The pound gains strength: will GBPUSD withstand the impact of US employment data

Ahead of US employment statistics, the GBPUSD pair is forming an upward wave, with quotes testing the 1.3660 level. Discover more in our analysis for 11 February 2026.

GBPUSD forecast: key takeaways

- US unemployment rate: previously at 4.4%, projected at 4.4%

- US Nonfarm Payrolls: previously at 50 thousand, projected at 70 thousand

- GBPUSD forecast for 11 February 2026: 1.3770

Fundamental analysis

The GBPUSD forecast for today, 11 February 2026, is favourable for the pound, with quotes having strong potential for further growth after a minor correction.

The outlook takes into account that the US unemployment rate for January may remain unchanged at 4.4%, which will be a neutral factor for the USD.

The market’s primary focus remains on US statistics, particularly the Nonfarm Payrolls report. US NFP is projected to increase to 70 thousand from the previous 50 thousand. Any deviation of actual data from expectations may sharply increase volatility in the pair. From the UK side, there are few significant releases; however, expectations regarding further steps by the Bank of England remain a supportive factor for the GBP. The regulator maintains cautious rhetoric, signalling that decisions will depend on inflation dynamics.

In the short term, the GBPUSD rate remains highly sensitive to US news. Strong data may restore pressure on the pound, while weak statistics will strengthen the pair’s potential for further gains.

Technical outlook

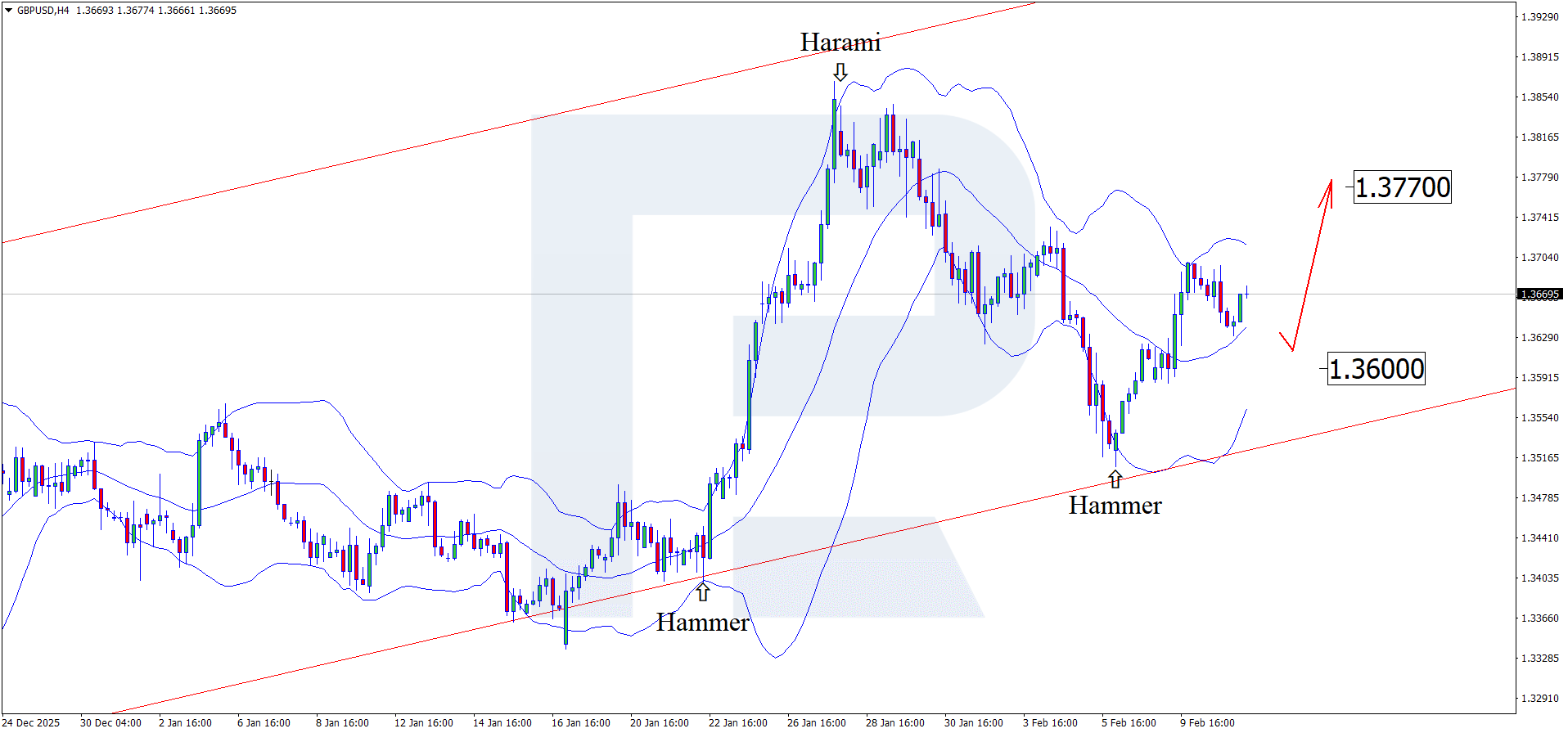

Having tested the lower Bollinger Band, the GBPUSD pair formed a Hammer reversal pattern on the H4 chart and may continue its upward movement following the pattern’s signal. The current upside target stands at 1.3770. A breakout above this resistance will open the door for continued upward momentum.

The GBPUSD forecast for today also considers an alternative scenario, in which the price undergoes a correction towards 1.3600 before renewed growth.

GBPUSD overview

- Asset: GBPUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 1.3770 and 1.3850

- Key support levels: 1.3600 and 1.3525

GBPUSD trading scenarios for today

Main scenario (Buy Stop )

Consolidation above 1.3700 will form a bullish market structure, with the next upside targets at the 1.3770 and 1.3850 resistance levels.

The risk-to-reward ratio is approximately 1:3.

- Buy Stop: 1.3700

- Take Profit: 1.3770

- Stop Loss: 1.3680

Alternative scenario (Sell Stop)

A breakout and consolidation below 1.3600 will indicate a breakdown of the current structure and increase the risks of a deeper correction after the January rally.

- Sell Stop: 1.3600

- Take Profit: 1.3520

- Stop Loss: 1.3650

Risk factors

Risks to the bullish GBPUSD scenario are associated with a potential strengthening of the US dollar and a more cautious tone from the Bank of England following its meeting. Positive US employment data may shift the balance towards continued corrective decline.

Summary

Amid expectations of US employment statistics, the pound continues to strengthen. GBPUSD technical analysis suggests growth towards the 1.3770 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.