NZDUSD is at a two-year low: the situation could deteriorate further

The NZDUSD pair is falling to 0.5763, testing another local low under significant pressure from the US dollar. Find out more in our analysis for 13 December 2024.

NZDUSD forecast: key trading points

- The NZDUSD pair continues its steep decline

- The market reacts negatively to the US dollar’s strength and the RBNZ’s interest rate plans

- NZDUSD forecast for 13 December 2024: 0.5690

Fundamental analysis

The NZDUSD rate has plunged to a new two-year low at 0.5763.

Substantial pressure from the US dollar is the main trigger for the New Zealand dollar. The USD strengthened after the release of the latest November CPI data in the US. The indicator rose more than expected, driving a rally in US Treasury bond yields.

The external environment remains unfavourable for the NZD rate. Promises of additional stimulus measures from China have failed to stabilise the Kiwi. Furthermore, expectations of a significant RBNZ interest rate cut in 2025 weigh negatively on New Zealand’s national currency.

The NZDUSD forecast appears unsettling.

NZDUSD technical analysis

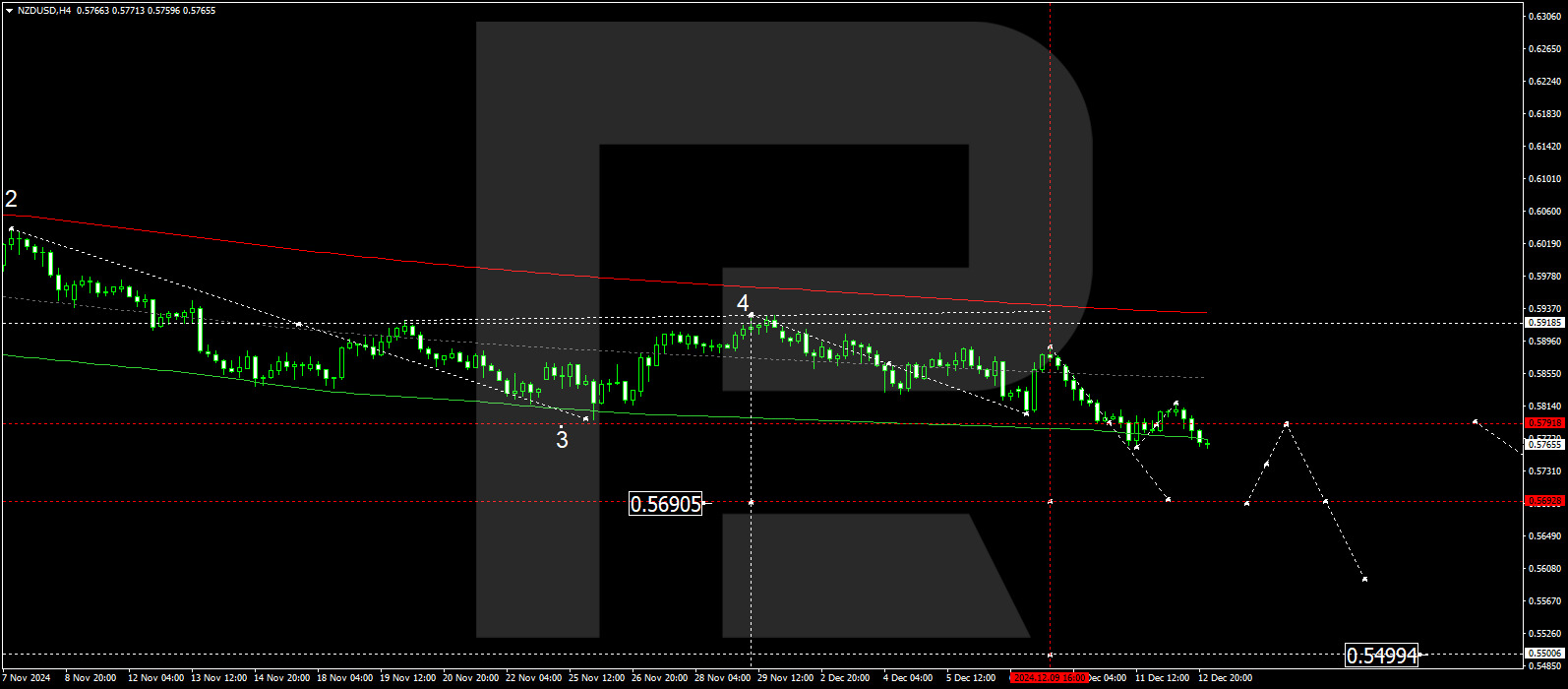

The NZDUSD H4 chart shows that the market is forming a downward wave towards the local target of 0.5690. This level is expected to be reached today, 13 December 2024, before a potential rise to 0.5790 (testing from below). Subsequently, a new downward wave may begin, aiming for 0.5595 and potentially extending the trend to the main target of 0.5500.

The Elliott Wave structure and wave matrix for the NZDUSD rate, with a pivot point at 0.5790, support this scenario. The market is forming a consolidation range around this level, with the price expected to break below the range towards the lower boundary of a price envelope at 0.5690. A correction may follow, targeting the central line at 0.5790.

Summary

The NZDUSD pair has incurred significant losses, with the minor trend only strengthening. Technical indicators for today’s NZDUSD forecast suggest that the downward wave could continue towards the 0.5690 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.