The yen rises: the Bank of Japan may raise the interest rate in December

The USDJPY pair is declining. The market awaits decisive moves from Japan’s regulator. Find out more in our analysis for 27 November 2024

USDJPY forecast: key trading points

- The USDJPY pair has been declining for three consecutive days

- Investors expect a December interest rate hike by the Bank of Japan

- USDJPY forecast for 27 November 2024: 149.90

Fundamental analysis

The USDJPY rate fell to 152.32 in the middle of the week, marking its third consecutive day of decline.

This week, Bank of Japan Governor Kazuo Ueda hinted at the likelihood of an interest rate hike next month, citing the yen’s weakness as a key reason.

The market is awaiting Tokyo inflation statistics this week, as the data may provide clues about the BoJ’s monetary policy prospects.

The yen is also in demand as a safe-haven asset amid market risk aversion following US President-elect Donald Trump’s announcement of future tariffs on Canada, China, and Mexico.

The USDJPY forecast suggests that the pair may further decline.

USDJPY technical analysis

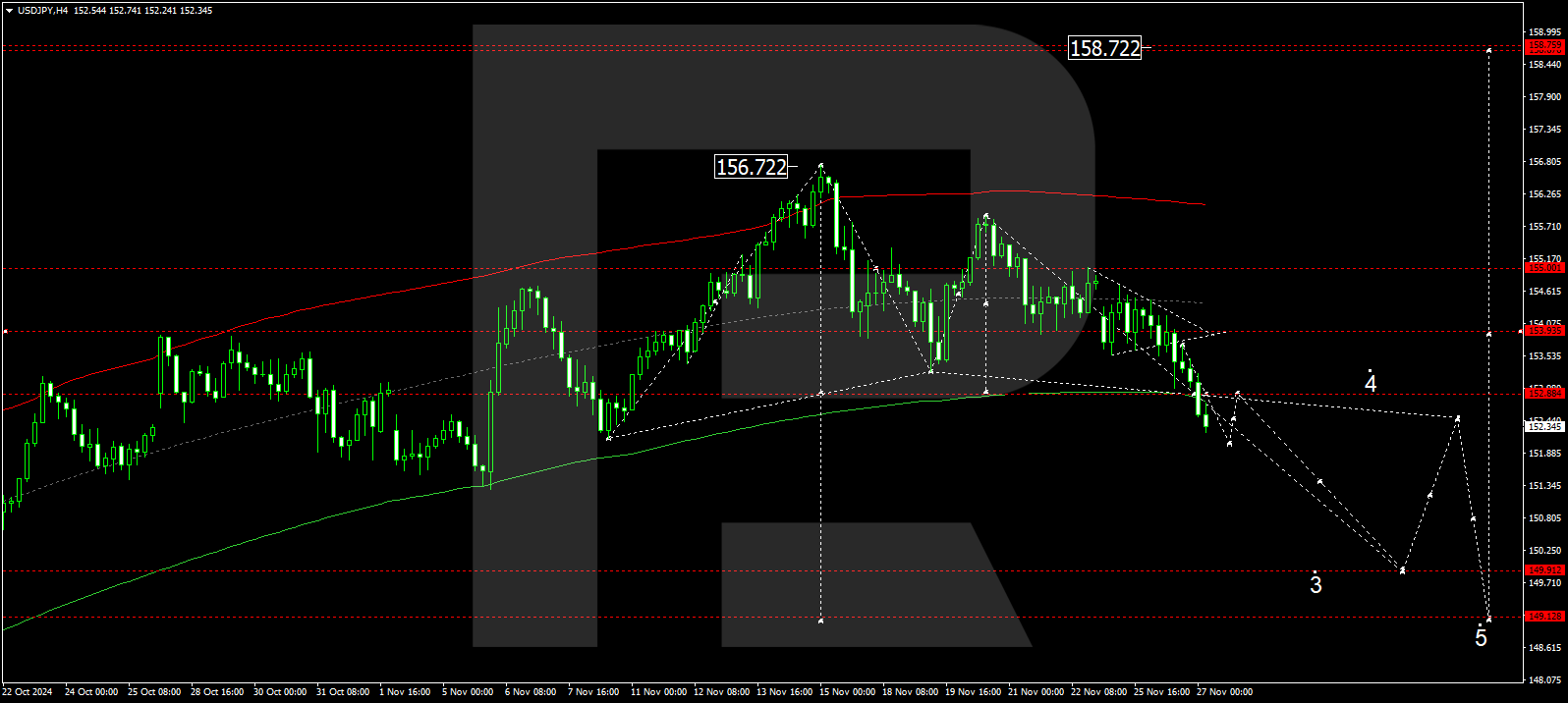

The USDJPY H4 chart indicates that the market has completed a downward wave to the 152.88 level and is now forming a consolidation range around it. Today, 27 November 2024, the market broke below this level and maintained its downward momentum, with the local target at 149.90. The market is continuing to develop a corrective wave. After reaching the target, the price could rise to 152.50 (testing from below). Subsequently, the correction may extend towards 149.12.

The Elliott Wave structure and downward wave matrix, with a pivot at 152.88, technically support this scenario for the USDJPY rate. The market has completed the first phase of the third downward wave, and today, a consolidation range is forming around the lower boundary of a price envelope. The price is expected to break below the range and continue developing the second phase of the downward wave. An ensuing rise to the envelope’s central line is possible, followed by another downward structure targeting the lower boundary at 149.12.

Summary

The USDJPY pair is losing strength, while the yen is regaining stability. Technical indicators for today’s USDJPY forecast suggest that the correction may continue towards the 149.90 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.