USDJPY: the pair awaits the Bank of Japan interest rate decision

The USDJPY rate is consolidating near 156.00, with the Bank of Japan interest rate decision in focus today. Find out more in our analysis for 24 January 2025.

USDJPY forecast: key trading points

- The Bank of Japan will decide on the interest rate today; the rate is expected to be raised to 5%

- Current trend: consolidating within a sideways range

- USDJPY forecast for 24 January 2025: 157.00 and 154.50

Fundamental analysis

The Bank of Japan holds a monetary policy meeting today. BoJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino have previously stated that an interest rate hike may be on the table at this meeting.

Most experts agree that the interest rate will be raised by 25 basis points to 0.5% since Japan’s inflation rate jumped to 3.6% year-on-year in December 2024 from 2.9% in the previous month, marking the highest level since January 2023.

Market participants will primarily focus on the regulator’s comments, which may shed light on the outlook for its future monetary policy.

USDJPY technical analysis

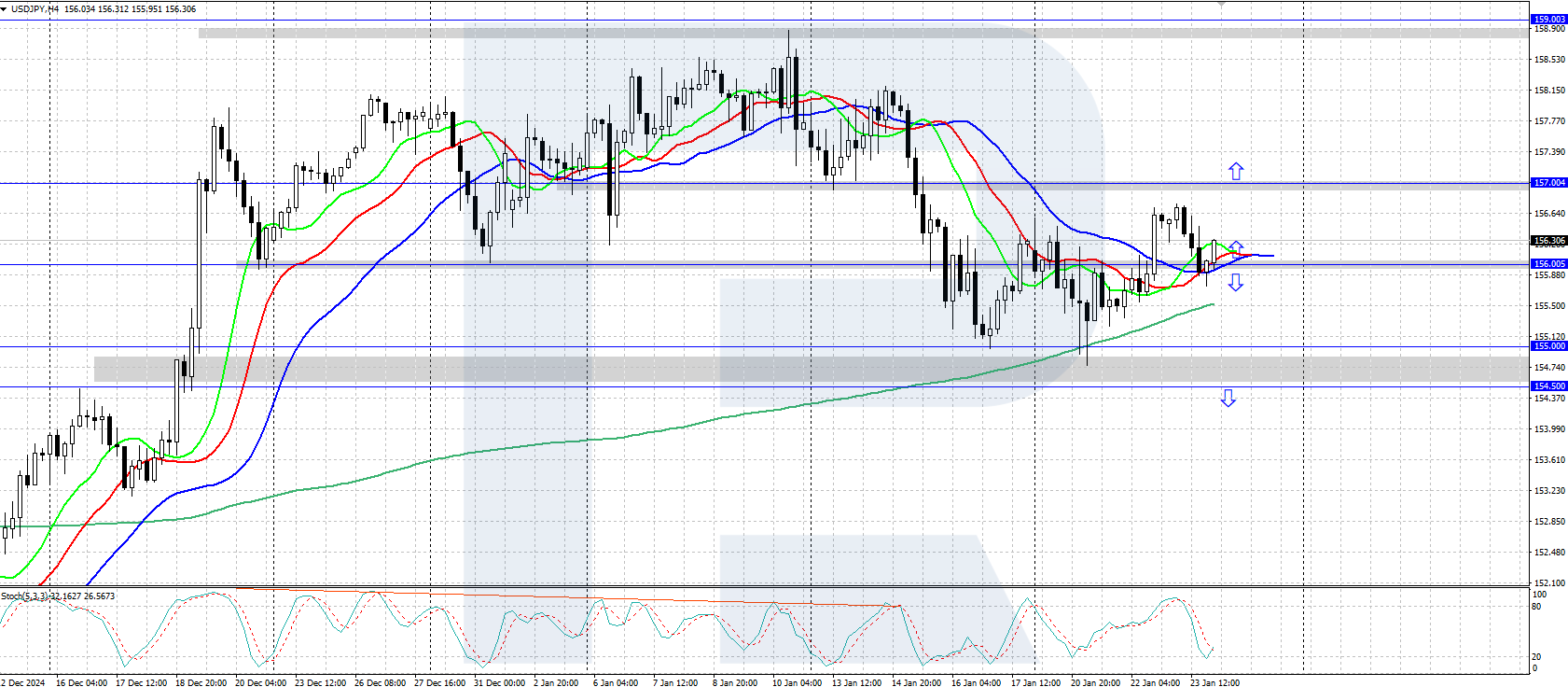

On the H4 chart, the USDJPY pair has formed a sideways consolidation between 155.00 and 157.00, with market participants awaiting the Bank of Japan rate decision. The direction of the price movement out of this range will determine further prospects for the pair’s moves.

Today’s USDJPY forecast suggests that the pair has the potential for growth to the 157.00 resistance level and above if the bulls hold the quotes above 156.00. Conversely, if the bears gain a foothold below 156.00, the price could decline to the 154.50-155.00 support area.

Summary

The USDJPY rate is consolidating between 155.00 and 157.00 this week. Today, the pair could see a surge in volatility following the Bank of Japan rate decision and the accompanying statement.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.