USDCAD is in a sideways channel: both Canada and the US face many risks

The USDCAD pair is consolidating around 1.4381. Canada is very hopeful about the new prime minister. Discover more in our analysis for 17 March 2025.

USDCAD forecast: key trading points

- The USDCAD pair starts the week with consolidation

- Statistics and US trade tariffs on Canada remain the primary drivers for the CAD

- USDCAD forecast for 17 March 2025: 1.4341

Fundamental analysis

The USDCAD rate starts the week around 1.4381.

The CAD closed the previous week with gains against the US dollar, marking the second consecutive week, which ended positively for the CAD. Canada is traditionally very sensitive to changes in commodity market sentiment. Brent prices are currently rising, which is positive for the Canadian dollar.

Investors are also positively assessing the appointment of the new Canadian prime minister. Earlier, he headed the Bank of Canada, meaning that he is well aware of the specifics of the economy and monetary processes.

Globally, the primary drivers for the CAD are macroeconomic statistics and export tariffs.

The USDCAD forecast is cautious.

USDCAD technical analysis

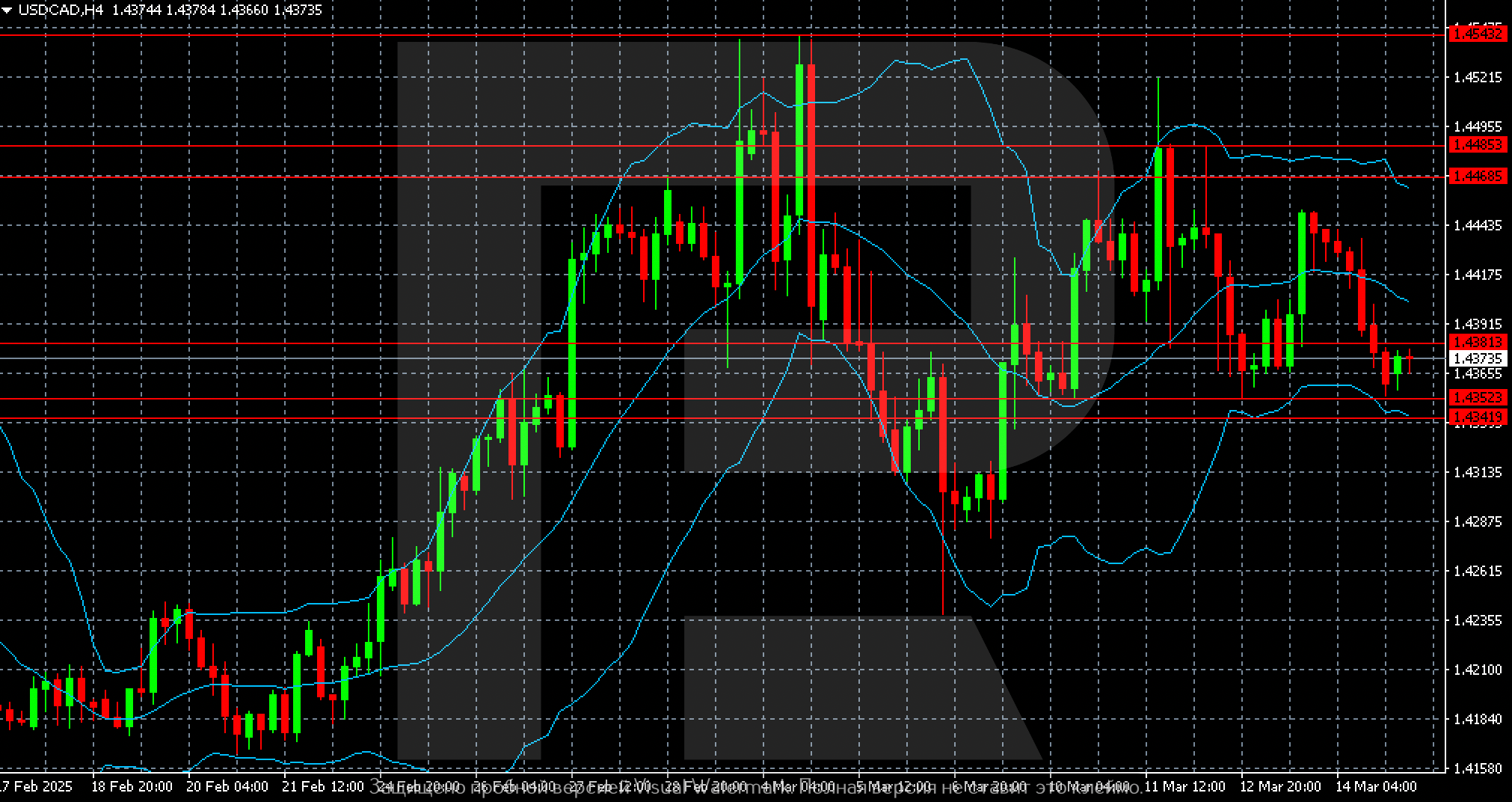

The boundaries of a sideways trading channel have formed between 1.4352 and 1.4468 on the USDCAD H4 chart. In case of a downward breakout, the first target will be the 1.4341 level. If a positive trend develops and the price breaks upwards, this will open the potential for a movement towards 1.4485.

Summary

The USDCAD pair is consolidating within a sideways channel. The market is closely monitoring the flow of US statistics and so far considers it unfavourable, which upholds the Canadian currency. The USDCAD forecast for today, 17 March 2025, expects the sideways range to remain between 1.4352 and 1.4468.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.