BoE interest rate and weak USD: triggers for GBPUSD growth

Rising unemployment in the US is putting pressure on the USD. Against this backdrop, GBPUSD may continue to rise toward the 1.3590 area. Details — in our analysis for 24 December 2025.

GBPUSD forecast: key takeaways

- Primary Jobless Claims in the US: previous value — 224K, forecast — 227K

- Current trend: moving upwards

- GBPUSD forecast for 24 December 2025: 1.3590 and 1.3472

Fundamental analysis

The GBPUSD forecast for December 17, 2025 is favorable for the British pound, as prices have strong potential for further growth following a minor correction.

US Initial Jobless Claims show the number of people filing for unemployment benefits for the first time during the previous week. This indicator reflects labor market conditions, and an increase signals rising unemployment.

The previous reading stood at 224K, while today’s forecast looks unfavorable for the USD, with expectations pointing to an increase to 227K. Although the expected rise is modest, actual data may differ significantly from forecasts, and such a deviation could negatively impact USD positions.

The Bank of England kept the interest rate unchanged at 4.0%, which in turn provided some support to the British pound.

GBPUSD technical analysis

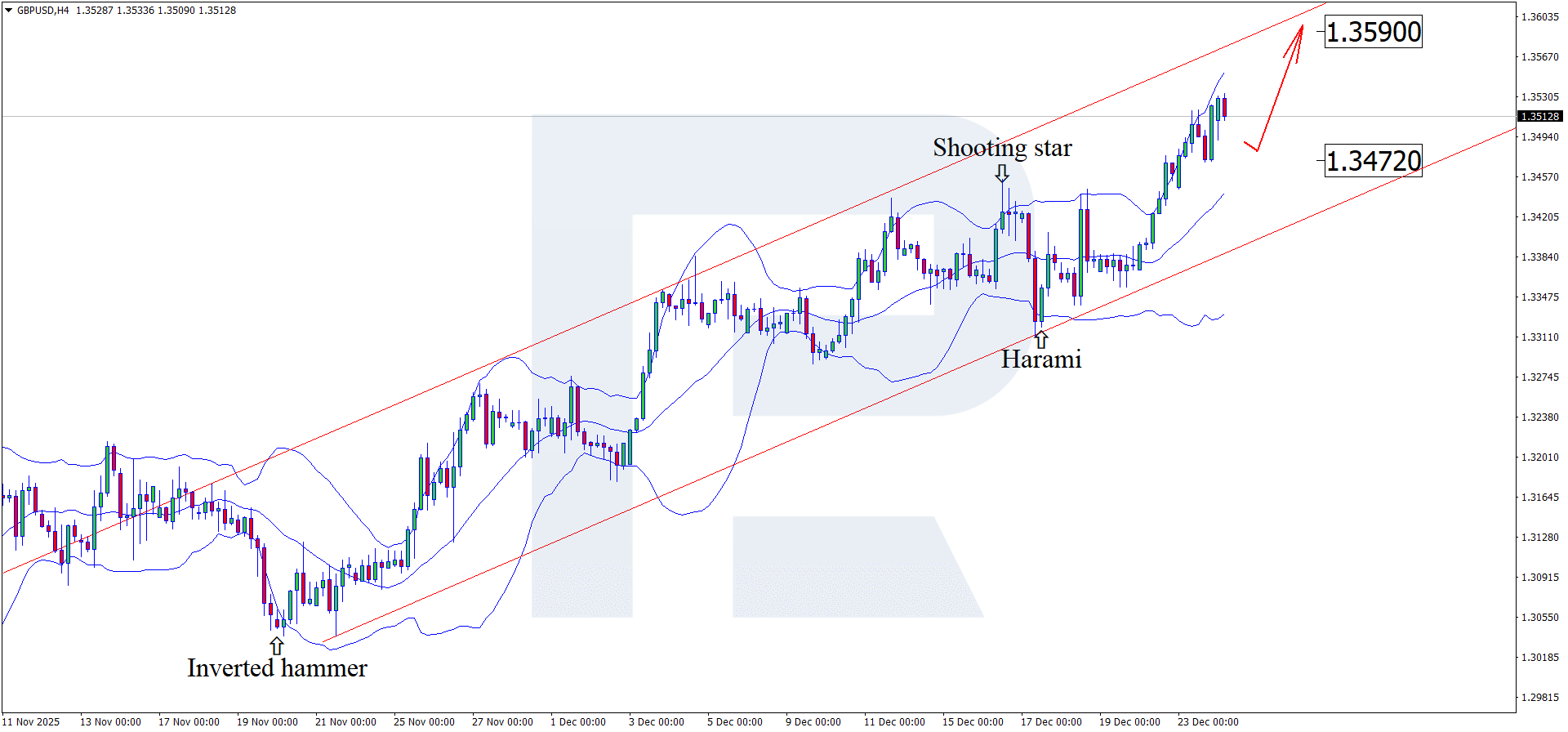

On the H4 chart, GBPUSD tested the lower Bollinger Band and formed a Harami reversal pattern. At this stage, the pair may continue its upward wave as the pattern signal plays out. The current upside target is 1.3590. A breakout above resistance would open the way for a stronger bullish trend.

The forecast for December 24, 2025 also considers an alternative scenario, involving a corrective pullback toward 1.3472 before growth resumes.

Summary

USD weakness continues amid soft US macroeconomic data. Technical analysis of GBPUSD for today suggests a continuation of the upward move toward 1.3590 following a correction.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.