Improving business activity in Japan may restrain USDJPY growth

The USDJPY rate is testing the 150.15 resistance level, with pressure from buyers persisting. Discover more in our analysis for 9 December 2024.

USDJPY forecast: key trading points

- Japan’s economy grew by 0.3% in Q3, above preliminary estimates and market expectations

- Toyoaki Nakamura expressed concern about the insufficient sustainability of wage growth

- Japan’s services PMI reached 49.4 points in November, marking the best reading since March

- USDJPY forecast for 9 December 2024: 149.27 and 150.20

Fundamental analysis

The USDJPY rate shows a slight increase on Monday, remaining within a narrow range. The revised data confirmed Japan’s economy grew by 0.3% in Q3 compared to the previous three months, exceeding preliminary estimates and market expectations of 0.2%.

For comparison, the economy expanded by 0.5% in Q2, indicating continued GDP growth for the second consecutive quarter. The Japanese yen is additionally supported by hawkish expectations about the Bank of Japan's monetary policy, bolstered by stronger-than-expected wage data.

Market opinions on the timing of the next Bank of Japan interest rate hike are divided. Some traders expect the policy to be changed as early as December, while others believe the decision will only be made in January. Bank of Japan Governor Kazuo Ueda confirmed that an interest rate hike is imminent if economic indicators continue to meet forecasts.

However, not all Policy Board members share the optimism of the regulator’s chief. Toyoaki Nakamura voiced concern over insufficient sustainability of wage growth and pointed to signs of economic weakness that could limit the possibilities of tightening monetary policy.

Meanwhile, Japan’s services PMI reached 49.4 points in November, marking the best reading since March. It surpassed the previous 47.5 and market expectations of 47.3, showing continued improvement in the services sector. The economic outlook index also rose, coming in at 49.4 points following October’s three-month low of 48.3. The data inflates hopes for Japan’s gradual economic recovery and confirms signs of stabilisation, which, according to today’s USDJPY forecast, could help strengthen the Japanese yen.

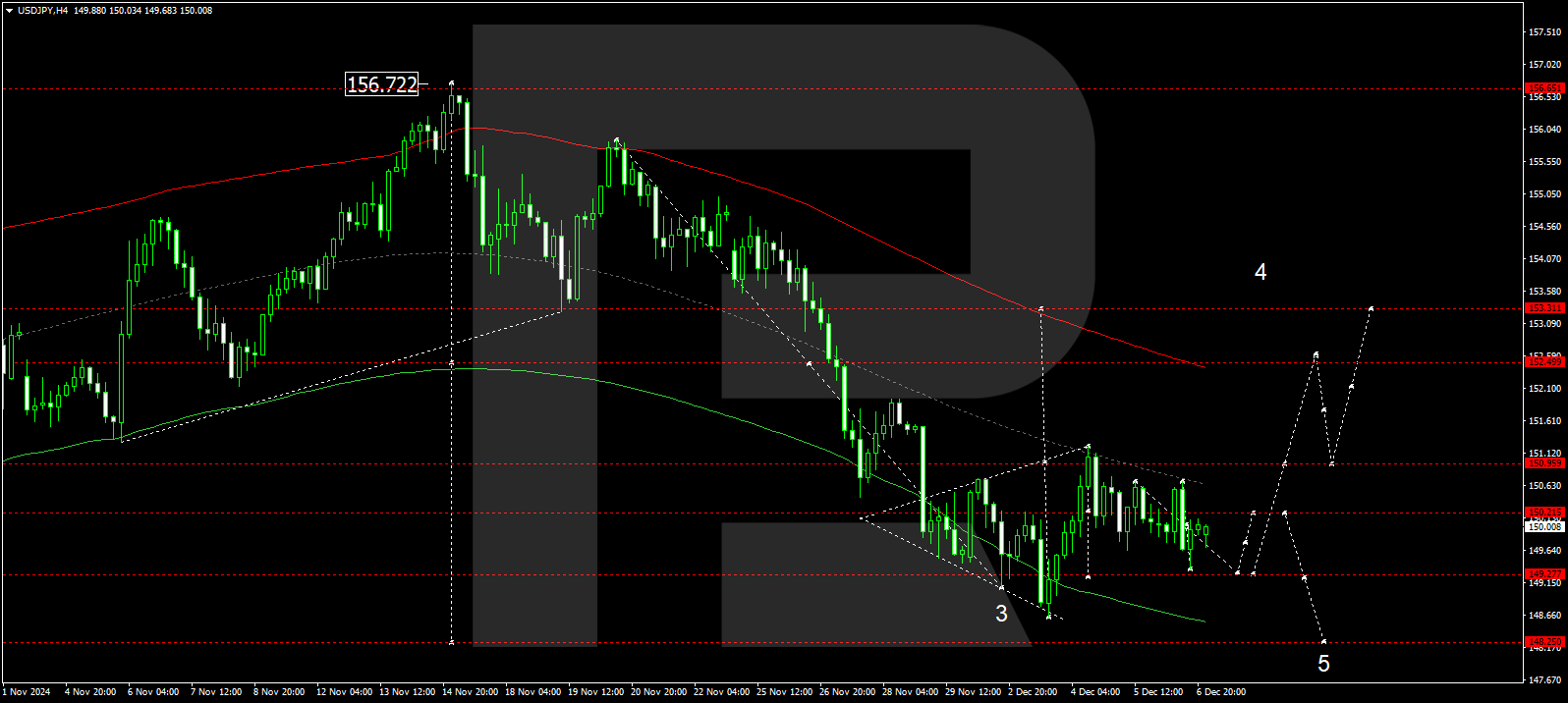

USDJPY technical analysis

The USDJPY H4 chart indicates that the market continues to develop a consolidation range around 150.20, which is expected to extend downwards to 149.27 today, 9 December 2024. Subsequently, a growth structure might develop, aiming for 150.20. A breakout above this level will open the potential for growth to 152.50. With a downward breakout, the trend could continue towards 148.25.

The Elliott Wave structure and growth wave matrix, with a pivot point at 150.20, technically support this scenario for the USDJPY rate. The market is forming a downward wave towards the lower boundary of a price envelope at 149.27. The price could reach this target level today before rising to the envelope’s upper boundary at 152.50, potentially extending further to 153.30.

Summary

The USDJPY rate remains under pressure due to Japan’s economic growth and hawkish expectations of a BoJ interest rate hike. Improved business activity and the increase in Tokyo’s economic outlook index may support the yen. Technical indicators for today’s USDJPY forecast suggest a potential decline to 149.27, followed by growth to the 150.20 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.