USDJPY: the yen may strengthen its position

Japan’s favourable news landscape may push the USDJPY rate down to 151.00. Find out more in our analysis for 13 December 2024.

USDJPY forecast: key trading points

- Japan’s Tankan Large All Industry Capex: previously at 10.6%, currently at 11.3%

- Japan’s Tankan Large Manufacturers Index: previously at 13 points, currently at 14 points

- Japan’s industrial production: previously at 1.6%, currently at 2.8%

- USDJPY forecast for 13 December 2024: 151.00

Fundamental analysis

Japan’s Tankan Large All Industry Capex, published by the Bank of Japan (BoJ), reflects leading companies’ plans to invest in fixed assets (equipment, technology, and real estate). This key indicator helps assess business sentiment and forecast economic activity, as rising capital expenditures typically signal companies’ confidence in economic stability and growth prospects.

Fundamental analysis for 13 December 2024 considers the uptick in the index to 11.3%, which suggests some stabilisation in the Japanese economy.

Japan’s Tankan Large Manufacturers Index is a business confidence indicator released by the Bank of Japan. It shows the difference between the proportion of companies that rate business conditions as ‘good’ and those that consider them ‘adverse’. A positive reading indicates optimism among major manufacturers, while a negative value suggests discontent. This indicator helps assess the current economic climate and forecast its future developments.

The previous reading was 13 points; the forecast for 13 December 2024 expected the figure to remain unchanged, but it increased to 14. This rise enhances investor confidence and optimism, potentially boosting the yen’s value against the US dollar.

Japan’s industrial production grew to 2.8% during the previous period, providing a positive signal for the yen, as the Japanese economy relies heavily on the industrial sector.

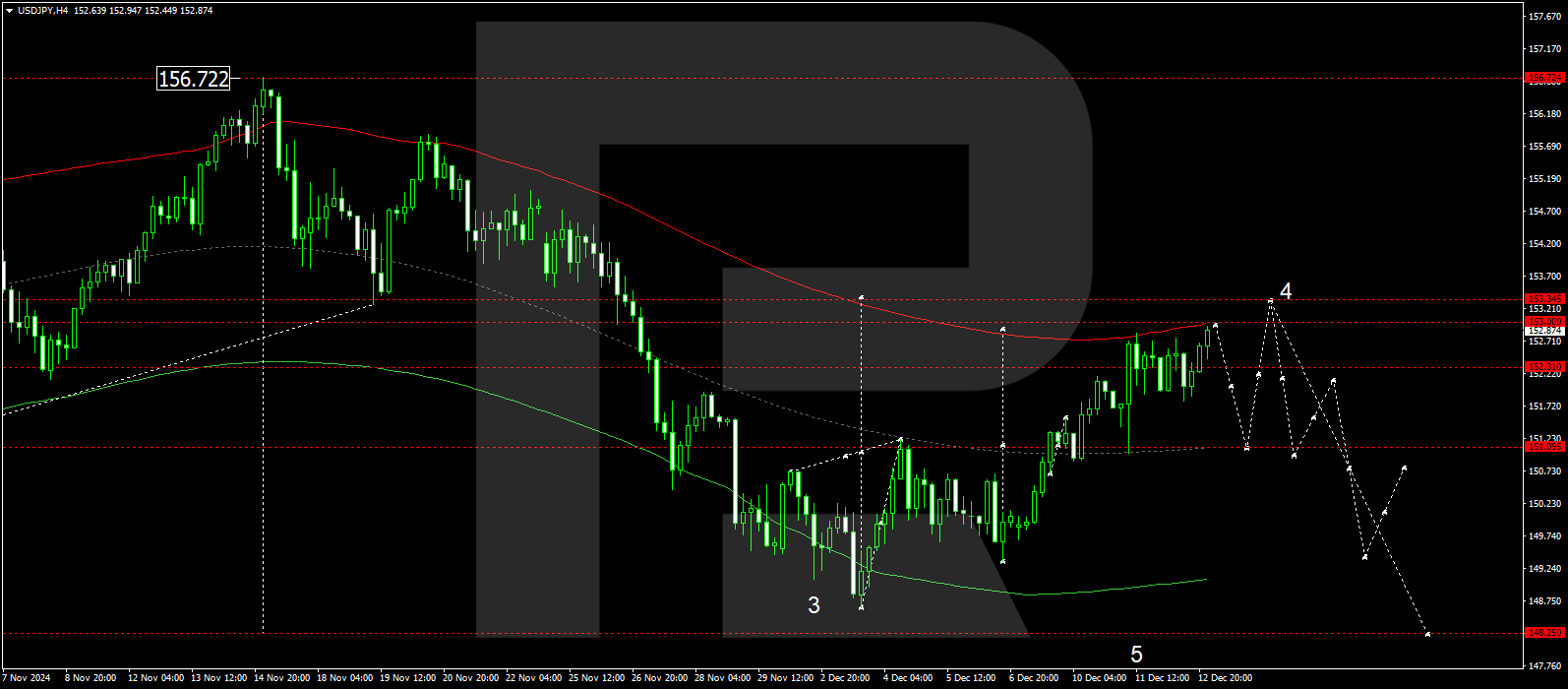

USDJPY technical analysis

The USDJPY H4 chart shows that the market is forming a consolidation range near 152.00, which may extend to 153.00 today, 13 December 2024. A breakout below the range could trigger a correction towards 151.00, while an upward breakout might initiate a growth wave towards 153.33, the main target.

The Elliott Wave structure and growth wave matrix, with a pivot point at 151.00, technically support this scenario for the USDJPY rate. The market has reached the upper boundary of a price envelope at 152.82, and a consolidation range is forming below this level today. The price is expected to break below the range, continuing its downward trajectory towards the envelope’s central line at 151.00. Subsequently, another growth wave may target the envelope’s upper boundary at 153.33.

Summary

Coupled with technical analysis for today’s USDJPY forecast, the combined improvement in Japan’s sentiment index and industrial production supports a potential decline to the 151.00 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.