Uncertainty over the Bank of Japan’s actions supports USDJPY growth

The USDJPY rate is correcting, with buyers preparing to test the 150.25 resistance level. Discover more in our analysis for 4 December 2024.

USDJPY forecast: key trading points

- The Bank of Japan has yet to decide on the timing of monetary policy tightening

- The markets estimate the likelihood of a 25-basis-point BoJ interest rate hike at 60%

- Investors are awaiting Japan’s earnings data due on Friday, which may shed light on further BoJ actions

- USDJPY forecast for 4 December 2024: 151.40

Fundamental analysis

The USDJPY rate strengthened on Wednesday, reaching the upper boundary of a descending channel, and approaching the key resistance level. The primary driver of the currency pair’s growth was lingering uncertainty about the timing of the BoJ's monetary policy tightening. The US dollar is additionally supported by strong US economic figures and President-elect Donald Trump’s statements about potential trade tariffs against major economies.

Bank of Japan Governor Kazuo Ueda noted over the weekend that further policy tightening measures are imminent, as the current economic data aligns with expectations. According to today’s USDJPY forecast, these prospects may weaken the current US dollar gains. The markets estimate the likelihood of a 25-basis-point interest rate hike this month at 60%, above the previous estimates of 50%. Investors are awaiting Japan’s earnings data release, scheduled for Friday, to obtain additional information about the regulator’s possible actions.

US job openings rose by 372,000 in October to 7.744 million. The revised September data showed 7.372 million, down from the previously announced 7.443 million, marking the lowest reading since January 2021. Analysts forecast an increase to 7.480 million.

USDJPY technical analysis

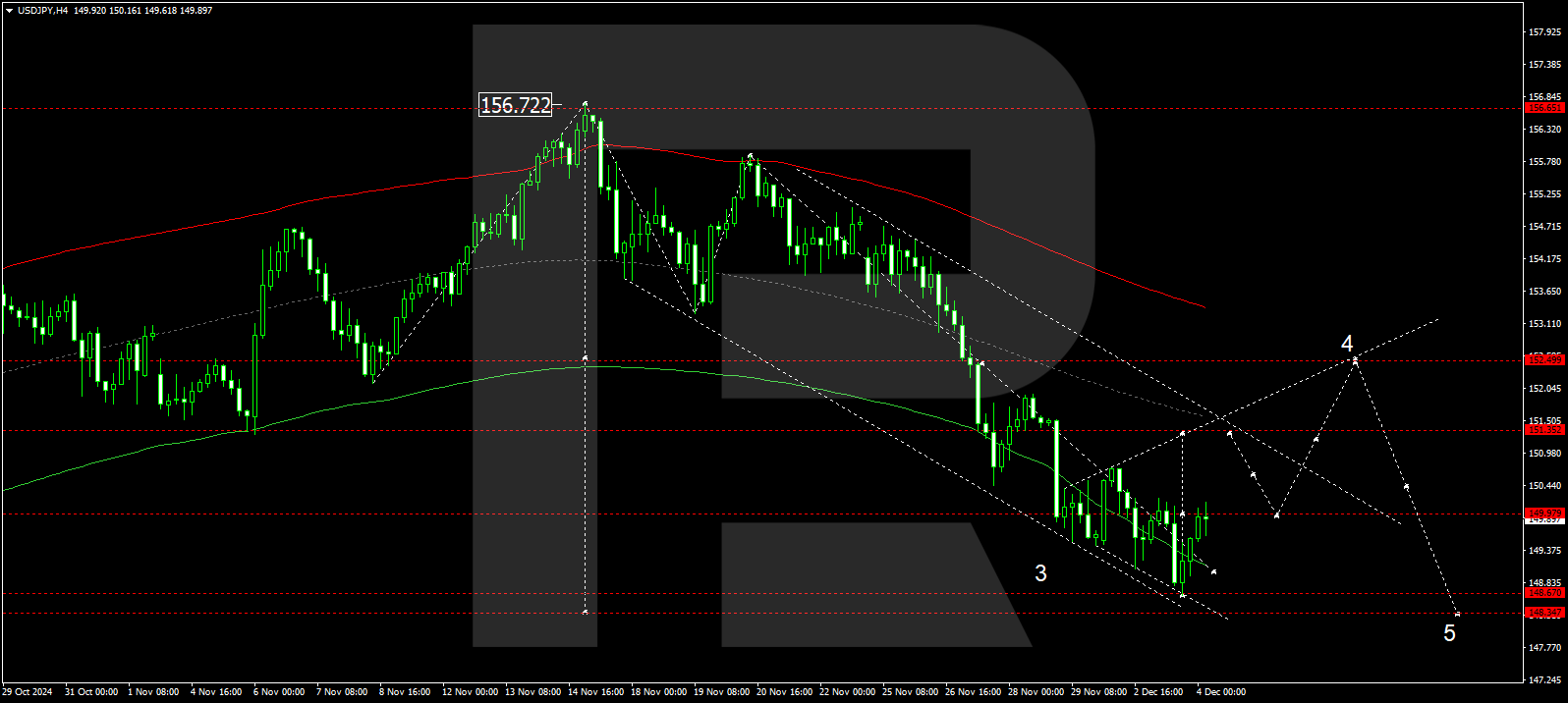

The USDJPY H4 chart indicates that the market has completed a downward wave to 148.68. Today, 4 December 2024, the market could return to 150.00, forming a broad consolidation range around this level. An upward breakout would open the potential for a growth wave targeting 151.40, potentially extending further to 152.50. A breakout below the range would drive a downward movement towards 148.30.

The Elliott Wave structure and downward wave matrix, with a pivot at 152.50, technically support this scenario for the USDJPY rate. The market has reached the target for the third downward wave at 148.68 and is now at the lower boundary of the price envelope, creating a consolidation range around 150.00. A breakout upwards could push the price to the envelope’s central line at 151.40. Conversely, a breakout below the range could lead to a drop to the envelope’s lower boundary at 148.30. Subsequently, the price is expected to rise to its upper boundary at 152.50 (testing from below).

Summary

The USDJPY rate has strengthened due to uncertainty about the Bank of Japan’s actions and a strong US dollar position amid positive economic data. The market focus on Japan’s upcoming earnings data may determine the future outlook for the BoJ interest rates and the USDJPY pair movements. Technical indicators for today’s USDJPY forecast suggest potential growth to the 151.40 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.