EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 18 December 2024

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 18 December 2024.

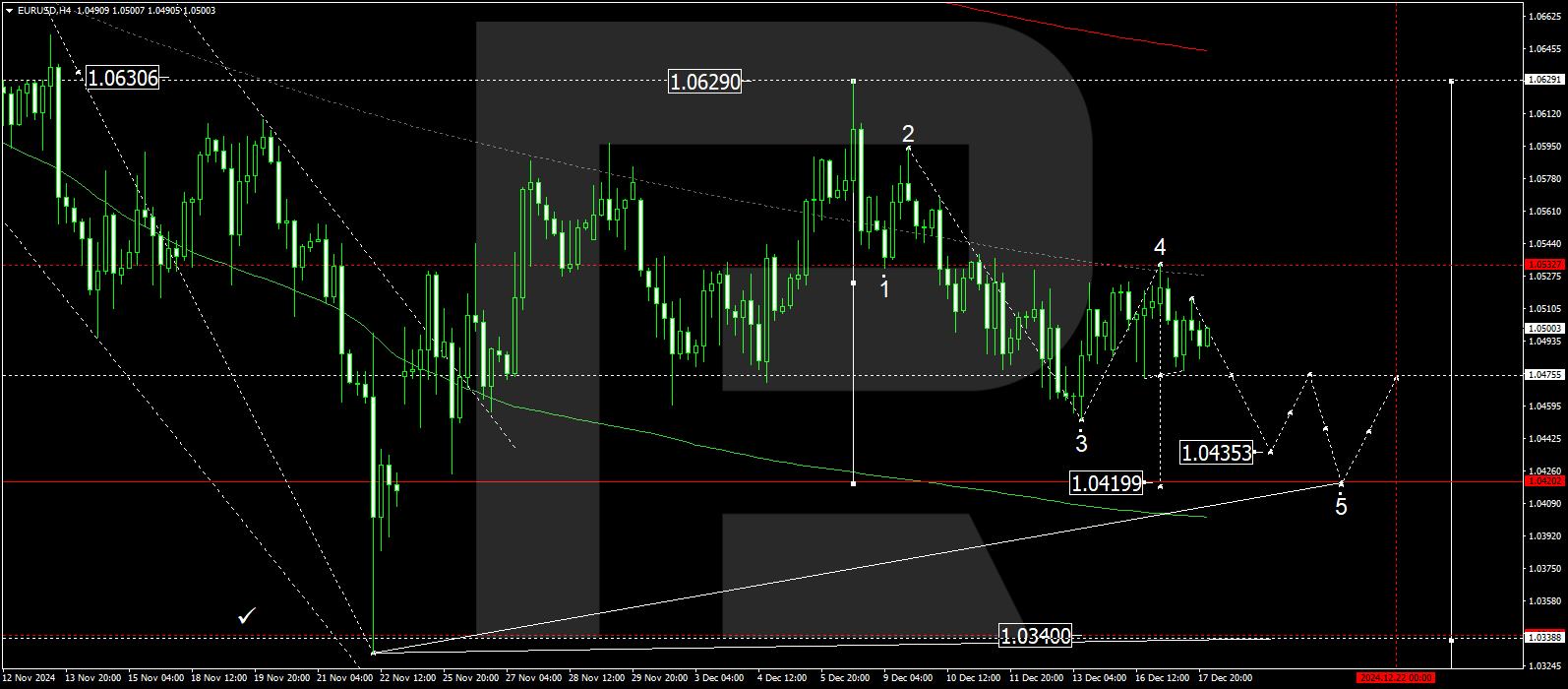

EURUSD forecast

The EURUSD H4 chart shows that the market has declined to 1.0478. Today, 18 December 2024, it has corrected towards 1.0515. Another downward wave structure is currently developing, aiming for 1.0475. Subsequently, a compact consolidation range could form around this level. A breakout below the range will open the potential for a downward movement towards 1.0435 and possibly further towards 1.0420, the primary target in this downward wave.

The Elliott Wave structure and matrix for the fifth downward wave, with a pivot point at 1.0475, technically confirm this scenario. This level is considered crucial for the downward wave in the EURUSD rate. The market has rebounded from the central line of a price envelope at 1.0533, with the downward wave expected to continue towards its lower boundary at 1.0420.

Technical indicators for today’s EURUSD forecast suggest a potential decline to the 1.0475 and 1.0435 levels.

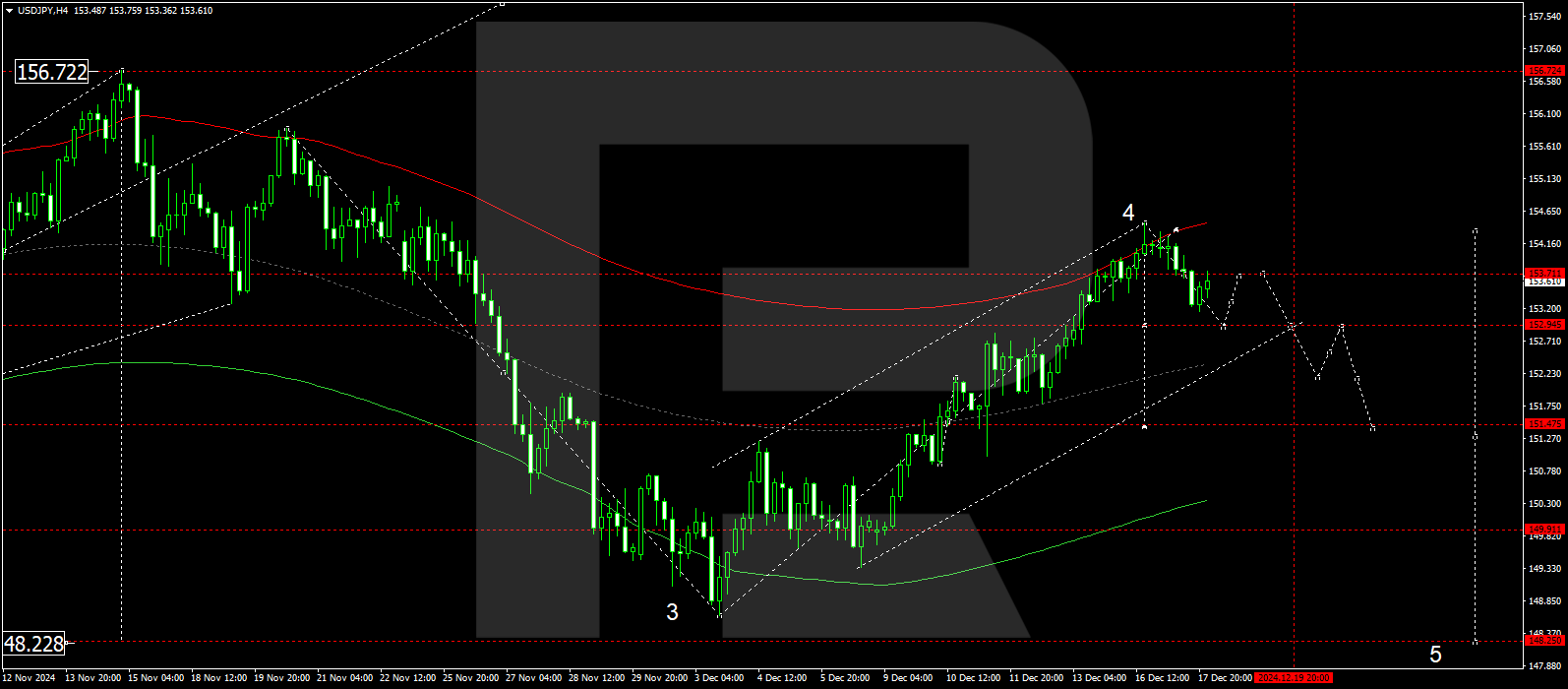

USDJPY forecast

The USDJPY H4 chart shows the market forming a downward wave towards 152.94. Today, 18 December 2024, the price is expected to reach this level and start correcting towards 153.73 (testing from below). Subsequently, a new downward wave could begin, aiming for 152.22 and possibly continuing the trend towards 151.51.

The Elliott Wave structure and growth wave matrix, pivoting at 151.51, technically support this scenario for the USDJPY rate. The market has rebounded from the upper boundary of a price envelope and maintains its downward momentum towards the central line of the envelope at 152.94. Subsequently, the price could break below this level, continuing the trend towards the envelope’s lower boundary at 151.51.

Technical indicators for today’s USDJPY forecast suggest a potential decline to the 152.92 level.

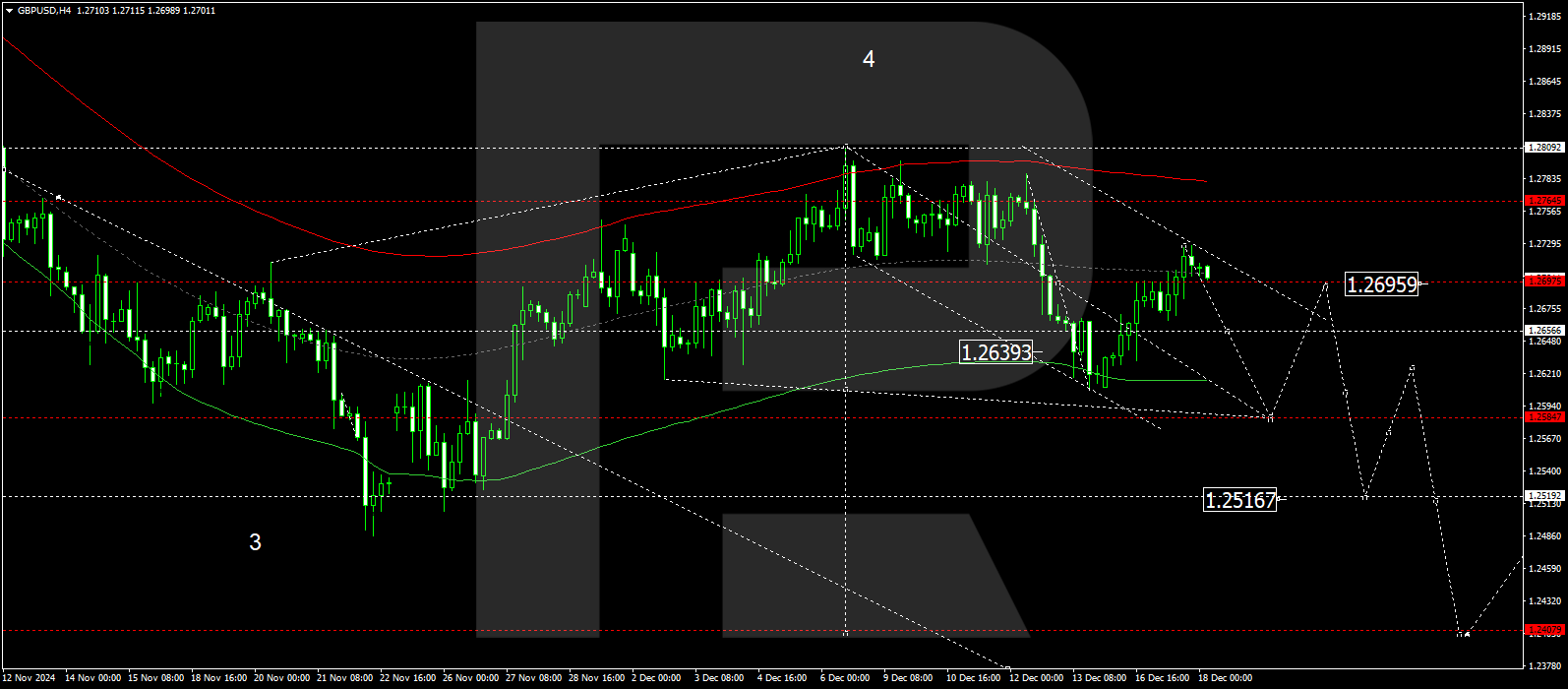

GBPUSD forecast

The GBPUSD H4 chart shows that the market has completed a corrective wave, reaching 1.2727. A downward wave towards the first target of 1.2585 may begin today, 18 December 2024. After reaching this level, a correction towards 1.2696 is possible. Subsequently, a new downward wave may develop, aiming for 1.2515 and potentially continuing towards 1.2400.

The Elliott Wave structure and wave matrix, with a pivot point at 1.2696, technically support this scenario for the GBPUSD rate. The market has rebounded from the envelope’s central line at 1.2727 and maintains its downward trajectory towards the local target of 1.2656. The downward wave may continue to develop, targeting the lower boundary of a price envelope at 1.2585.

Technical indicators for today’s GBPUSD forecast suggest that the downward wave could continue towards the 1.2656 and 1.2585 levels.

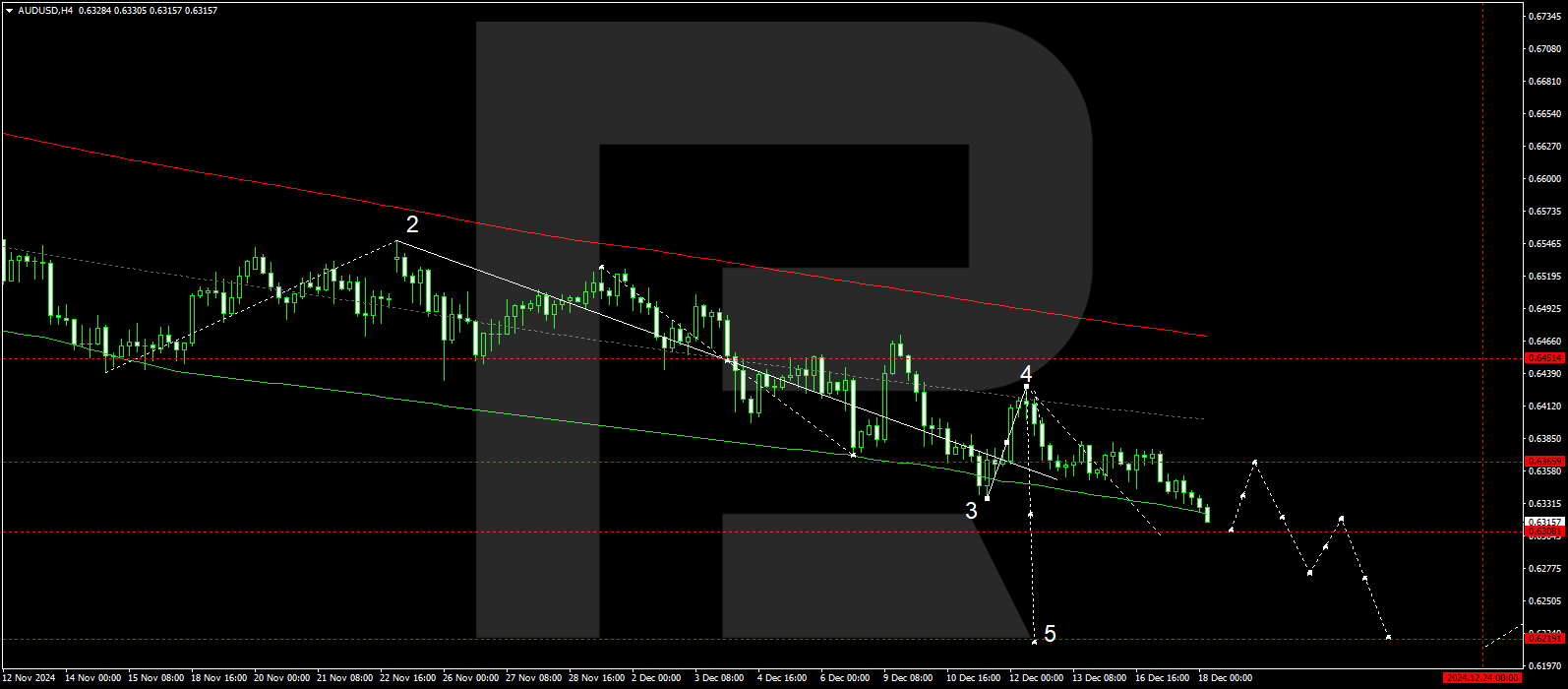

AUDUSD forecast

The AUDUSD H4 chart shows that the market has broken below 0.6333 and is continuing its downward momentum to the local target of 0.6300. Today, 18 December 2024, the price may correct towards 0.6363 (testing from below). A broad consolidation range may form around this level. After the price reaches it, another downward wave is expected to start, aiming for 0.6222 as the main target.

The Elliott Wave structure and downward wave matrix, with a pivot point at 0.6333, technically support this scenario for the AUDUSD rate. The market maintains its downward trajectory towards the lower boundary of a price envelope at 0.6300. Today, a correction towards the envelope’s central line at 0.6333 is expected. Subsequently, another wave will likely develop in line with the trend, targeting the envelope’s lower boundary at 0.6222.

Technical indicators for today’s AUDUSD forecast suggest that the growth wave could continue towards the 0.6300 level.

USDCAD forecast

The USDCAD H4 chart shows the market has completed a consolidation range around 1.4222 and, breaking above it, is continuing its movement towards 1.4333. The price is expected to reach this level today, 18 December 2024. Subsequently, a correction towards 1.4222 may begin, potentially followed by a new growth wave towards the main target of 1.4480.

The Elliott Wave structure and wave matrix, with a pivot point at 1,4222, technically support this scenario. This level is considered crucial for a growth wave in the USDCAD rate. The market continues its growth wave towards the upper boundary of a price envelope at 1.4333. After the price reaches this level, a downward wave may follow, aiming for the central line of a price envelope at 1.4222. Subsequently, a new growth wave could begin, targeting the envelope’s upper boundary at 1.4480.

Technical indicators for today’s USDJPY forecast suggest a potential decline to the 152.92 level.

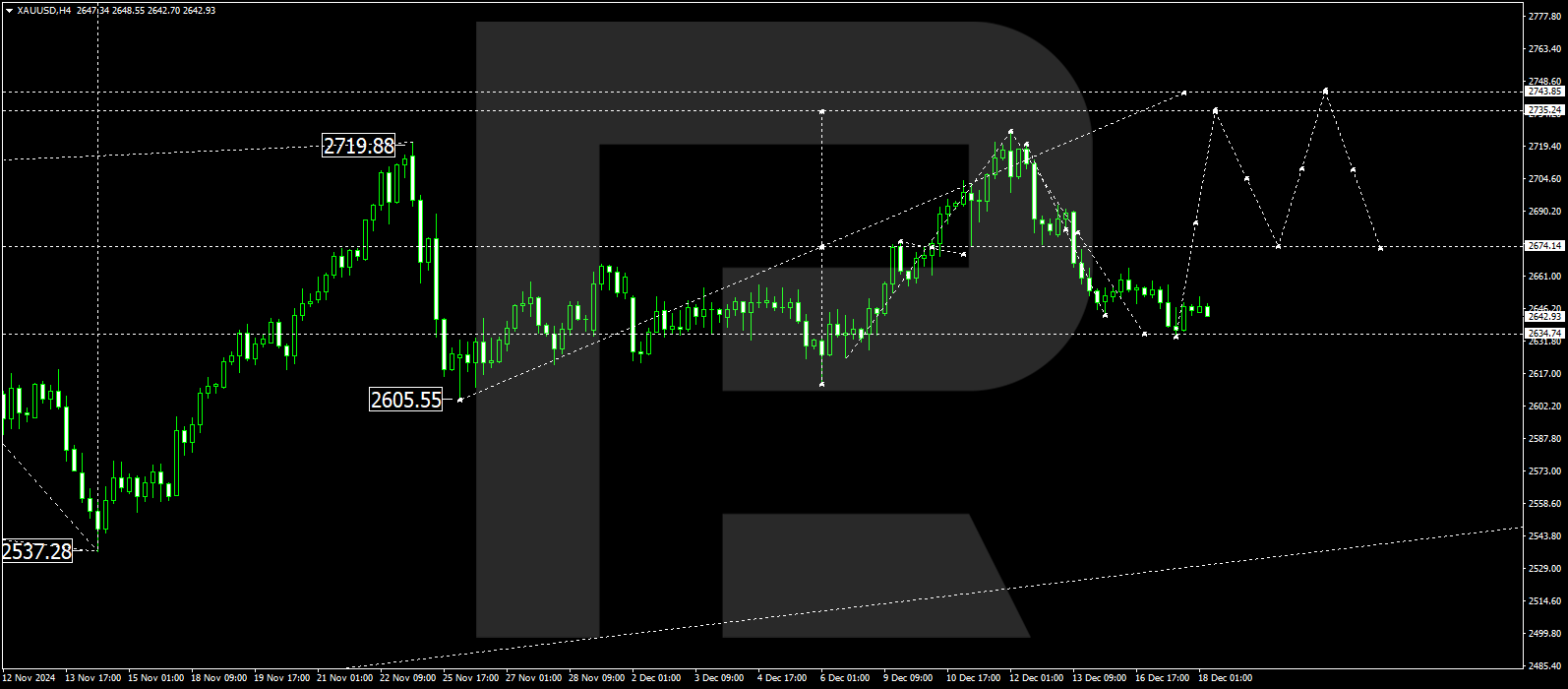

XAUUSD forecast

The XAUUSD H4 chart shows the market has formed a correction towards 2,634.70. A new wave is expected to begin today, 18 December 2024, targeting 2,690.00. A breakout above this level could extend the growth wave towards the local target of 2,735.25.

The Elliott Wave structure and wave matrix, with a pivot point at 2,674.00, technically support this scenario. This level is considered crucial for the uptrend in the XAUUSD rate. The market is forming a consolidation range around the central line of an envelope. Today, the trend might continue towards the envelope’s upper boundary at 2,735.25.

Technical indicators suggest a potential rise in the XAUUSD rate to the 2,690.00 and 2,735.25 levels.

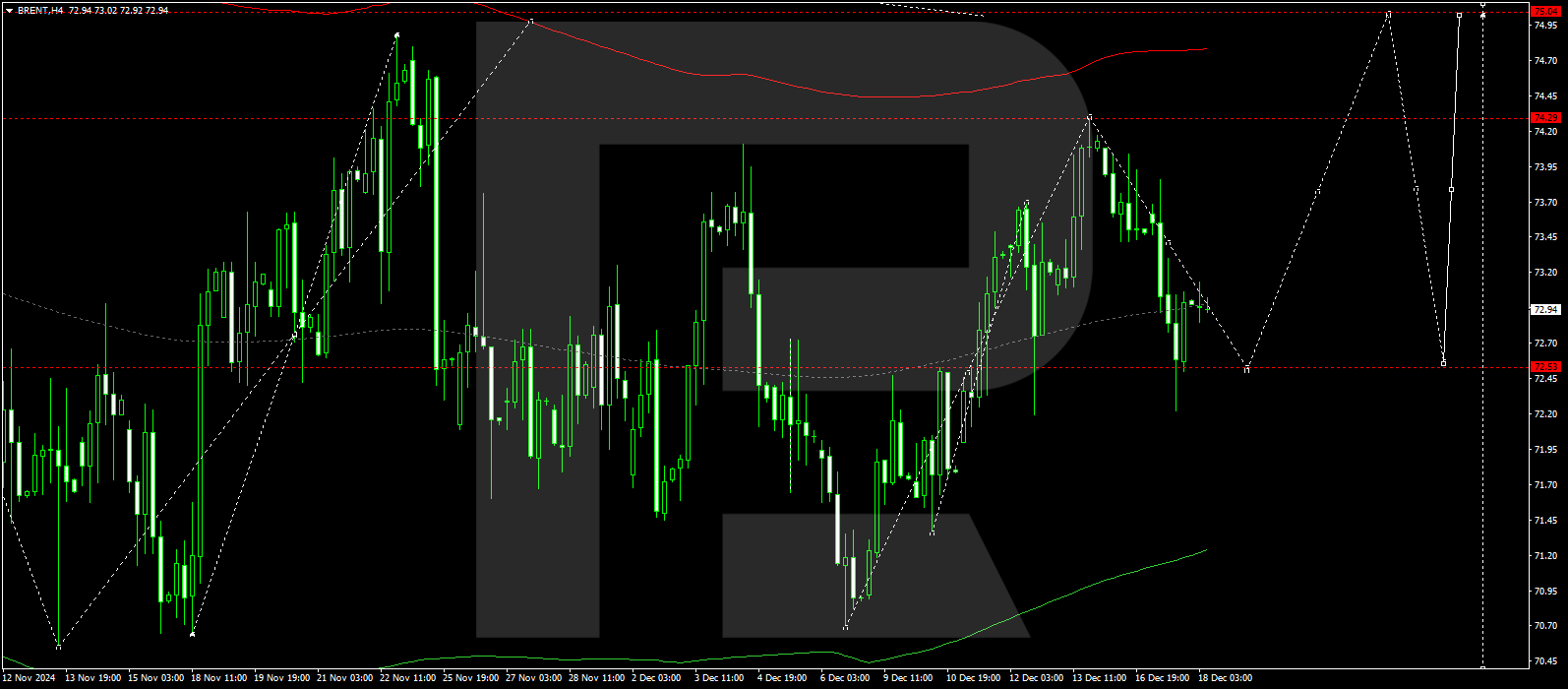

Brent forecast

The Brent H4 chart shows the market continuing to form a broad consolidation range around 72.55, which has extended to 74.30. Today, 18 December 2024, the price has technically returned to 72.55 (testing from above). Subsequently, a growth wave may begin, aiming for 75.05. With a breakout above this level, the trend could continue towards the local target of 79.00.

The Elliott Wave structure and wave matrix, with a pivot point at 72.55, technically support this scenario. This level is considered crucial for the Brent rate. The market has rebounded from the upper boundary of an envelope at 74.30, maintaining its downward trajectory towards the envelope’s central line at 72.55. Today, the trend could continue towards the envelope’s upper boundary at 75.05.

Technical indicators for today’s Brent forecast suggest a potential rise to the 74.30 and 75.05 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.