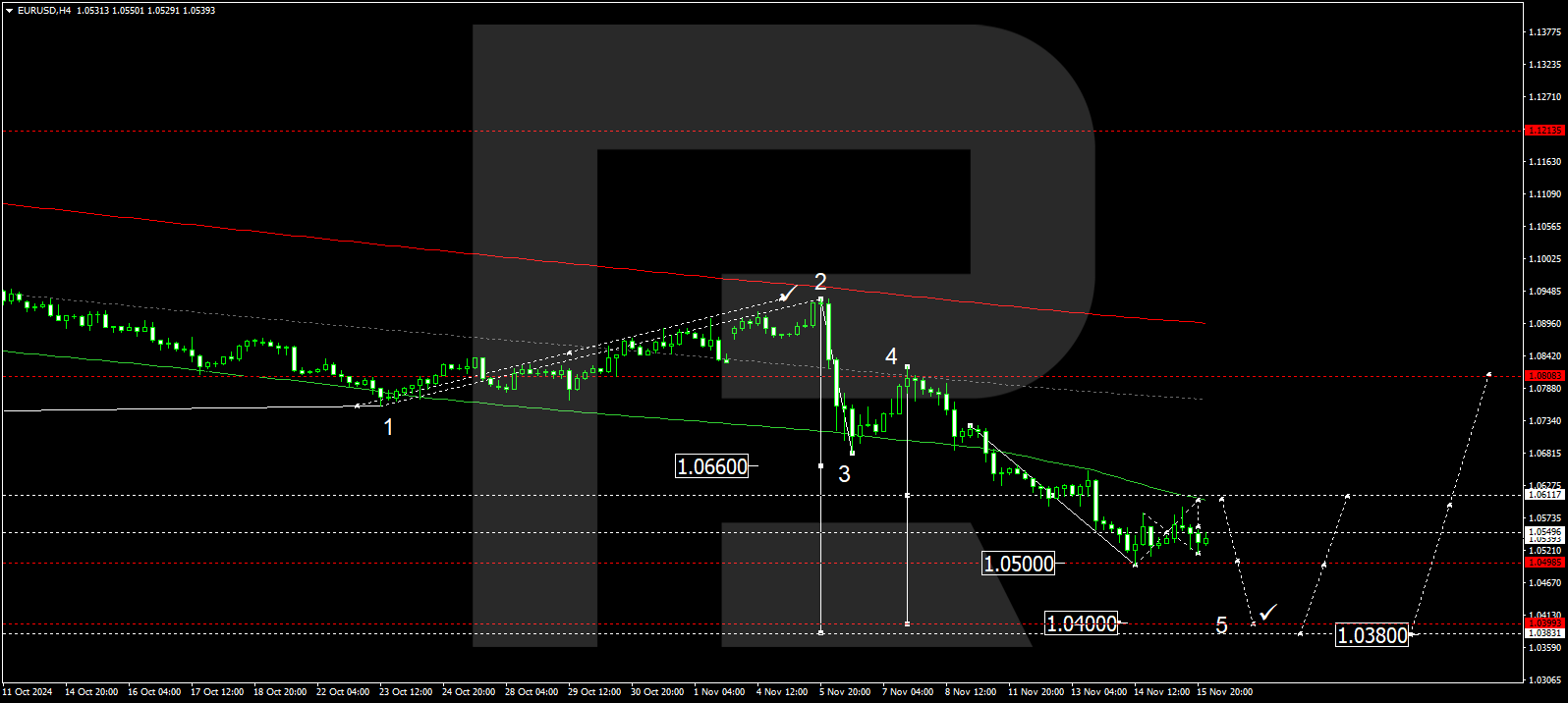

The EURUSD H4 chart indicates that the market is forming a consolidation range around 1.0555, which could extend upwards to the 1.0600 level today, 18 November 2024. After reaching it, the price will likely decline to 1.0555. If this level breaks and the price exits the consolidation range downwards, a further movement towards 1.0400 is likely, with a potential extension to 1.0380 as the primary target.

The Elliott Wave structure and matrix of the downward wave’s second half, with a pivot point at 1.0600, technically support this scenario. This level is considered crucial within the downward wave structure for the EURUSD rate. The market has advanced to the lower boundary of a price envelope at 1.0500, with a consolidation range forming above this level. An upward breakout could lead to a correction towards the envelope’s central line at 1.0660. Conversely, a downward breakout could extend the wave towards the lower boundary of the envelope at 1.0400.

Summary

While the EURUSD pair is stable on Monday morning, fundamental factors indicate the potential for further decline. Technical indicators for today’s EURUSD forecast suggest that the downward wave could continue towards the 1.0400 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.