USDJPY declines: the yen catches an opportunity in an attempt to strengthen

The USDJPY pair is hovering around 155.76 on Thursday, marking the second day of decline, with the yen aggressive. Find out more in our analysis for 16 January 2025.

USDJPY forecast: key trading points

- The USDJPY pair is rapidly declining on the currency market

- The market is receiving signals that the Bank of Japan is ready to raise the interest rate at the next meeting

- USDJPY forecast for 16 January 2025: 155.14

Fundamental analysis

The USDJPY rate is rapidly falling, moving towards 155.76.

The yen’s position improved significantly after comments from the Bank of Japan Governor Kazuo Ueda. The monetary policymaker said the regulator would discuss an interest rate hike next week based on its quarterly GDP and inflation forecasts.

Ueda also noted that the political prospects for the new US administration and wage negotiations with trade unions in Japan are becoming key factors influencing the decision to raise borrowing costs.

The very probability of a rate hike is important to the JPY.

The USDJPY forecast is unfavourable.

USDJPY technical analysis

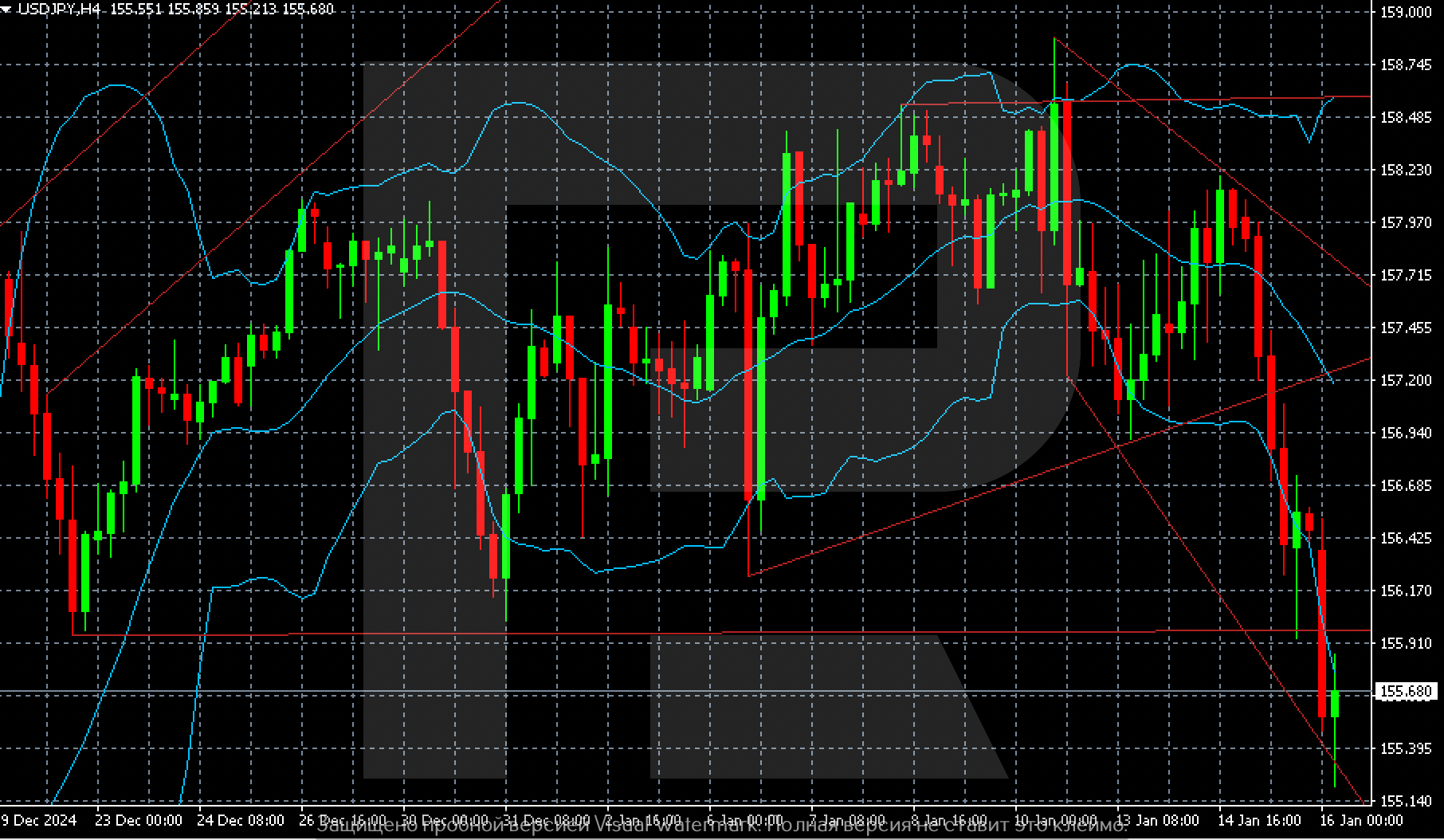

On the H4 chart, the USDJPY pair’s decline appears excessive, but the momentum so far remains. The support level is 155.97. While the pair hovers below it, the selling target will be the 155.14 level and then the 154.95 mark.

For USDJPY sales to become stable, the price needs to secure below 154.40, which is confirmed by higher timeframes.

Summary

The USDJPY pair is declining for the second consecutive day, and investors hope for a BoJ interest rate hike soon. The USDJPY forecast for today, 16 January 2025, suggests a further decline to the 155.14 USD level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.