USDCAD: sideways movement for now, but further decline expected

The USDCAD pair is hovering around 1.3863. The market is assessing the prospects of easing US-China trade tensions and closely following the Canadian elections. Discover more in our analysis for 28 April 2025.

USDCAD forecast: key trading points

- The USDCAD pair has paused its sharp decline, entering a sideways trading channel, but the outlook remains bearish

- Market focus remains on the upcoming Canadian elections

- USDCAD forecast for 28 April 2025: 1.3780

Fundamental analysis

The USDCAD rate is stable at the beginning of the week, holding near 1.3863.

Investors are gathering data and evaluating the potential easing of US-China trade tensions. At the same time, attention is turning to the outcome of Canada's general elections.

The Canadian elections could impact the CAD outlook, depending on the new government's approach to trade negotiations. Analysts and investors said ahead of Monday’s vote that Canada could elect a more business-friendly government compared to recent years. However, its trade-dependent economy may face increased deficit spending risks.

Current polls show Prime Minister Mark Carney’s Liberal Party maintaining a lead, although the gap with the main opposition Conservative Party is narrowing.

Earlier economic data showed retail sales in Canada declined by 0.4% month-on-month in February, driven by reduced sales of vehicles and auto parts. However, preliminary estimates for March suggest a 0.7% month-on-month upturn in sales.

The USDCAD forecast is negative.

USDCAD technical analysis

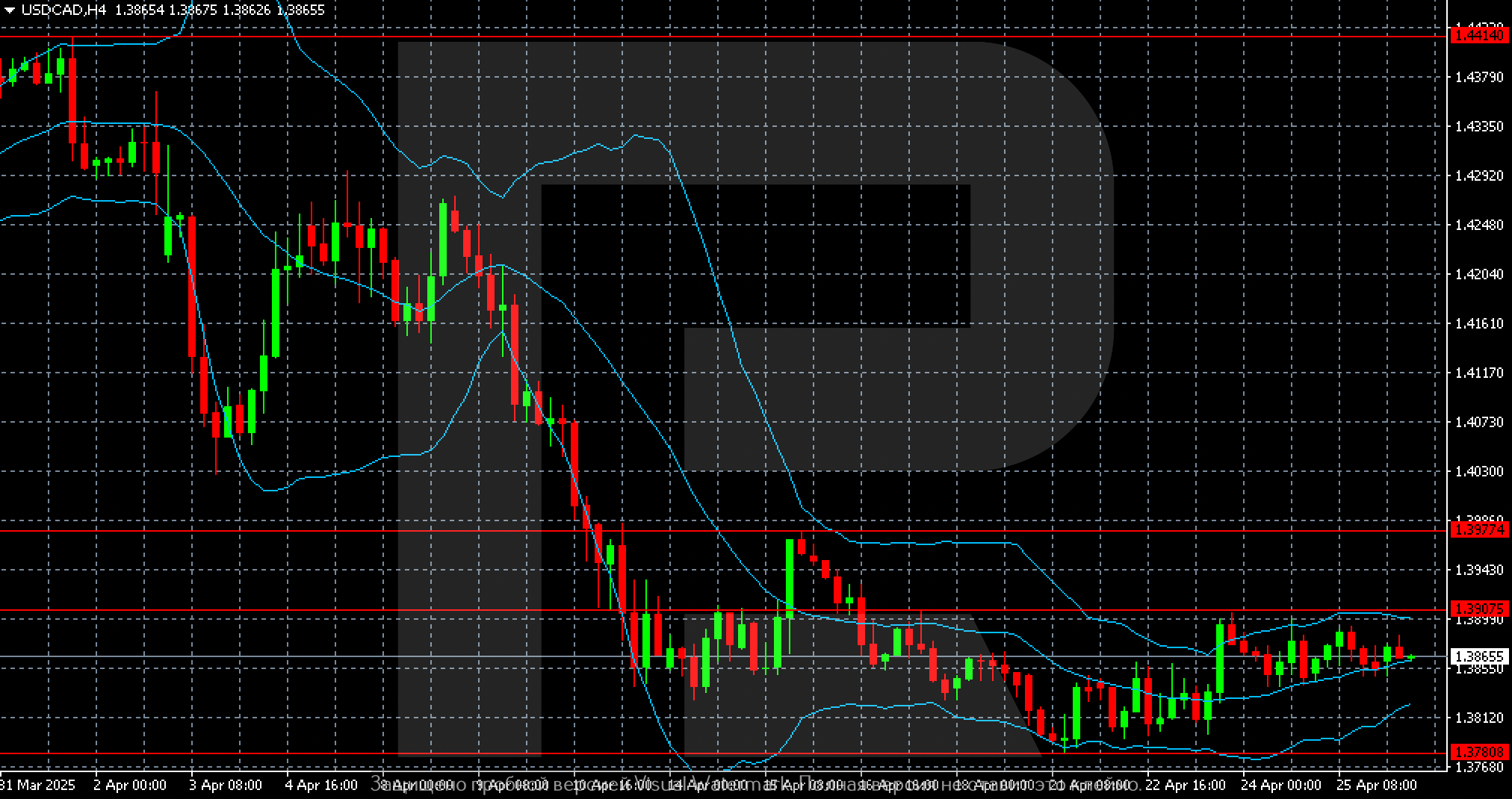

On the USDCAD H4 chart, the sideways range is limited by the 1.3780 and 1.3907 levels. A breakout above the upper boundary could trigger a corrective move towards 1.3977.

Without such a breakout, the primary trend will remain downward, with the market likely to retest the 1.3780 level.

Summary

The USDCAD pair has temporarily halted its decline but retains a bearish outlook. The USDCAD forecast for today, 28 April 2025, anticipates a downward move towards 1.3780 following stabilisation within the sideways trading channel.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.