USDJPY: the yen attempts to regain ground against the US dollar

The USDJPY rate fell below 150.00 amid positive fundamental data from Japan. More details in our analysis for 29 November 2024.

USDJPY forecast: key trading points

- Tokyo’s core CPI in November: previously at 1.8%, currently at 2.2%

- Japan’s industrial production in October: previously at 1.6%, currently at 3.0%

- Japan’s retail sales (y/y): previously at 0.6%, currently at 2.2%

- USDJPY forecast for 29 November 2024: 151.88

Fundamental analysis

The core CPI reflects the dynamics of the cost of goods and services from the consumer perspective. It is calculated for the Tokyo region and provides preliminary inflation data for Japan. The actual CPI rose to 2.2% in November, up from the previous period, indicating improved living standards in Tokyo.

Japan’s industrial production was expected to rise to 3.8%, but the actual reading was slightly lower at 3.0%. However, this figure nearly doubled from the previous reading, which, according to the forecast for 29 October 2024, may help the yen strengthen against the US dollar.

The fundamental analysis for 29 November 2024 considers Japan’s significant increase in retail sales, which rose to 2.2%. New Year preparations and higher living standards may have driven the uptick in sales.

Actual data for almost all Japanese indicators was stronger than in the previous period, contributing to the yen’s strengthening.

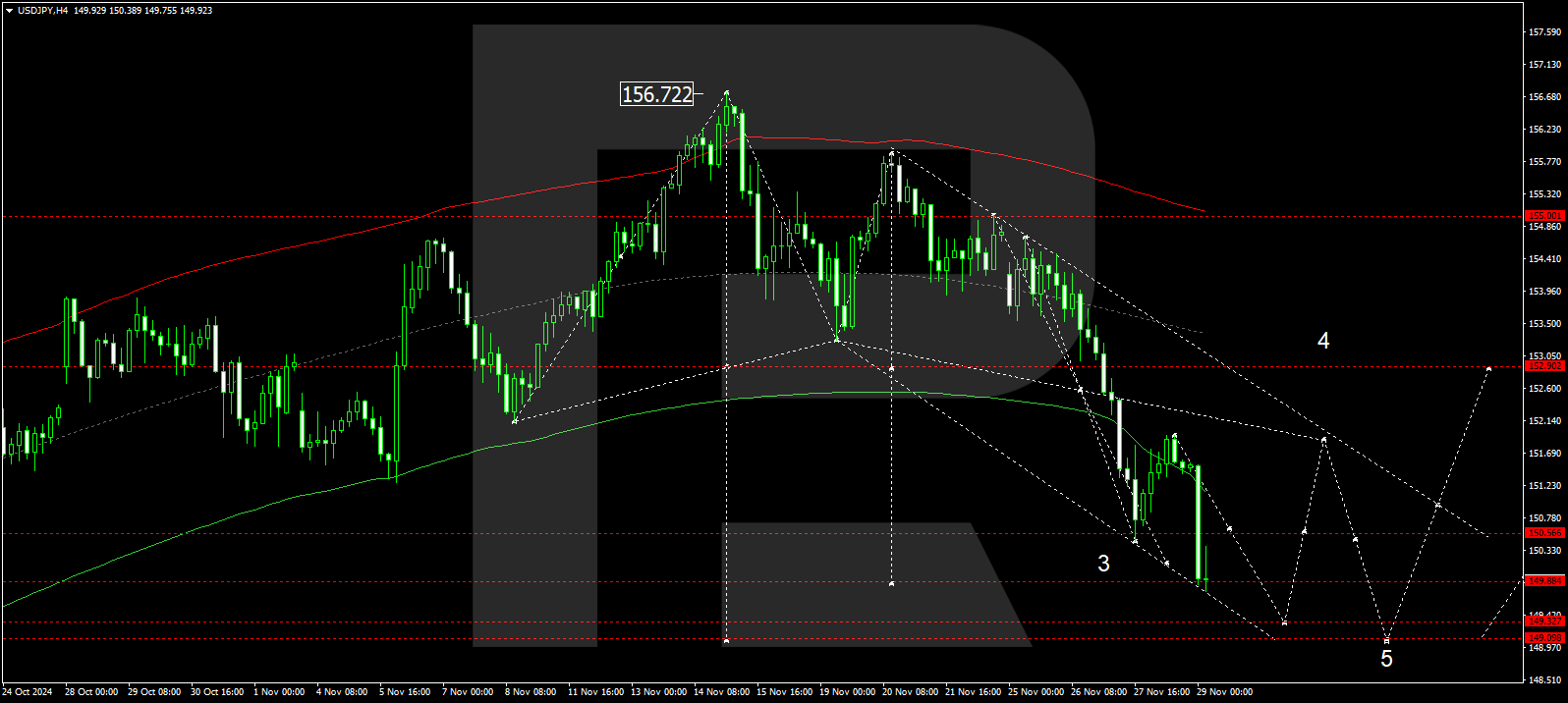

USDJPY technical analysis

The USDJPY H4 chart indicates that the market has completed a downward wave towards the 149.77 level and is now forming a consolidation range above it. The market could break below this level today, 29 November 2024, targeting 149.33. In case of an upward breakout, the price is expected to rise to 151.88. The market continues to develop a corrective wave, with the main target at 149.10.

The Elliott Wave structure and downward wave matrix, with a pivot at 152.90, technically support this scenario for the USDJPY rate. The market has reached the estimated target for the second half of the third downward wave. Today, the market is at the lower boundary of a price envelope, creating a consolidation range. An upward breakout could drive the price to the envelope’s central line at 151.90. Conversely, a breakout below the range could lead to a decline to the envelope’s lower boundary at 149.10 before rising to its upper boundary at 152.90.

Summary

Positive fundamental data from Japan helped strengthen the yen. Technical analysis for today’s USDJPY forecast suggests potential growth to the 151.88 level once the correction is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.