USDCHF strengthens amid a decline in Switzerland’s PMI

The USDCHF rate is advancing towards the 0.8905 resistance level. Discover more in our analysis for 3 December 2024.

USDCHF forecast: key trading points

- Switzerland’s PMI decreased by 1.4 points to 48.5 in November, remaining in a stagnation zone below the 50.0 level for 23 consecutive months

- Switzerland’s retail sales rose by 1.4% year-on-year in October, down from 1.8% in September

- Investors will focus on Wednesday’s speeches by Federal Reserve officials, including Jerome Powell

- USDCHF forecast for 3 December 2024: 0.8910

Fundamental analysis

The USDCHF rate has risen for the second consecutive day, holding above the crucial support level of 0.8800. The US dollar continues to strengthen amid expectations of strong US economic indicators and concerns following Donald Trump’s threat to impose 100% export tariffs on BRICS countries if they attempt to replace the US dollar as a reserve currency.

Meanwhile, Switzerland’s procure.ch manufacturing PMI declined by 1.4 points to 48.5 in November. This development marks the 23rd consecutive month below the 50.0 threshold, highlighting ongoing challenges in the country’s manufacturing sector. New orders have remained stagnant over the past three months, with no growth since September. According to today’s USDCHF forecast, the weak PMI reading may further strengthen the US dollar.

Switzerland’s retail sales rose 1.4% year-on-year in October, slowing from the 1.8% growth recorded in September. Sales of food, drinks, and tobacco increased by 0.3%, while sales of non-food products grew by 3.2%.

Investors are now focused on the upcoming speeches from Federal Reserve officials, including an address by Chair Jerome Powell on Wednesday evening. Attention is also directed towards critical economic reports, with the job vacancy report due on Tuesday, initial jobless claims on Thursday, and the November nonfarm employment report scheduled for Friday.

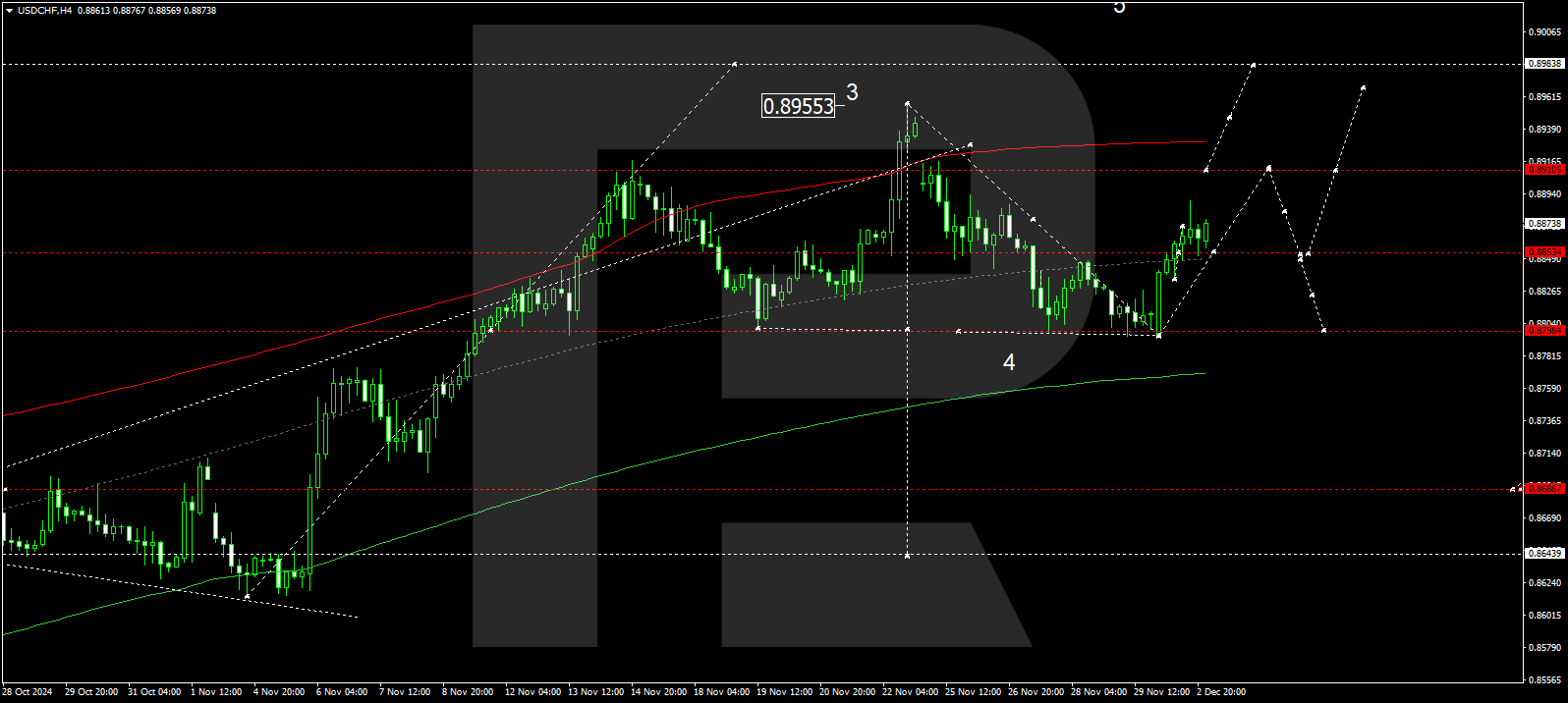

USDCHF technical analysis

The USDCHF H4 chart shows that the market has completed a growth wave, reaching 0.8855. A consolidation range is forming around this level today, 3 December 2024. With an upward breakout, the growth wave could extend towards 0.8910, potentially continuing towards 0.8989. Conversely, a breakout below the range could lead to a decline to 0.8800, possibly extending further to 0.8688.

The Elliott Wave structure and wave matrix, with a pivot point at 0.8855, technically support this scenario. This level is considered critical for initiating another growth wave in the USDCHF rate. The market is forming a consolidation range around the central line of a price envelope at 0.8855. An upward breakout will open the potential for growth to the envelope’s upper boundary at 0.8910. Conversely, a downward breakout might trigger a decline towards 0.8800, possibly extending the envelope’s lower boundary at 0.8688.

Summary

The USDCHF rate continues to strengthen amid expectations of robust US economic statistics and geopolitical risks stemming from Trump’s statements. In the coming days, critical economic data and Federal Reserve officials’ speeches will likely influence the currency pair’s movements. Technical indicators for today’s USDCHF forecast suggest the potential for a growth wave towards 0.8910.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.