USDJPY: the pair has the potential to continue its ascent after completing a correction

The decrease in Japan’s machine tool orders could drive growth in the USDJPY rate to 152.50. More details in our analysis for 10 December 2024.

USDJPY forecast: key trading points

- Japan’s machine tool orders for November: previously at 9.4%, currently at 3.0%

- US Q3 nonfarm productivity level: previously at 2.2%, projected at 2.3%

- US Q3 labour costs change: previously at 1.9%, projected at 1.3%

- USDJPY forecast for 10 December 2024: 152.50

Fundamental analysis

Fundamental analysis for 10 December 2024 shows that Japan’s machine tool orders decreased significantly to 3.0% in November, down 6.4% from October. This is a negative factor for the economy, which may signal an economic slowdown and a decline in production. Given Japan’s well-developed machine tool industry, the drop in orders within this sector adversely impacts the value of the national currency.

The US Q3 nonfarm productivity level is likely to remain unchanged. The forecast for 10 December 2024 suggests that the reading could be 2.3%. Although growth is almost symbolic, it will still be a positive factor for the US dollar.

Labour costs reflect the change in the cost of labour required to produce one unit of output. The indicator is calculated by dividing hourly wages by output per unit.

The projected Q3 reading may drop to 1.3%. Although this is not considered significant news, when combined with other data, it may reflect the general state of the labour market and the economic outlook.

USDJPY technical analysis

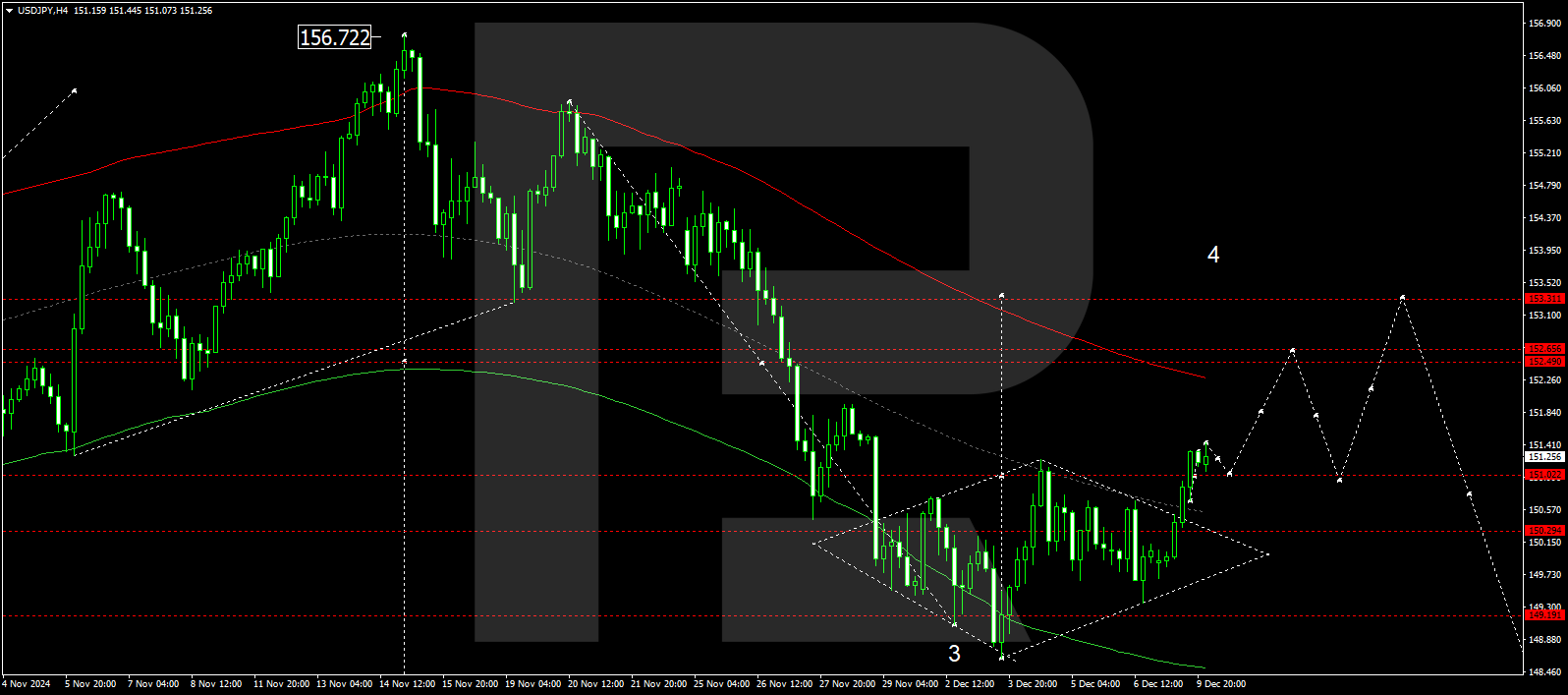

The USDJPY H4 chart indicates that the market has received support at 149.35 and has begun developing a new growth wave. The price broke above the 151.00 level today, 10 December 2024, effectively opening the potential for a growth wave towards the local target of 152.50. After reaching this level, the price could correct to 151.00 (testing from above). Subsequently, a growth wave might develop, targeting 153.30.

The Elliott Wave structure and growth wave matrix, with a pivot point at 151.00, technically support this scenario for the USDJPY rate. The market is forming a consolidation range around it. The price is expected to continue its upward momentum to the upper boundary of a price envelope at 152.50 before declining to its central line at 151.00. Once the price reaches this level, another growth structure could develop, aiming for the envelope’s upper boundary at 153.30.

Summary

Together with technical analysis for today’s USDJPY forecast, the current fundamental data from Japan and the US suggests potential growth to the 152.50 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.