EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 24 January 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 24 January 2025.

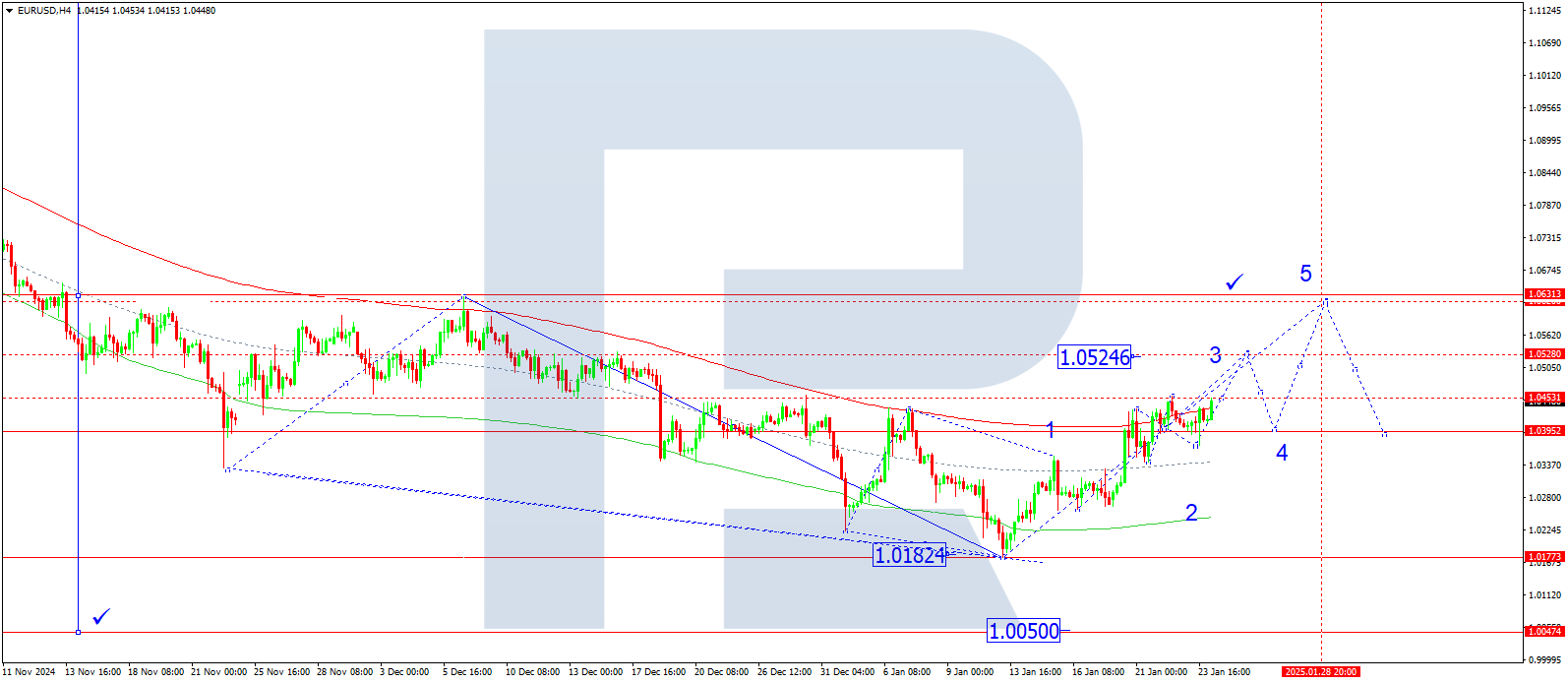

EURUSD forecast

On the H4 chart, EURUSD found support at 1.0372 and completed a growth wave to 1.0454. A consolidation range has formed around 1.0398. On 24 January 2025, an upward breakout could lead to growth towards 1.0525. After reaching this level, a decline to 1.0400 is expected. If the market breaks below the lower boundary of the range, movement towards 1.0300 may follow.

Technically, this scenario aligns with the Elliott Wave structure and the first-wave growth matrix centred at 1.0398, which is key for EURUSD. The market is consolidating around this level, and a breakout upwards could trigger a wave to the upper boundary of the price Envelope at 1.0525, followed by a decline to the central line at 1.0398.

Technical indicators for today’s EURUSD forecast suggest potential growth to 1.0525.

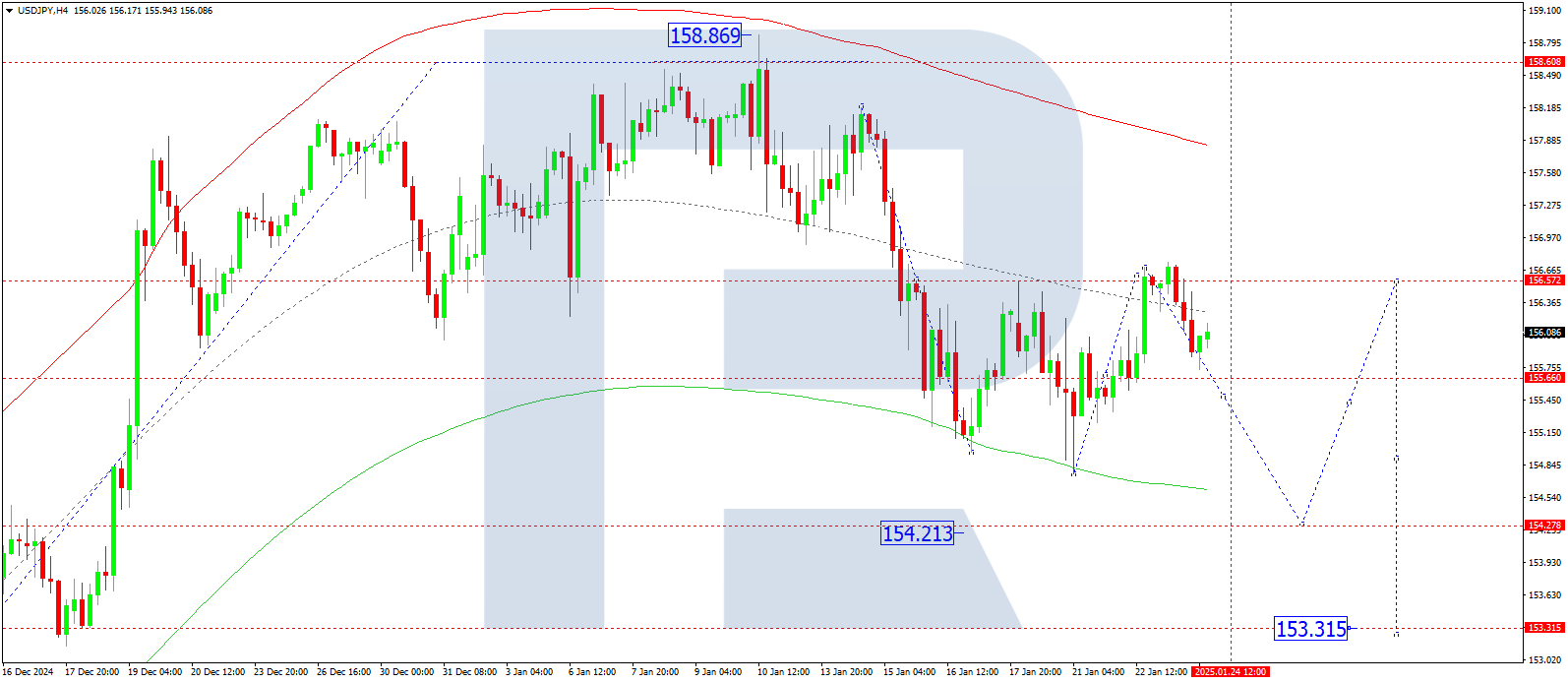

USDJPY forecast

On the H4 chart, USDJPY completed a growth wave to 156.69. On 24 January 2025, a decline to 155.60 is expected. If this level is broken, the market could continue to 154.20 as the first target. After reaching this level, a new growth wave to 156.56 is likely.

Technically, this scenario aligns with the Elliott Wave structure and the correction matrix centred at 156.56. The market is retracing from the central line of the price Envelope at 156.69 and is expected to move towards its lower boundary at 154.20.

Technical indicators for today’s USDJPY forecast suggest potential declines to 154.20.

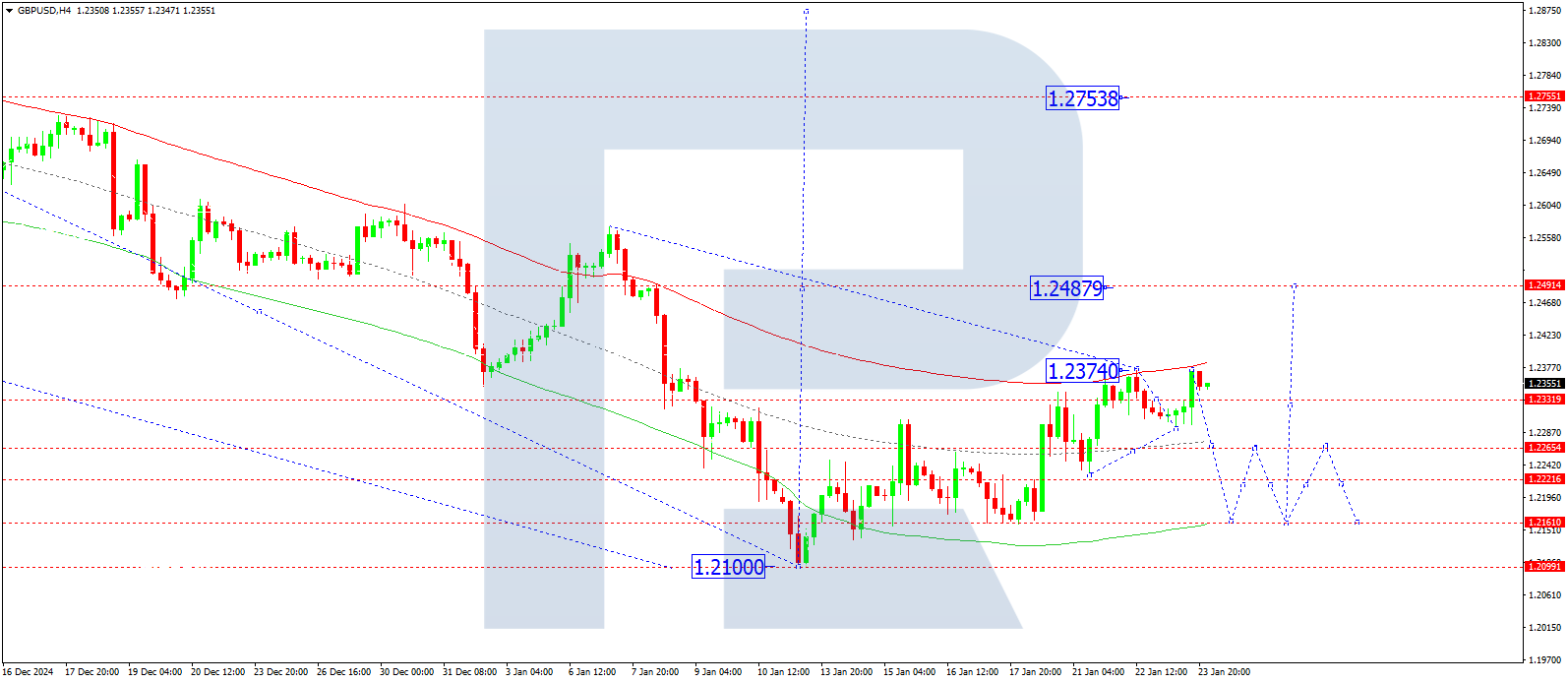

GBPUSD forecast

On the H4 chart, GBPUSD is consolidating around 1.2344. On 24 January 2025, an upward breakout may lead to a growth wave towards 1.2522. After reaching this level, a decline to 1.2344 is expected. If the market breaks below 1.2290, further movement towards 1.2222 may occur.

Technically, this scenario aligns with the Elliott Wave structure and the first-wave growth matrix centred at 1.2344. The market is consolidating above the central line of the price Envelope at 1.2344. An upward breakout could lead to a growth wave to the upper boundary at 1.2522, followed by a decline to the central line at 1.2344.

Technical indicators for today’s GBPUSD forecast suggest potential growth to 1.2522.

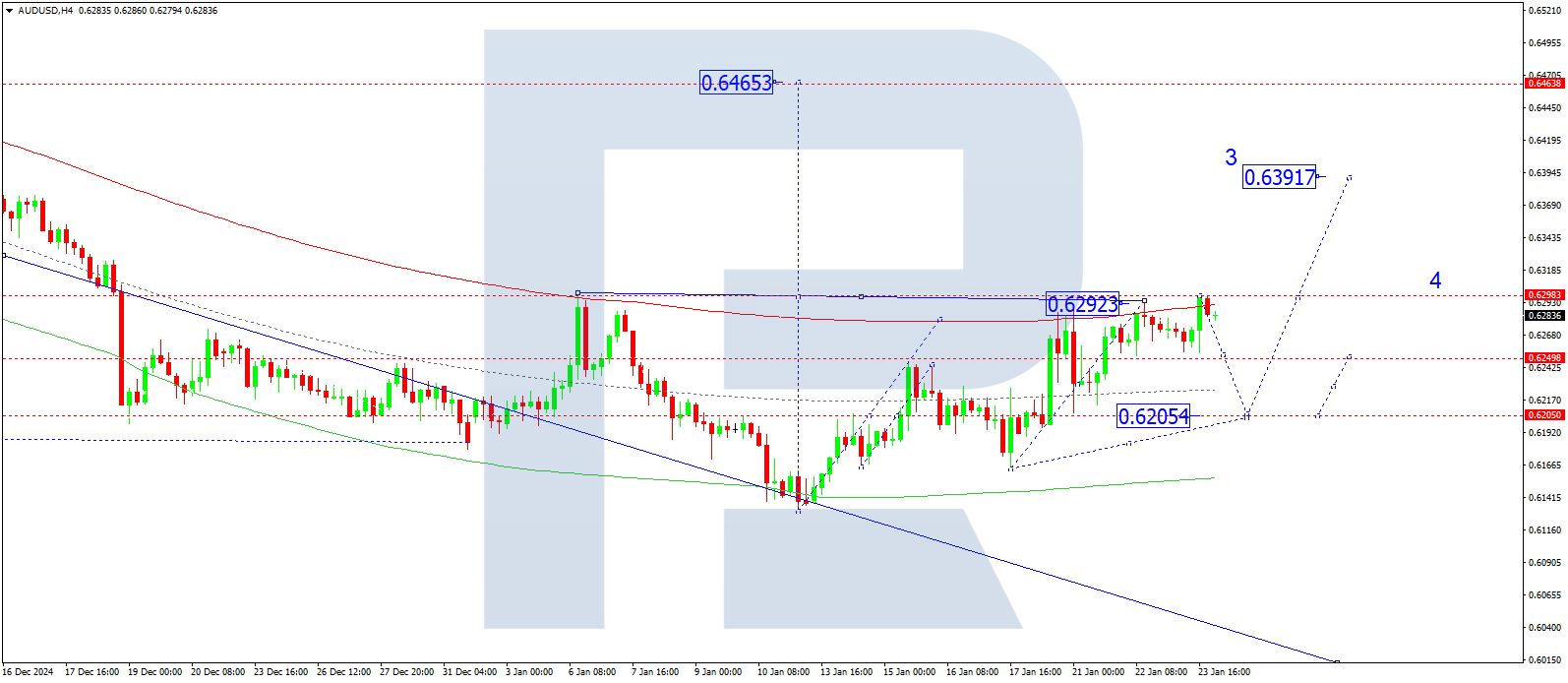

AUDUSD forecast

On the H4 chart, AUDUSD is consolidating around 0.6275. On 24 January 2025, growth towards 0.6344 is anticipated. After reaching this level, a decline to 0.6275 may occur. If the market breaks below 0.6275, movement towards 0.6200 could follow.

Technically, this scenario aligns with the Elliott Wave structure and the growth wave matrix centred at 0.6275. The market is consolidating around this level, with potential for a growth wave to the upper boundary of the price Envelope at 0.6344, followed by a decline to its central line at 0.6275.

Technical indicators for today’s AUDUSD forecast suggest potential growth to 0.6344.

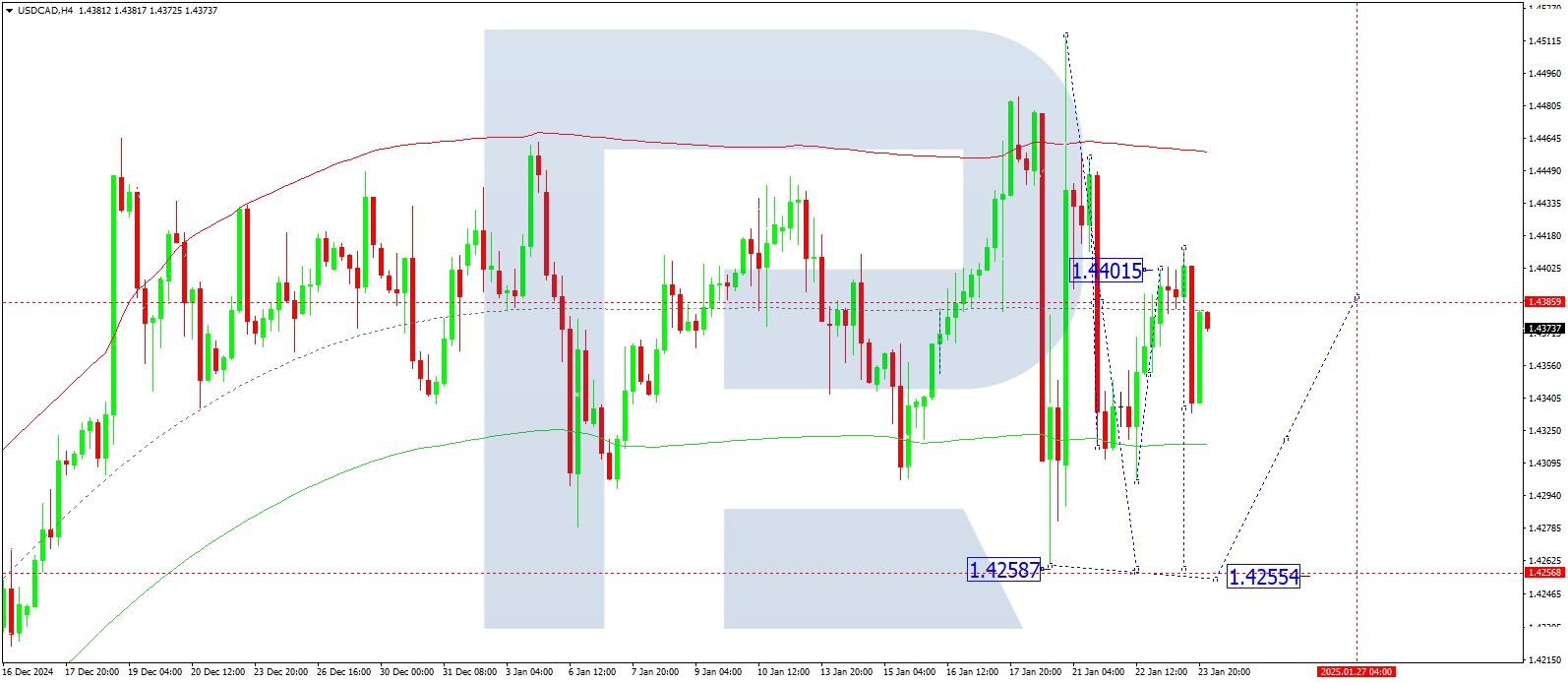

USDCAD forecast

On the H4 chart, USDCAD continues its downward wave towards 1.4255. On 24 January 2025, this target level is expected to be reached. After this, a growth wave towards 1.4400 may follow.

Technically, this scenario aligns with the Elliott Wave structure and the correction matrix centred at 1.4384, which is key for USDCAD. The market is developing a downward wave towards the lower boundary of the price Envelope at 1.4255, with subsequent growth towards the central line at 1.4384 likely.

Technical indicators for today’s USDCAD forecast suggest a decline to 1.4255.

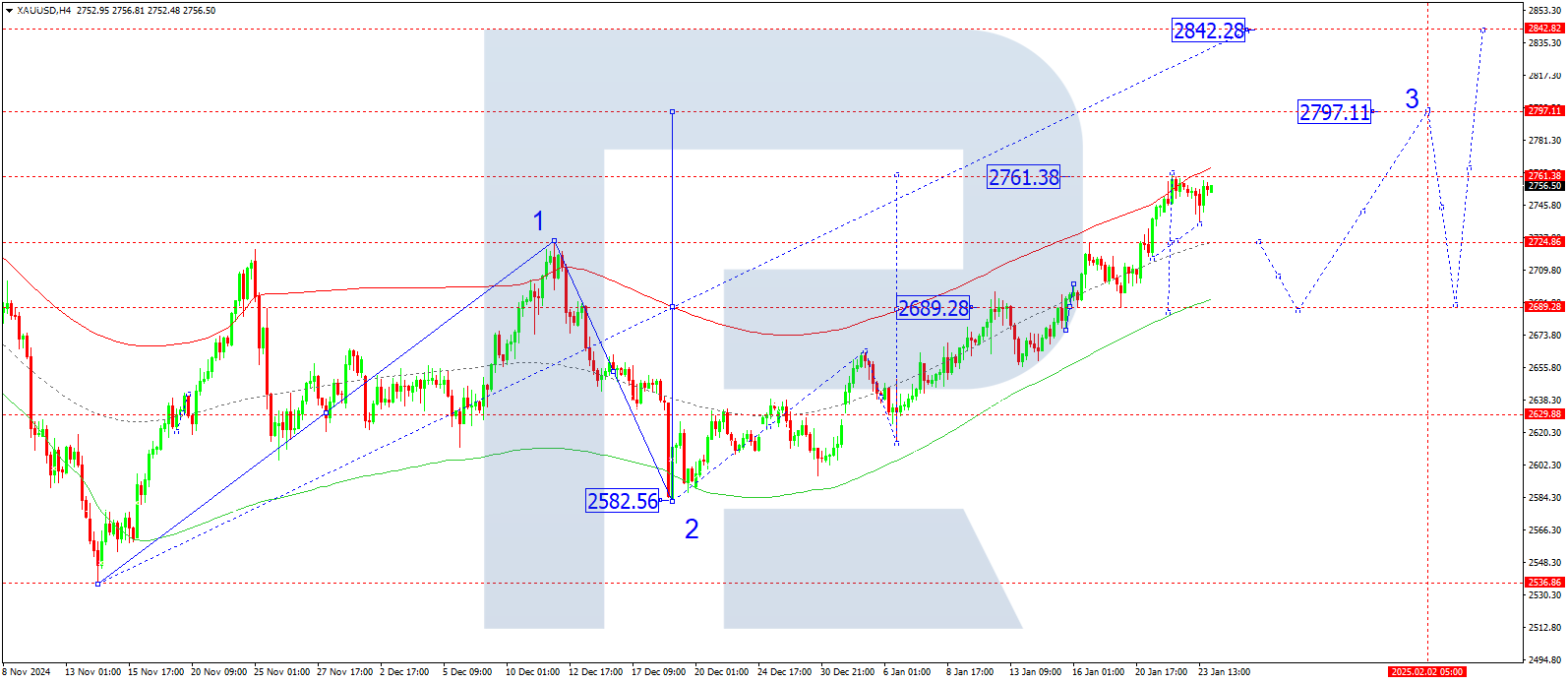

XAUUSD forecast

On the H4 chart, XAUUSD found support at 2,740 and broke above 2,761. On 24 January 2025, growth towards 2,797 is anticipated as the local target. Subsequently, a decline to 2,740 may occur. If this level is broken downwards, further movement towards 2,689 is possible.

Technically, this scenario aligns with the Elliott Wave structure and the growth wave matrix centred at 2,689. The market is continuing its growth wave to the upper boundary of the price Envelope at 2,797, with a decline to the central line at 2,740 likely following.

Technical indicators for today’s XAUUSD forecast suggest potential growth to 2,797.

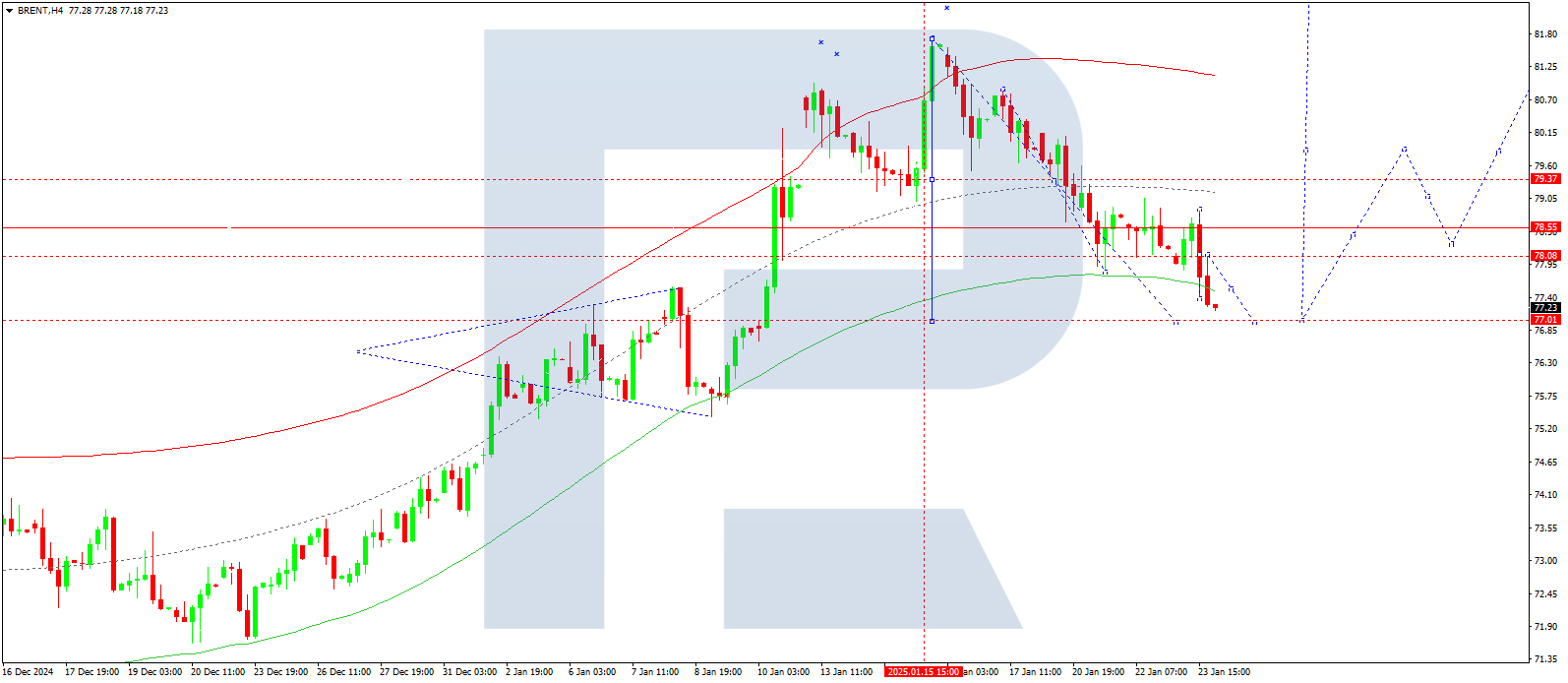

Brent forecast

On the H4 chart, Brent crude completed a correction wave to 77.00. On 24 January 2025, a consolidation range around this level is expected. An upward breakout could lead to a new growth wave towards 82.66 as the local target.

Technically, this scenario aligns with the Elliott Wave structure and the correction matrix centred at 79.37, which is key for Brent. The market has completed a downward wave to the lower boundary of the price Envelope at 77.00. Growth towards its central line at 79.37, followed by a continuation to 82.66, is anticipated.

Technical indicators for today’s Brent forecast suggest potential growth to 79.37 and 82.66.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.