USDJPY: the yen loses ground again following a correction

US and Japanese manufacturing PMI data could support the USDJPY pair’s uptrend, with a target of 150.68. Find out more in our analysis for 2 December 2024.

USDJPY forecast: key trading points

- Japan’s manufacturing PMI: previously at 49.2, currently at 49.0

- US manufacturing PMI: previously at 48.5, projected at 48.8

- CFTC JPY speculative net positions: previously at -46.9 thousand

- USDJPY forecast for 2 December 2024: 150.68 and 149.30

Fundamental analysis

The manufacturing PMI measures purchasing managers’ activity in the industrial sector, reflecting the sector’s performance and production trends. As purchasing managers are the first to access their companies’ key performance data, the PMI is a vital indicator of overall economic conditions. Readings above 50.0 indicate increased production, while those below it signal a downturn.

Fundamental analysis for 2 December 2024 indicates that Japan’s previous reading was 49.2 points, now down by 0.2. This decline in production could weigh negatively on the yen.

The forecast for 2 December 2024 suggests that the US PMI could rise to 48.8 points. A stronger-than-forecasted reading could further support the US dollar and boost growth in the USDJPY rate.

CFTC JPY speculative net positions could fall below the previous -46.9 thousand as investors take profits and close positions. While no forecast has been issued, this data release typically significantly impacts the USDJPY rate.

USDJPY technical analysis

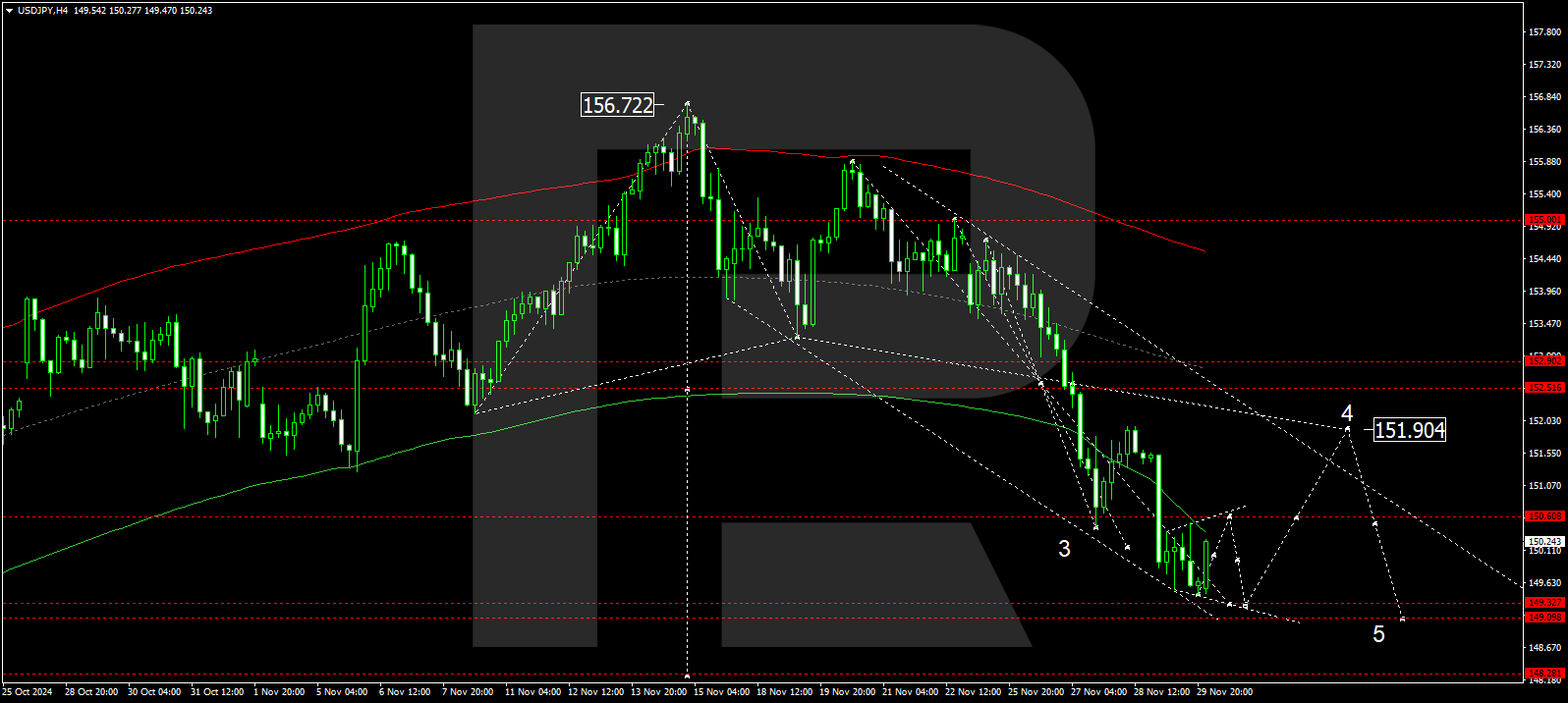

The USDJPY H4 chart indicates that the market has completed a downward wave, reaching 149.49. Today, 2 December 2024, the market could extend to 150.68, forming a broad consolidation range near 150.00. A further decline to 149.30 is expected, after which a new growth wave could target 151.90.

The Elliott Wave structure and downward wave matrix, with a pivot at 152.50, technically support this scenario for the USDJPY rate. The market has reached the estimated target for the third downward wave and is now at the lower boundary of the price envelope, creating a consolidation range near 150.00. A breakout upwards could push the price to the envelope’s central line at 151.90. Conversely, a breakout below the range could lead to a drop to the envelope’s lower boundary at 149.30 before rising to its upper boundary at 152.90.

Summary

Combining technical analysis for today’s USDJPY forecast, mixed fundamental data suggests potential growth to 150.68, followed by a decline to 149.30.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.