GBPUSD declines at the beginning of the week as the news lull ends

The British pound sterling is undergoing a correction after its recent rise and is trading at 1.2691, as the impact of the US dollar has returned in full force. Find out more in our analysis for 2 December 2024.

GBPUSD forecast: key trading points

- The GBPUSD pair rose briefly before pausing

- The extended US holidays provided support for the pound’s rise

- GBPUSD forecast for 2 December 2024: 1.2635 and 1.2763

Fundamental analysis

The GBPUSD rate has dropped to 1.2691.

At the end of last week, the GBP strengthened against the US dollar as overseas investors observed an extended Thanksgiving holiday. Trading volumes were low, but November proved to be highly volatile.

However, the pound’s November losses against the US dollar were less pronounced than the euro’s. The GBP’s resilience was supported by expectations of a more decisive monetary policy from the Bank of England and the threat of tariff complications from the new US administration. For the pound, the absence of news was indeed good news.

The GBPUSD forecast appears moderate.

GBPUSD technical analysis

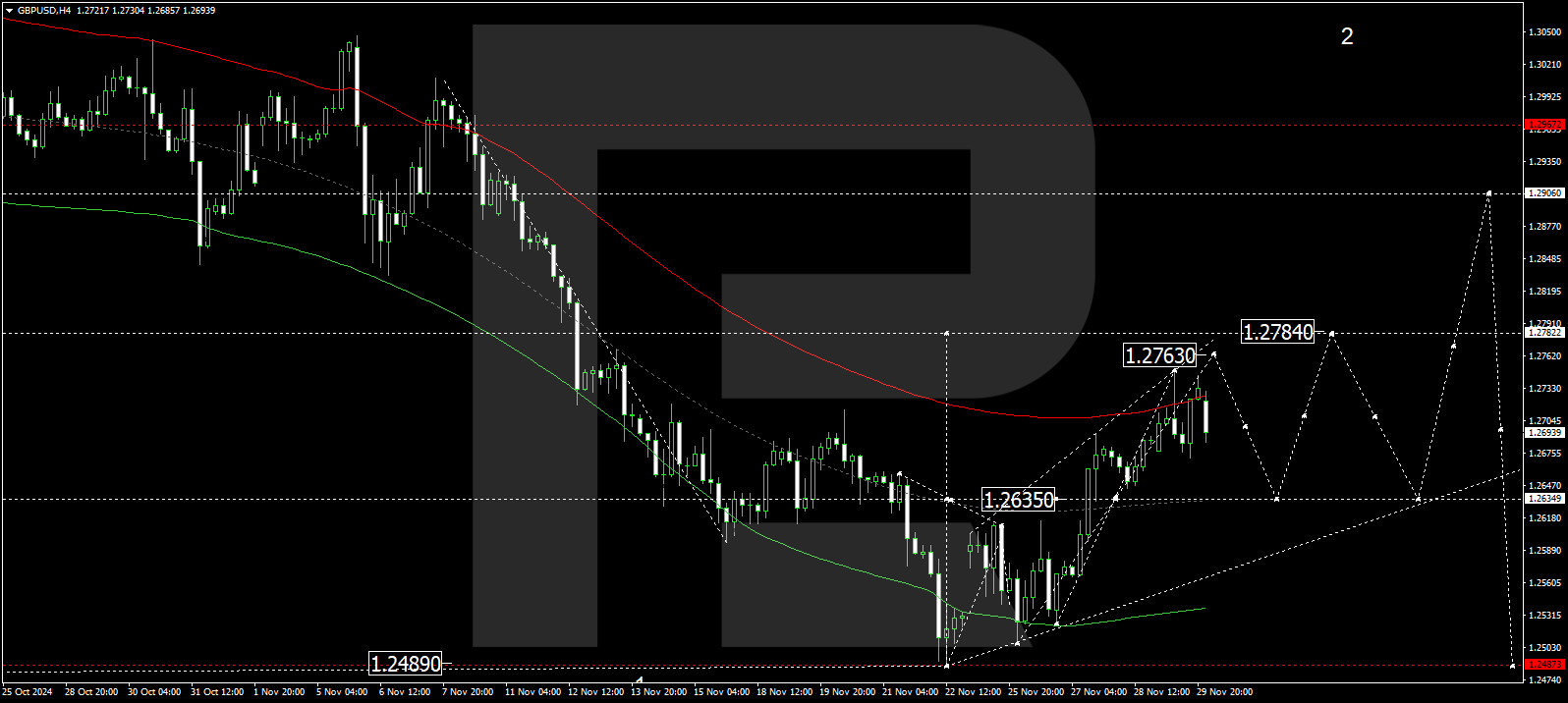

The GBPUSD H4 chart shows that the market has reached the 1.2749 level. A correction towards 1.2635 might form today, 2 December 2024, followed by a rise to 1.2763, the local target. A wide consolidation range could form around 1.2635. If the price breaks upwards, the wave could extend to 1.2784. A breakout below the range will open the potential for a downward wave towards 1.2480, with the trend potentially continuing towards 1.2445, the main target.

The Elliott Wave structure and wave matrix, with a pivot point at 1.2635, technically support this scenario for the GBPUSD rate. The market has climbed to the upper boundary of a price envelope at 1.2749. After reaching this level, the price could tumble to the envelope’s central line at 1.2635 before rising again to its upper boundary at 1.2784.

Summary

The GBPUSD pair has strengthened due to the news lull. Technical indicators for today’s GBPUSD forecast suggest a potential downward wave towards 1.2635, followed by an upward move to 1.2763.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.