USDCAD: the Canadian dollar loses ground against the USD again

Lower wholesale sales in Canada and positive US fundamental data may propel the USDCAD pair further to 1.4440. More details in our analysis for 27 January 2025.

USDCAD forecast: key trading points

- Canada’s wholesale sales: previously at -0.2

- US new home sales: previously at 664 thousand, projected at 669 thousand

- US building permits: previously at 1,493 million, projected at 1,483 million

- USDCAD forecast for 27 January 2025: 1.4343 and 1.4440

Fundamental analysis

Fundamental analysis for 27 January 2025 takes into account that Canada’s wholesale sales have decreased to -2% over the past three months, indicating a decline in the purchasing power of the population. A weaker-than-forecast reading may impair the Canadian dollar, pushing up the USDCAD rate.

The forecast for today, 27 January 2025, suggests that US new home sales may reach 669 thousand. If the actual reading aligns with expectations or exceeds them, this could provide additional support to the US dollar.

US building permits are projected to decrease to 1,483 million. Although the decline is not critical, it signals some contraction in the construction sector, which could affect the entire construction chain in the future.

USDCAD technical analysis

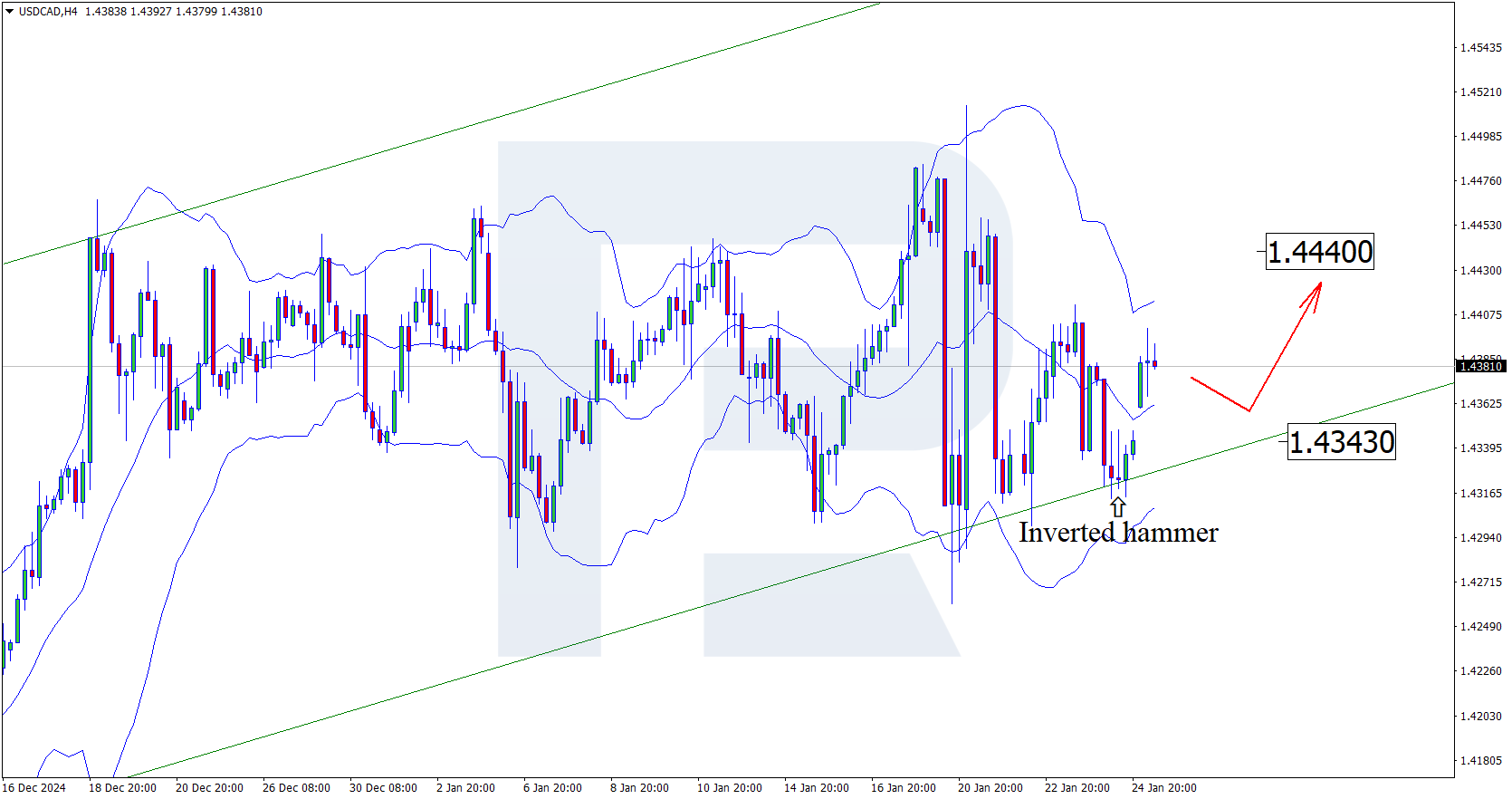

On the H4 chat, the USDCAD price formed an Inverted Hammer reversal pattern near the lower Bollinger band. At this stage, it continues developing a growth wave following the signal received. Since the quotes remain within an ascending channel, the upward wave is expected to continue to the nearest resistance level at 1.4440. A breakout above this level would open the potential for a more substantial uptrend.

However, an alternative scenario is possible, where the price could pull back to the 1.4343 support level and cover the gap before resuming growth.

Summary

Alongside the USDCAD technical analysis, low fundamental indicators from Canada suggest growth to the 1.4440 resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.