USDJPY continues its ascent: rate prospects weigh on the yen

The USDJPY pair rose to 153.77 at the start of the week as investors bet on the Bank of Japan’s indecision. Find out more in our analysis for 16 December 2024.

USDJPY forecast: key trading points

- The USDJPY pair continues its rally

- Investors believe that the Bank of Japan will refrain from raising the interest rate in December

- USDJPY forecast for 16 December 2024: 151.51

Fundamental analysis

The USDJPY rate continued its rally on Monday, reaching 153.77. The Japanese yen has declined for seven consecutive trading sessions.

The instrument’s current values represent a three-week high. The market remains firmly against the yen amid expectations that the Bank of Japan will refrain from raising interest rates this week. Expectations around borrowing costs have shifted significantly following the regulator’s comments on slight economic delays and a potential postponement of its rate decision.

BoJ officials stated they wanted to see more evidence of wage growth before the regulator resumes adjusting its monetary policy.

The USDJPY forecast appears optimistic.

USDJPY technical analysis

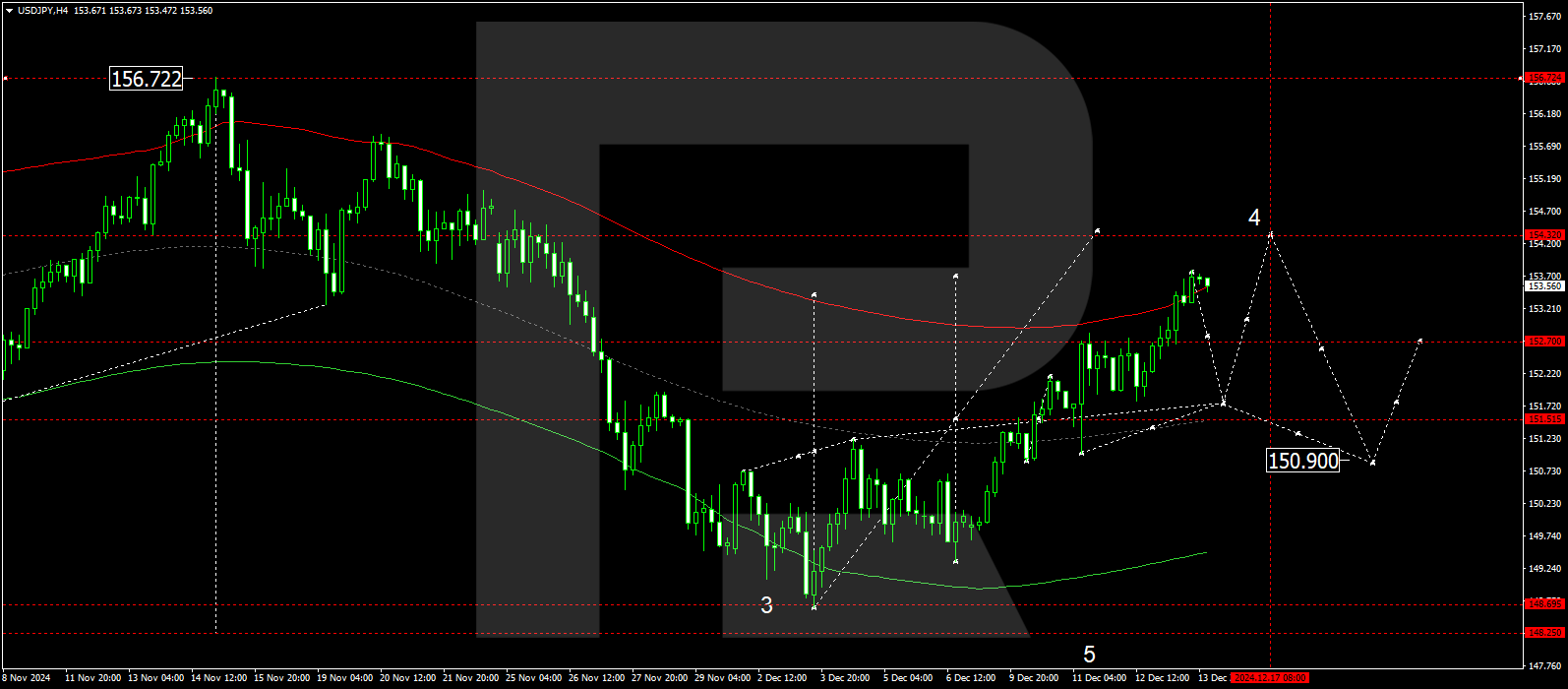

The USDJPY H4 chart shows that the market has completed a growth wave, reaching 153.75. Today, 16 December 2024, a new consolidation range could form below it. A downward breakout might lead to a correction towards 151.51. An upward breakout could extend the growth wave towards 154.33, the main target.

The Elliott Wave structure and growth wave matrix, with a pivot point at 151.51, technically support this scenario for the USDJPY rate. The market has reached the upper boundary of a price envelope at 153.75, and a consolidation range is forming below this level today. The price is expected to break below the range, continuing its downward trajectory towards the envelope’s central line at 151.51. Subsequently, another growth wave may target the envelope’s upper boundary at 154.33.

Summary

The USDJPY rate has been rising nonstop for the seventh consecutive trading session due to market players’ disappointment at the BoJ’s stance. Technical indicators for today’s USDJPY forecast suggest that a correction could start, aiming for 151.51.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.