USDCAD hits a four-week low after strong GDP

The USDCAD pair dipped to 1.3980 as the market fully priced in strong Canadian data. Discover more in our analysis for 1 December 2025.

USDCAD forecast: key trading points

- Market focus: the USDCAD pair fell to a four-week low after Canada’s GDP release

- Current trend: the Canadian dollar appears strong thanks to active oil exports

- USDCAD forecast for 1 December 2025: 1.3937

Fundamental analysis

The USDCAD rate fell to a four-week low after stronger-than-expected quarterly GDP data. These figures reduced expectations of additional easing from the Bank of Canada. Over the past week, the CAD gained about 0.9%, marking its best performance since May.

The recent weakening of the US dollar also supports demand for the CAD, as markets are betting on a Fed rate cut in December.

Canada’s economy grew by 2.6% y/y in Q3, driven by increased oil exports and higher government spending. Business investment and consumer activity remained weak. The consensus forecast expected a 0.5% rise.

Following the release, investors adjusted their expectations for the Bank of Canada’s terminal rate. The market now sees it at 2.15% in July, slightly above the previous 2.14%. Earlier, the central bank cut its key rate to 2.25%, the lowest in three years.

The strong GDP report strengthened the Canadian dollar. However, to reduce the fundamental discount of the CAD, Canada needs either a rapid economic turnaround or progress on extending the USMCA trade agreement, which expires in 2026.

The USDCAD forecast is negative.

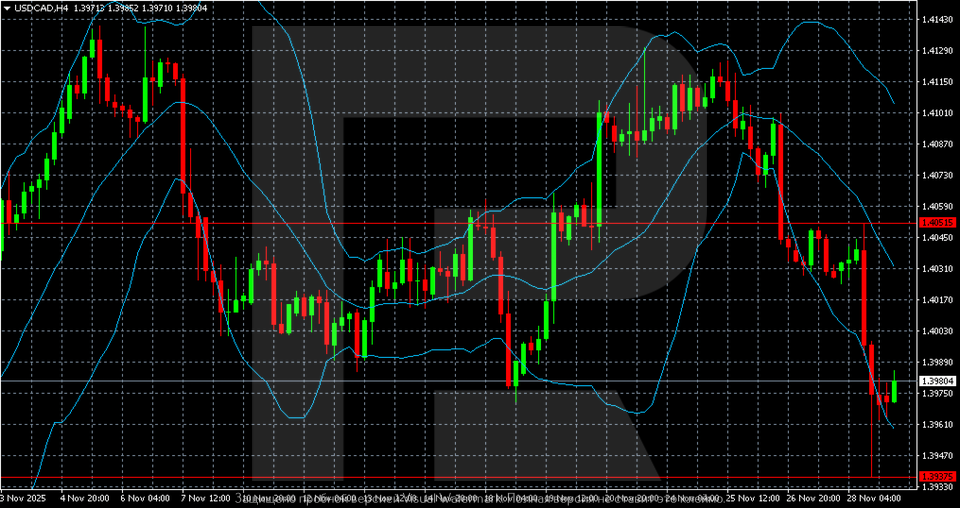

USDCAD technical analysis

On the H4 chart, the USDCAD pair remains under pressure following a sharp downward impulse late last week. After confidently breaking below the 1.4050 support level, the pair consolidated below the middle Bollinger Band and continues to move in the lower part of the range.

Candlesticks show a series of strong red bars, indicating that sellers dominate with almost no pauses. The price hit a new low at 1.3937, now the nearest local support level. The current corrective attempt looks modest: the pair is only testing the lower band without rising above the 1.3985–1.4000 zone.

The upper resistance level is located at 1.4050, previously a key horizontal balance line. As long as the price remains below it, pressure on the USDCAD pair persists. Any recovery looks like a technical pause within the broader bearish impulse.

Summary

The USDCAD pair appears rather weak. The USDCAD forecast for today, 1 December 2025, suggests a return to 1.3937.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.