USDJPY: the pair undergoes a moderate correction following a surge

The USDJPY rate corrected to the 156.75 support level today after a steady rise on Wednesday and Thursday. Discover more in our analysis for 20 December 2024.

USDJPY forecast: key trading points

- The Bank of Japan left the interest rate unchanged at 0.25%

- Japan’s inflation is accelerating, with the Consumer Price Index (CPI) showing a 2.9% increase in November

- USDJPY forecast for 20 December 2024: 158.00 and 156.75

Fundamental analysis

The USDJPY pair is rapidly strengthening this week after the BoJ kept the interest rate unchanged at its December meeting, citing the need to assess wage trends, global economic uncertainties, and the policies of the new US administration.

The yen also faced pressure from a strong US dollar. On Wednesday, the Federal Reserve lowered the interest rate by 25 basis points, signalling to market participants an upcoming pause in the monetary policy easing cycle in 2025.

The Japanese currency is supported by today’s inflation statistics for November, which showed Japan’s national Consumer Price Index rising by 2.9% year-on-year, up from 2.2% in the previous month. Rising inflation gives the Bank of Japan a compelling case to raise the interest rate at its next meeting.

USDJPY technical analysis

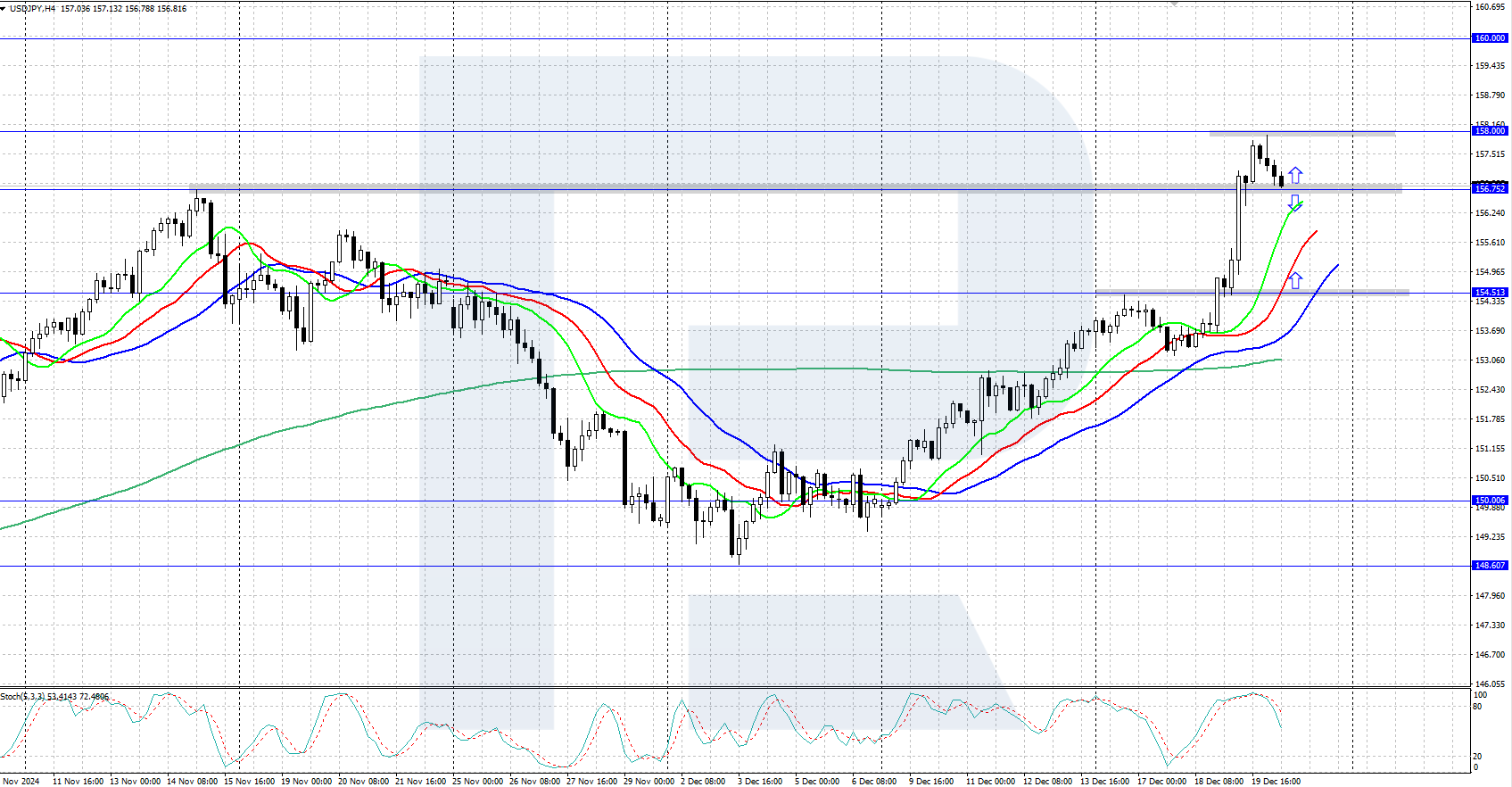

The USDJPY H4 chart indicates a strong upward momentum following the Federal Reserve meeting and the BoJ rate decision. The trend remains upward, supported by the rising alligator indicator. However, a downward correction could occur before growth resumes, as suggested by the Stochastic indicator, which is in the overbought area.

The short-term USDJPY forecast suggests the pair may rise towards the 158.00 resistance level and higher if bulls hold the price above the key support level at 156.75. However, if bears break through the 156.75 support level, the price could correct further towards 154.50.

Summary

The USDJPY pair is undergoing a moderate correction following a surge, falling to 156.75. The yen was bolstered by Japan’s November inflation data, which indicated a faster growth rate than the previous month.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.