Canada turns the tables – employment growth drives USDCAD lower

The CAD continues to strengthen, with the USDCAD pair trading around 1.4025. Discover more in our analysis for 10 November 2025.

USDCAD forecast: key trading points

- The CAD continues to strengthen against the USD

- The labour market once again shows employment growth

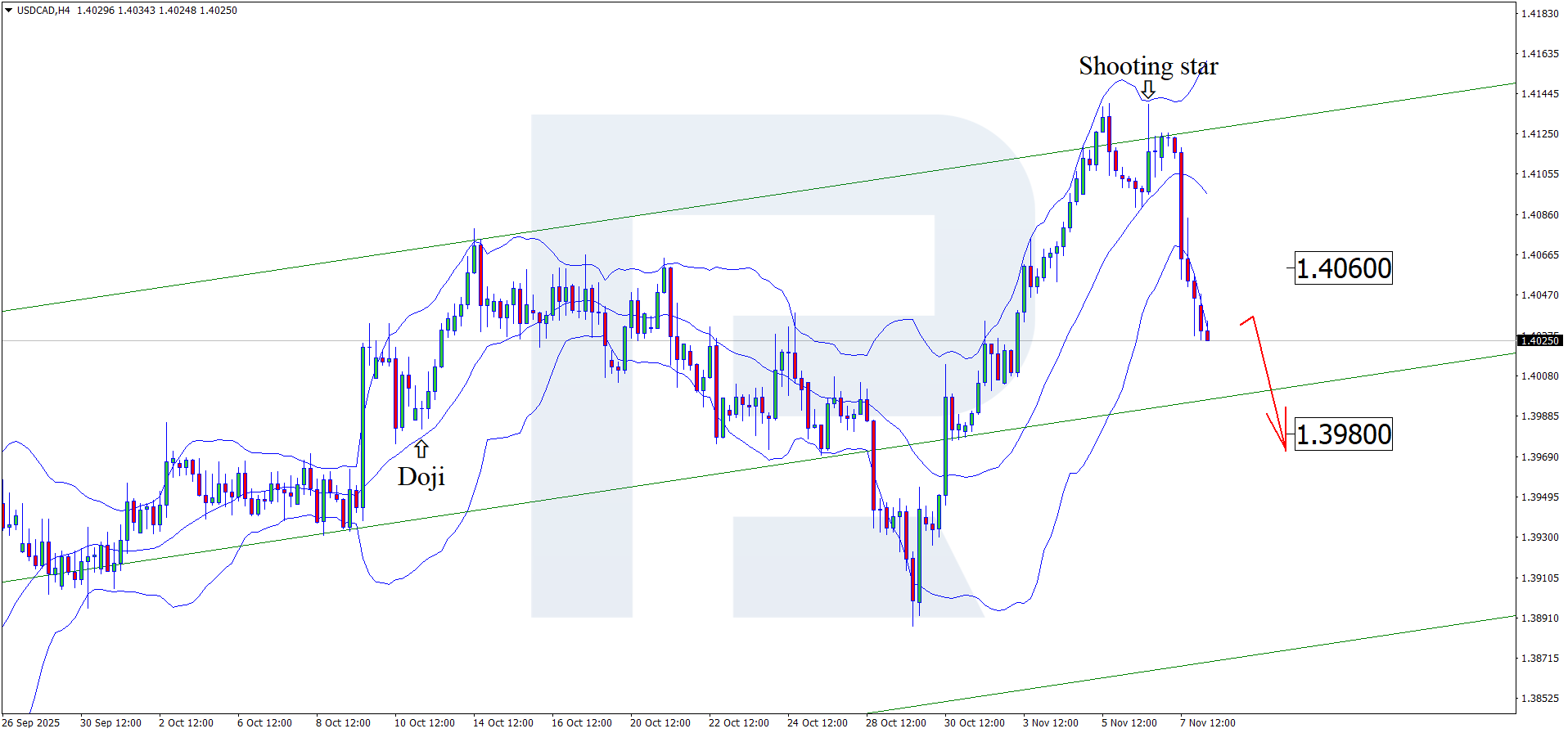

- USDCAD forecast for 10 November 2025: 1.4060 and 1.3980

Fundamental analysis

Today’s USDCAD outlook is optimistic for the CAD, as the pair continues to decline and trades near 1.4025.

Canada’s labour market showed strong employment growth of 66,600 in October, contrary to expectations of a decline. The rise in employment calls into question another potential rate cut by the Bank of Canada. The USDCAD rate is forming a correction after previous growth.

If upcoming US data turns out weaker than expected or signals of monetary policy easing emerge, this could shift the balance in favour of the USD and potentially trigger a continuation of the uptrend later.

Since the CAD is closely tied to the commodity market, positive developments in the oil sector and export data may also influence the USDCAD rate.

USDCAD technical analysis

On the H4 chart, the USDCAD pair formed a Shooting Star reversal pattern near the upper Bollinger Band. The pair is now forming a downward wave following the signal from the pattern. Since the quotes remain within an upward channel, further decline towards the nearest support level at 1.3980 can be expected. If the price rebounds from support, this could open the door for a continued upward movement.

At the same time, the forecast for 10 November 2025 also includes an alternative scenario, where the price rises towards 1.4060 before a decline.

Summary

The CAD continues to strengthen. The USDCAD technical analysis suggests further decline towards the 1.3980 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.