USDCHF declines to 0.8780: the franc maintains the upper hand

The USDCHF pair has been under selling pressure for the fifth consecutive trading session as the market assesses the situation regarding US trade duties. Find out more in our analysis for 10 December 2024.

USDCHF forecast: key trading points

- The USDCHF pair continues to decline

- Investors are monitoring developments concerning US trade duties

- USDCHF forecast for 10 December 2024: 0.8800 and 0.8870

Fundamental analysis

The USDCHF rate has retreated to 0.8780, with the sell-off continuing for the fifth consecutive trading session. The instrument’s downtrend is solidifying and becoming increasingly stable.

The market is responding to the US rhetoric on high import duties. This will affect all US trade partners, including Switzerland, but will also reduce the strong dollar’s impact.

However, global risk aversion maintains increased demand for the US dollar as a safe-haven asset, exerting local pressure on other currencies.

The USDCHF forecast remains favourable for the franc.

USDCHF technical analysis

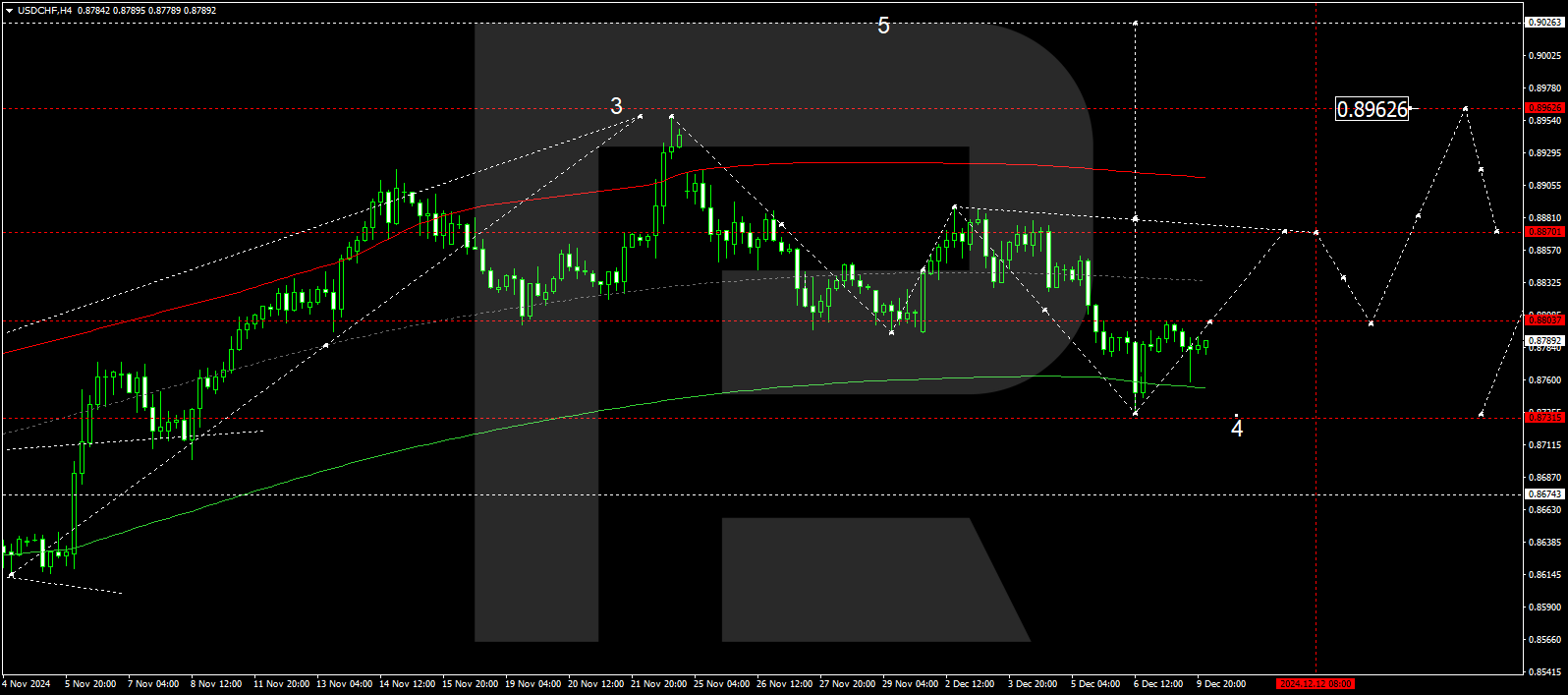

The USDCHF H4 chart shows the market has completed a downward wave, reaching 0.8735. A consolidation range is forming above this level today, 10 December 2024. A downward breakout could extend the range to 0.8731, while an upward breakout might create a wave towards 0.8870, the first target.

The Elliott Wave structure and wave matrix, with a pivot point at 0.8870, technically support this scenario. This level is considered crucial for initiating another growth wave in the USDCHF rate. The market is forming a consolidation range above the lower boundary of a price envelope. A growth wave could follow, targeting its upper boundary at 0.8870.

Summary

The USDCHF pair remains under pressure on Tuesday. Technical indicators for today’s USDCHF forecast suggest a potential growth wave towards the 0.8800 and 0.8870 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.