USDJPY: the yen is under pressure as a BoJ rate hike appears unlikely

The USDJPY rate is retreating from the resistance level, currently at 152.48. Discover more in our analysis for 12 December 2024.

USDJPY forecast: key trading points

- Market expectations for a Bank of Japan interest rate hike in December have declined

- Traders believe the BoJ will keep the rate unchanged at 0.25%

- US CPI data for November met inflation forecasts, paving the way for Fed monetary policy easing

- The markets estimate the likelihood of a rate cut by the US regulator next week at 98.6%

- USDJPY forecast for 12 December 2024: 151.00

Fundamental analysis

The USDJPY rate has risen for the fourth consecutive day, but buyers are struggling to surpass the 152.75 resistance level today. Market expectations for a Bank of Japan interest rate hike in December have softened.

According to traders, the BoJ is unlikely to adjust the 0.25% interest rate at its meeting on 18-19 December, opting instead to thoroughly assess external risks and wage growth prospects by the end of 2024. This increases the likelihood of a rate hike in January or March when new data becomes available. Some BoJ officials see no urgent need for monetary tightening due to moderate inflation. However, the decision may depend on the actions of the US Federal Reserve. Currently, investors estimate the likelihood of a BoJ interest rate hike at the December meeting to be 30%.

The November CPI data revealed that headline and core inflation indicators aligned with forecasts, setting the stage for further interest rate cuts by the Federal Reserve. Markets now assess the probability of a 25-basis-point rate cut next week at 98.6%, which, according to today’s USDJPY forecast, could limit the US dollar’s upward momentum.

USDJPY technical analysis

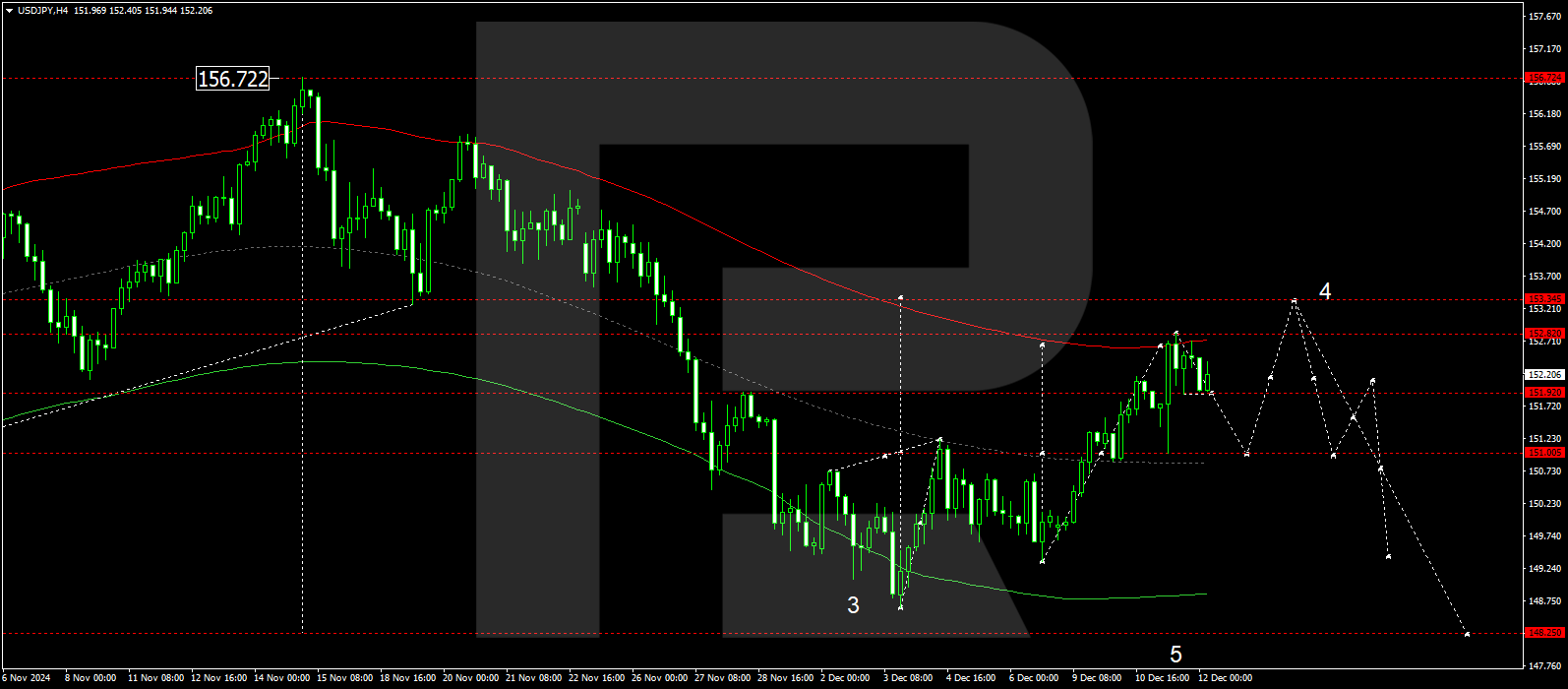

The USDJPY H4 chart shows that the market has completed a growth wave, reaching the local target of 152.82. A downward movement towards 151.00 (testing from above) is forming today, 12 December 2024. After reaching this level, the price could rise to 153.33, the main target of the growth wave. Subsequently, a downward wave might develop, targeting 151.00 and potentially extending the trend to 148.25.

The Elliott Wave structure and growth wave matrix, with a pivot point at 151.00, technically support this scenario for the USDJPY rate. The market has reached the upper boundary of a price envelope at 152.82, and a consolidation range is forming below this level today. The price is projected to break below the range, continuing its downward trajectory towards the envelope’s central line at 151.00. Subsequently, another growth wave may follow, targeting the envelope’s upper boundary at 153.33.

Summary

The USDJPY rate shows signs of weakening, encountering strong resistance at 152.75. However, the Japanese yen remains under pressure due to the revised expectations of a BoJ rate hike. Technical indicators for today’s USDJPY forecast suggest a potential decline to the 151.00 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.