USDCAD in consolidation, waiting for fresh signals

The USDCAD pair gained 0.7% in October, as markets remain tense amid shifting monetary and political factors. Discover more in our analysis for 3 November 2025.

USDCAD forecast: key trading points

- Market focus: the USDCAD pair strengthened following weak Canadian GDP data

- Current trend: the market is consolidating amid a lack of fresh catalysts

- USDCAD forecast for 3 November 2025: 1.3977 or 1.4035

Fundamental analysis

The Canadian dollar weakened against the US dollar after data showed an unexpected GDP contraction of 0.3% in August. The USDCAD pair is hovering around 1.4020, trading within the 1.3980–1.4035 range. In October, the CAD lost 0.7%, marking its second consecutive monthly decline, despite signals from the Bank of Canada suggesting that the easing cycle may be nearing its end.

Last Wednesday, the BoC lowered rates for the fourth time this year and noted that further reductions were highly unlikely. The Canadian dollar briefly strengthened on the statement, but the effect quickly faded after Federal Reserve Chairman Jerome Powell’s hawkish remarks. Adding to the pressure, Canada’s GDP fell by 0.3% in August following a revised 0.3% increase in July, while markets expected it to remain flat. Preliminary estimates point to a 0.1% rebound in September, which could help avoid a recession in Q3.

Meanwhile, President Donald Trump stated that trade negotiations between the US and Canada, paused last week, will not resume in the near term.

In the commodity market, oil prices rose by 0.6% to 61 USD per barrel, slightly cushioning losses for the Canadian currency.

USDCAD technical analysis

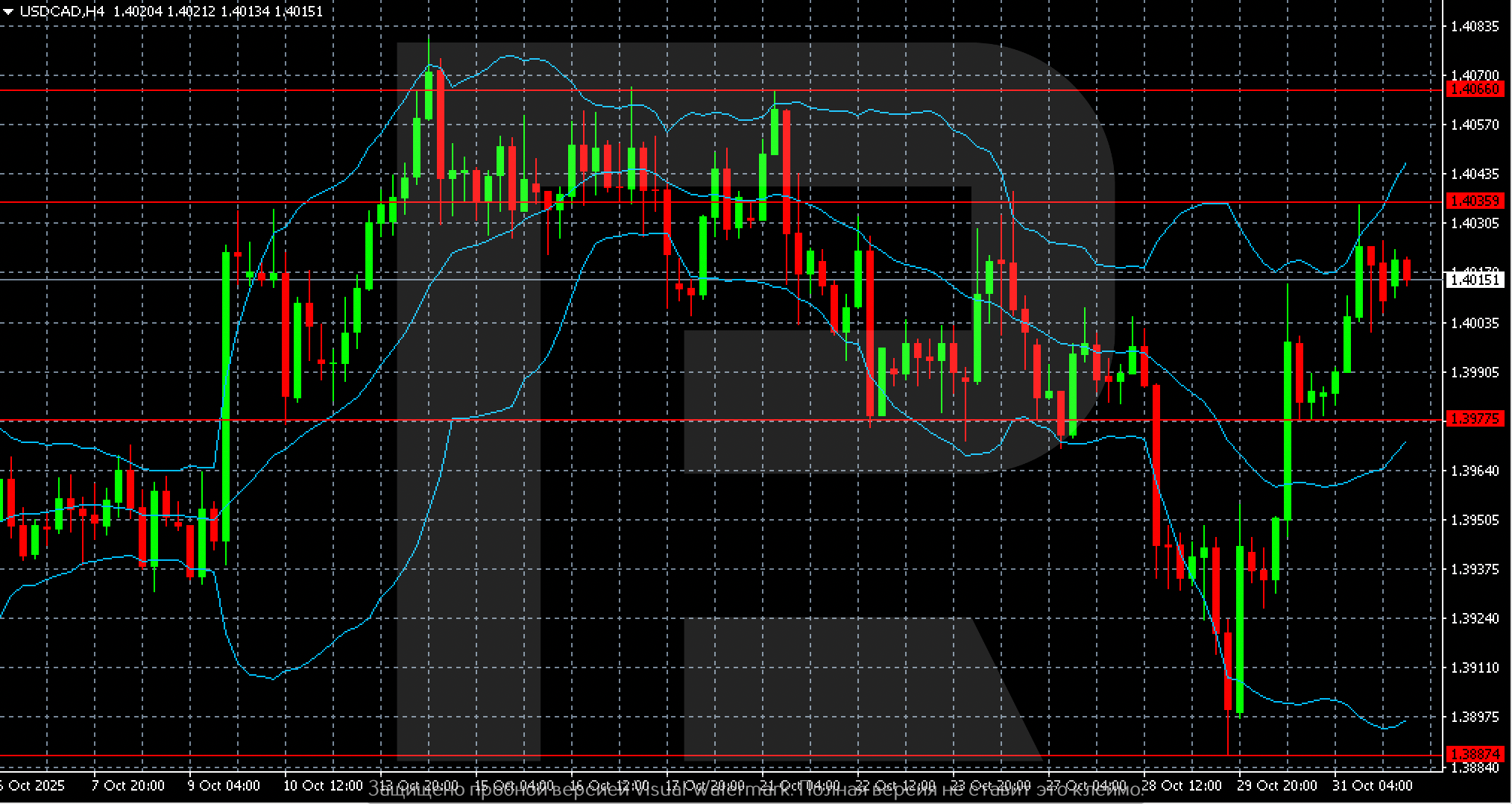

On the H4 chart, the USDCAD pair remains locked in a sideways range between support at 1.3977 and resistance at 1.4035. After dipping to a low of 1.3888 in late October, the pair rebounded, but upside momentum remains limited.

Volatility is decreasing, Bollinger Bands are narrowing, and the price is hovering just above the midline, indicating a consolidation phase and possible preparation for a new move.

Key resistance lies at 1.4035–1.4066; a breakout above this area would open the way towards 1.4100–1.4120. At the same time, strong support is seen at 1.3977 and 1.3888, with a consolidation below these levels likely to extend the decline towards 1.3850.

Overall, the pair is consolidating after October’s volatility. As long as the 1.4060 level remains unbroken, upside potential for the US dollar versus the loonie appears limited.

Summary

The USDCAD pair is in a consolidation phase following recent sharp swings. The USDCAD forecast for today, 3 November 2025, suggests range-bound movement between 1.3977 and 1.4035.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.