USDCAD: economic risks in Canada are intensifying

The USDCAD rate is rising after reversing from the support level, with the current price at 1.4273. Find out more in our analysis for 23 December 2024.

USDCAD forecast: key trading points

- Investors are revising expectations for Federal Reserve interest rate cuts

- Canada’s core inflation rose to 2.7%, exceeding analysts’ expectations

- The resignation of Minister of Finance Chrystia Freeland over disagreements with Prime Minister Justin Trudeau increased political instability

- USDCAD forecast for 23 December 2024: 1.4435 and 1.4565

Fundamental analysis

After two sessions of decline, the USDCAD rate began to rise. Investors are reassessing their expectations for Federal Reserve interest rates amid easing US inflation. Earlier in September, the Fed had projected four rate cuts in 2025, but now only two are expected.

Canada’s core inflation rose to 2.7% in November, exceeding analysts’ forecasts of 2.5%. This limits the scope for further monetary policy easing by the Bank of Canada, heightening economic risks. The regulator’s recent interest rate cut was a forced measure in response to rising unemployment and an economic slowdown. Moreover, Minister of Finance Chrystia Freeland’s resignation due to her disagreements with Prime Minister Trudeau compounds the situation. Her resignation increases uncertainty in monetary policy and undermines investor confidence in the future outlook.

The combination of easing US inflation, increased economic risks in Canada, and political instability continue to support demand for the US dollar, which, according to today’s USDCAD forecast, may bolster the currency pair.

USDCAD technical analysis

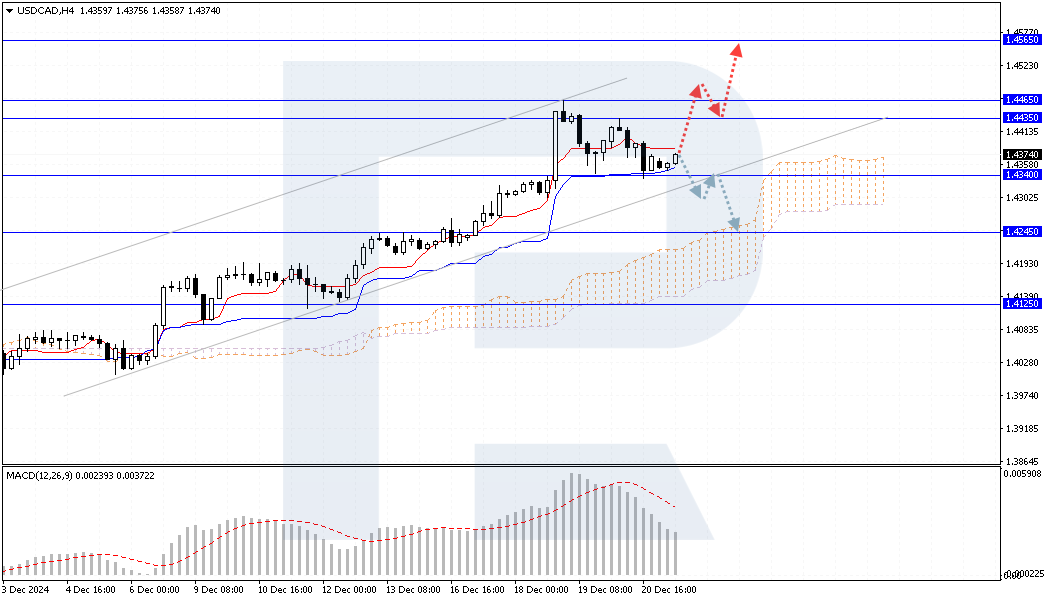

The USDCAD pair is testing the signal lines of the Ichimoku indicator. The price remains above the Cloud, supporting the uptrend. As part of today’s forecast, the price is expected to attempt to rise further and test the 1.4435 resistance level. A breakout above this level may signal a stronger upward movement to the target of 1.4565.

A breakout of the Tenkan-Sen line will further confirm the rise, with the price securing above 1.4390. The bullish scenario could be invalidated if the price breaks below the lower boundary of the ascending channel and establishes itself below 1.4340. In this case, a downward correction is expected to continue towards the target of 1.4245.

Summary

The USDCAD rate continues its upward momentum amid easing US inflation and growing economic and political risks in Canada. Demand for the US dollar is expected to persist, helping strengthen the currency pair. The USDCAD technical analysis indicates that the pair is moving within the uptrend. A breakout above the 1.4435 resistance level will open the way for growth to 1.4565. Conversely, if the price secures below the 1.4340 level, this may trigger a downward correction towards the 1.4245 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.