NZDUSD: the New Zealand dollar is still likely to strengthen

The US dollar continues to lose ground against the New Zealand dollar amid fundamental data. Find out more in our analysis for 8 November 2024.

NZDUSD forecast: key trading points

Fundamental analysis

The weekly Commodity Futures Trading Commission (CFTC) report analyses the volume of non-commercial traders’ speculative positions in the US markets. This report shows the difference between traders’ long and short NZD positions on the Chicago and New York futures markets. The CFTC report is published every Friday and covers data as of Tuesday of the current week.

According to the previous data, the number of long speculative NZD positions remains negative, indicating that bears dominate the market.

The fundamental analysis for 8 November 2024 shows that the number of speculative net NZD positions has been negative for three reporting periods. Nevertheless, the NZD may continue to strengthen against the US dollar.

The University of Michigan Consumer Sentiment Index is a key economic indicator that measures American consumers' confidence in the economy's current state and outlook. Published by the Institute for Social Research, this index is regularly used by economists, the government, and investors to predict consumer demand and analyse US economic trends.

The index is based on monthly surveys of approximately 500 American households. Respondents answer questions about:

Their current financial position and how it has recently changed

Their short-term economic forecasts and views on the economic outlook for the next 12 months

Their long-term expectations and views on economic conditions for the next five years

The forecast for 8 November 2024 suggests that the index may rise by 0.5% from the previous period.

US FOMC member Michelle Bowman, who is also a member of the Federal Reserve Board of Governors, will deliver a speech today, 8 November 2024. Her report may provide data on future US monetary policy.

NZDUSD technical analysis

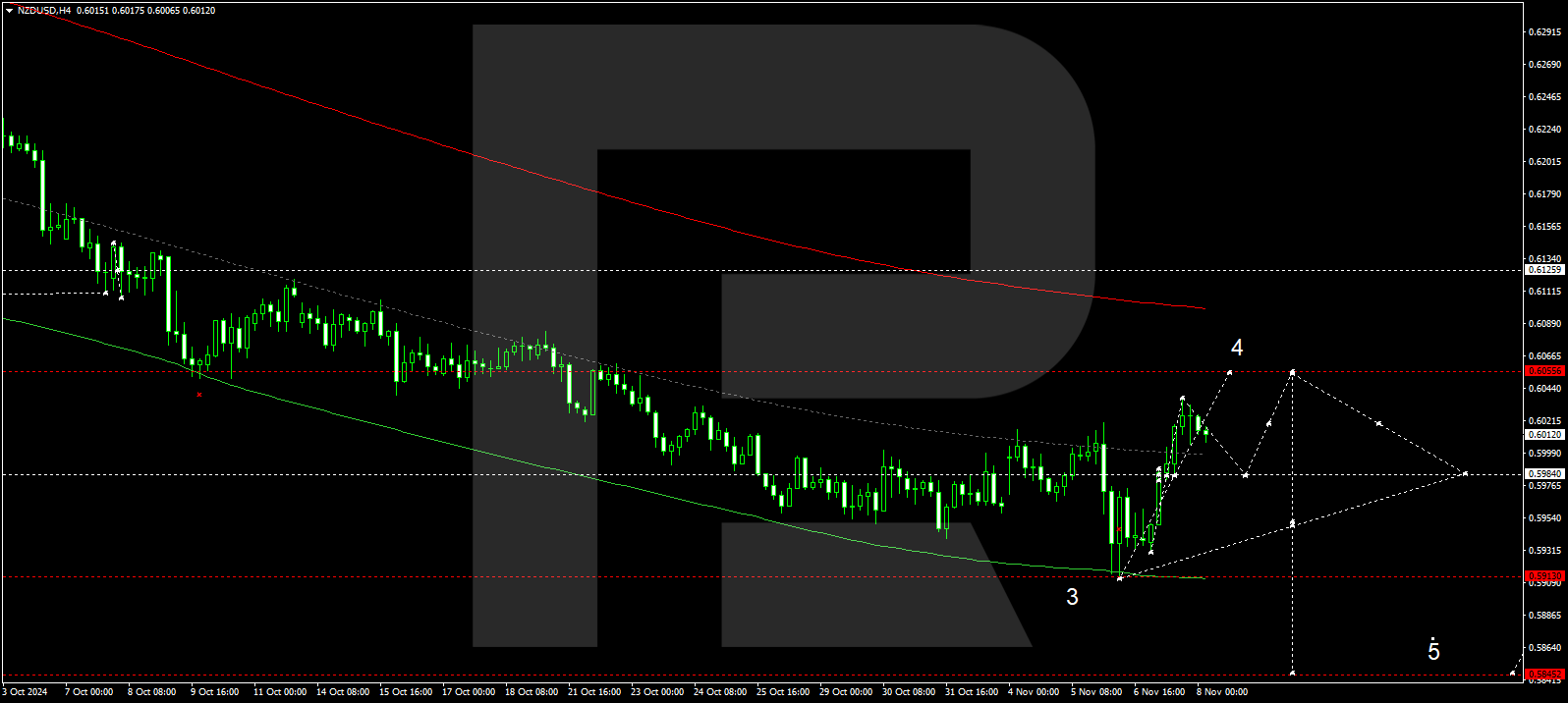

The NZDUSD H4 chart shows that the market has formed a consolidation range around the 0.5984 level. After breaking above it, the price has reached the local target of the growth impulse at 0.6037. A technical return to the 0.5984 level (testing from above) could follow today, 8 November 2024. Subsequently, upward momentum might continue to 0.6055, the first target. A downward wave could start once the price reaches this target, aiming for 0.5984.

The Elliott Wave structure and wave matrix for the NZDUSD rate, with a pivot point at 0.6125, technically confirm this scenario. The market is currently at the midline of a price envelope, with a consolidation range expected to form around this line. A breakout above this range could lead to the continuation of the corrective wave towards the upper boundary of the price envelope at 0.6055.

Summary

Together with the positive fundamental data from New Zealand, the technical analysis for today’s NZDUSD forecast suggests that the growth wave could continue towards the 0.6055 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.