GBPUSD: the pound is poised for a significant correction

A speech by a member of the Bank of England’s Monetary Policy Committee and a decline in US economic indicators may help the British pound regain ground. Discover more in our analysis for 25 November 2024.

GBPUSD forecast: key trading points

- A speech by Swati Dhingra, a member of the Bank of England’s Monetary Policy Committee

- Dallas Fed Manufacturing Index: previously at -3.0, projected at -9.6

- GBPUSD forecast for 25 November 2024: 1.2545 and 1.2600

Fundamental analysis

Today, 25 November 2024, Swati Dhingra, a member of the Bank of England’s Monetary Policy Committee, will deliver a speech at the third Bank of England Watchers conference dedicated to inflation issues. In her speech, she will analyse the current inflation environment and evaluate the role of qualitative data in monetary policymaking.

In her speech, Dhingra is expected to raise issues of sustainable inflation, accurate forecasting, and the importance of adopting data-driven approaches when making economic decisions. She has previously numerously emphasised the need to improve the quality of economic data and revise forecasting models to better respond to macroeconomic challenges.

This speech will likely provide insights into the Bank of England’s future monetary policy actions, including efforts to reduce inflation and stabilise interest rates.

The fundamental analysis for 25 November 2024 indicates that Dhingra’s speech’s positive tone may support the British pound.

The Dallas Fed Manufacturing Index, released monthly, provides information on business conditions and the level of activity in the Texas manufacturing sector.

It is based on a survey of over 100 major regional manufacturing companies. Managers of these companies answer questions about changes in key indicators (including output, new orders, employment rate, and price dynamics) and expectations for the next six months. Additionally, they assess overall business activity based on criteria indicating growth, decline, or stability.

An index is calculated for each indicator by subtracting the percentage of respondents reporting a decrease from those reporting an increase. A positive index reading indicates improving business conditions. The results are seasonally adjusted to enhance the accuracy of the analysis.

The forecast for 25 November 2024 suggests the index may decline to -9.6. While not a major indicator, Texas's manufacturing sector is the top US exporter and the second largest by output, following the state of California.

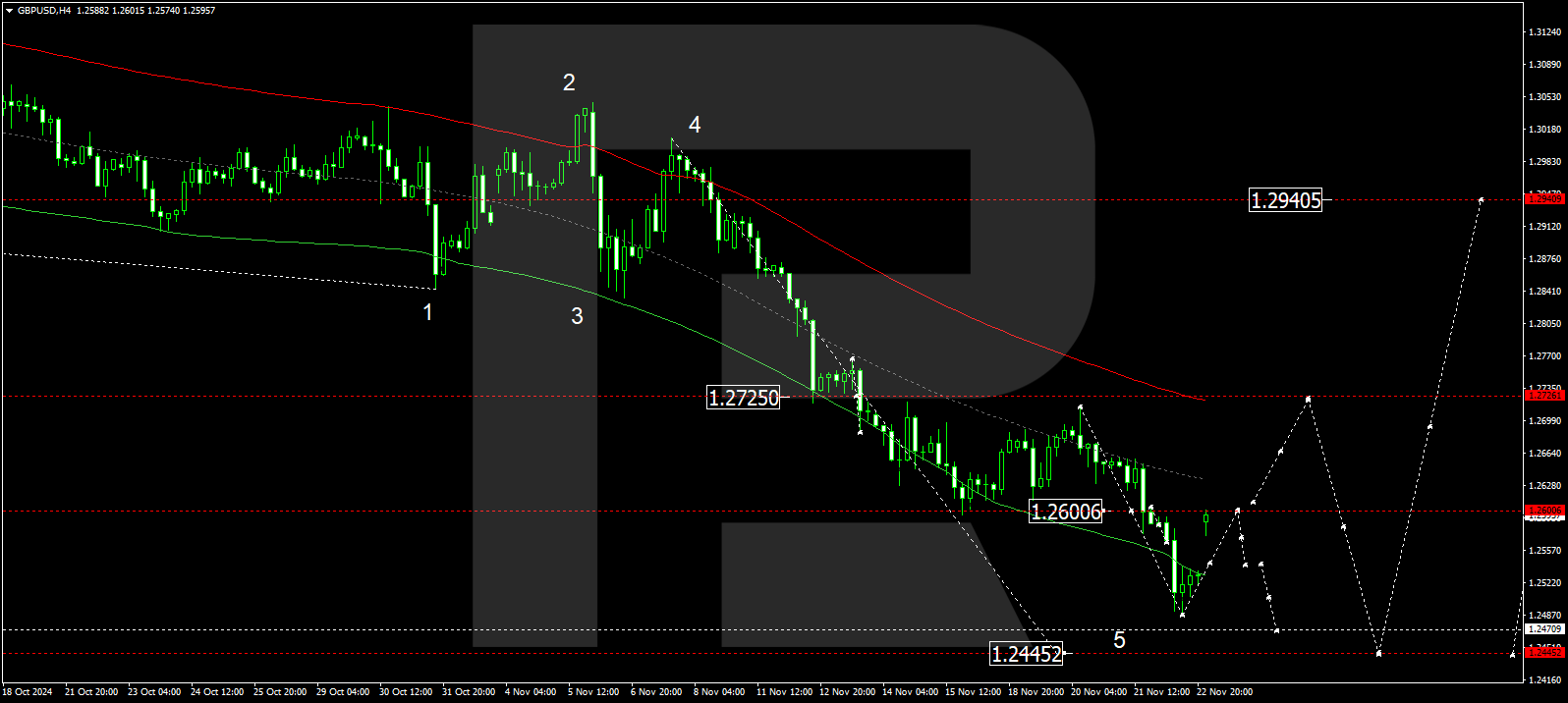

GBPUSD technical analysis

The GBPUSD H4 chart shows that the market has reached the local target of 1.2487. Today, 25 November 2024, a correction towards 1.2600 is possible, followed by a decline towards 1.2545. A new consolidation range may form around this level. An upward breakout could extend the correction towards 1.2660. A breakout below the range would open the potential for a downward wave towards 1.2470 and potentially further towards the local target of 1.2445.

The Elliott Wave structure and wave matrix, with a pivot point at 1.2725, technically support this scenario for the GBPUSD rate. The market has declined to the envelope’s lower boundary at 1.2487, which could be followed by potential growth towards the central line of the price envelope at 1.2600. An upward breakout would open the potential for a further correction towards its upper boundary at 1.2725.

Summary

Coupled with technical analysis for today’s GBPUSD forecast, the speech by the Bank of England’s Monetary Policy Committee member could influence the pound’s value and enable a potential downward wave towards the 1.2545 level, followed by growth to the 1.2600 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.