EURUSD is under pressure amid positive US data

The EURUSD rate is showing a correction after yesterday’s aggressive decline. Find out more in our analysis for 22 November 2024.

EURUSD forecast: key trading points

- The likelihood of a Federal Reserve interest rate cut in December is estimated by markets at 55.9%, with some traders expecting a pause

- US initial jobless claims fell to a seven-month low

- US existing home sales increased by 3.4% in October

- EURUSD forecast for 22 November 2024: 1.0400, 1.0380, and 1.0320

Fundamental analysis

The EURUSD rate has been declining for the fourth consecutive day. Sellers have secured positions below the short-term support level at 1.0510, while the crucial 1.0450 support remains intact. The US dollar is hovering at two-year highs, driven by investors’ optimism about the Federal Reserve’s monetary policy outlook. The odds of a December rate cut are decreasing: markets currently estimate the likelihood of a 25-basis-point reduction at 55.9%, while some traders expect a temporary pause.

Thursday’s data revealed that US initial jobless claims unexpectedly dropped to a seven-month low. The number of Americans filing for benefits for the first time fell by 6,000 to 213,000. As per today’s EURUSD forecast, this data confirms the labour market’s strength and supports the US dollar.

US existing home sales increased 3.4% in October compared to the previous month, reaching 3.96 million homes year-on-year. Additionally, in October, the property resale figure was 2.9% higher year-on-year, marking the first annual increase since July 2021. This reinforces confidence in the resilience of the US economy.

EURUSD technical analysis

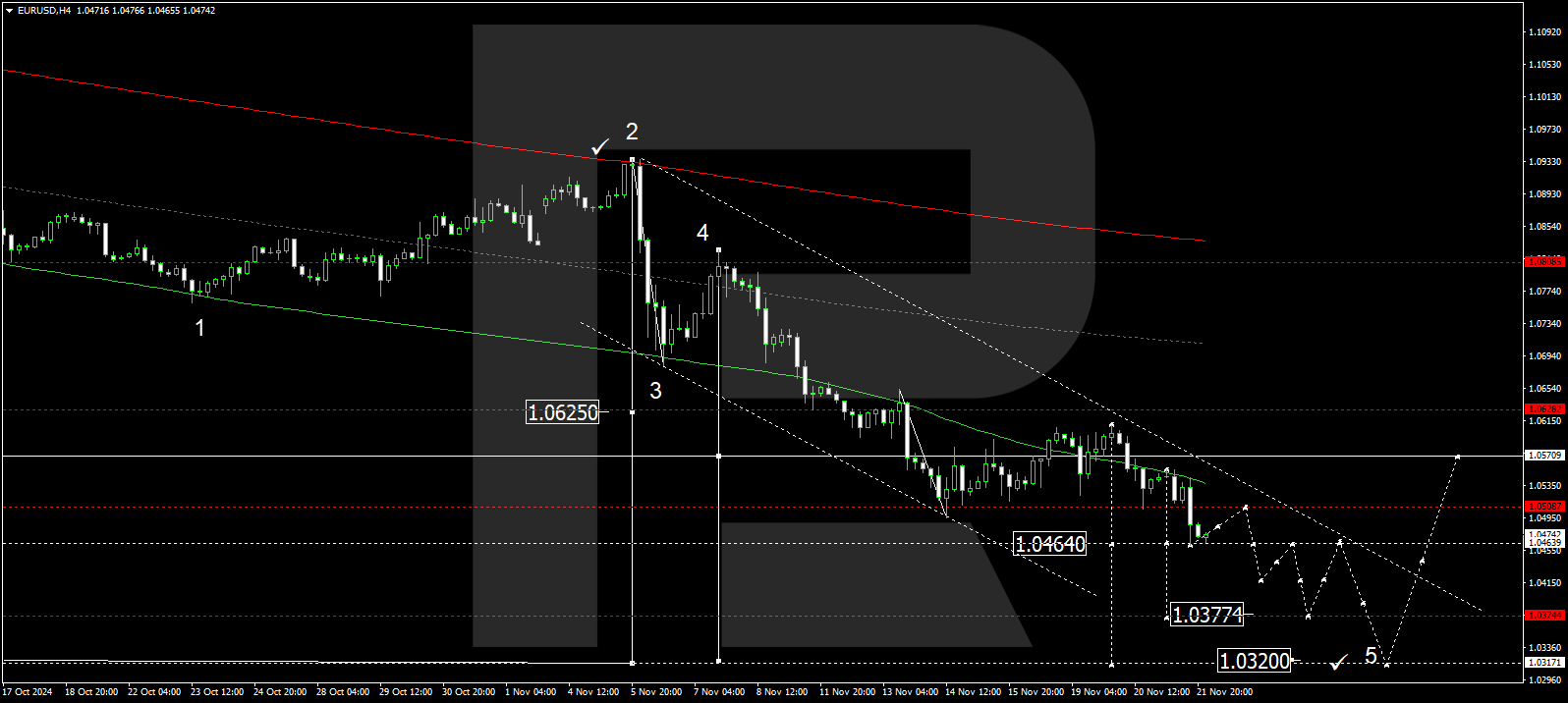

The EURUSD H4 chart shows that the market formed a consolidation range above 1.0500 before breaking below it and declining to 1.0464. The price could correct towards 1.0500 (testing from below) today, 22 November 2024. Subsequently, the second half of a downward wave might develop, aiming for the 1.0400, 1.0380, and 1.0320 levels.

The Elliott Wave structure and matrix for the second half of the downward wave, with a pivot point at 1.0500, technically support this scenario. This level is crucial for the downward wave in the EURUSD rate. The market has declined to 1.0464, where a compact consolidation range could form. Subsequently, the downward structure is expected to extend further towards the envelope’s lower boundary at 1.0320.

Summary

The EURUSD rate continues to decline due to the current strength of the US dollar, which is supported by optimism surrounding the Fed’s monetary policy and positive economic data. A more robust labour market and rising US home sales underscore economic resilience, reinforcing the US currency’s position. Technical indicators for today’s EURUSD forecast suggest the wave could extend towards the 1.0400, 1.0380, and 1.0320 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.