USDJPY: yen vs. dollar – a surprise turn after the Fed decision

The US interest rate decision and weaker fundamentals may cause the yen to strengthen and push the USDJPY rate down to the 147.50 support level. Find more details in our analysis for 20 March 2025.

USDJPY forecast: key trading points

- Today is a public holiday in Japan, Vernal Equinox Day

- US existing home sales: previously at 4.08 million, projected at 3.59 million

- The US Leading Economic Index (LEI): previously at -0.3% million, projected at -0.2%

- USDJPY forecast for 20 March 2025: 149.00 and 147.50

Fundamental analysis

The forecast for 20 March 2025 takes into account that despite the holiday in Japan, the yen is strengthening after the Federal Reserve’s interest rate decision and amid expectations of a BoJ rate hike.

US existing home sales show the volume of real estate sold in the previous reporting period. The reading is projected to be 3.59 million, down from the previous 4.08 million. Such figures indicate a decrease in the purchasing power of citizens. Rising food and energy prices also restrain them from buying existing homes. If the actual sales reading is below the forecast, the USDJPY rate could remain within the downward wave.

The US Leading Economic Index is a composite indicator showing future economic trends. It includes 10 key metrics such as jobless claims, construction volume, business activity levels, stock market, and money supply.

The LEI helps forecast recession or economic growth 6-12 months in advance. If the index falls for several consecutive months, this signals a potential economic downturn. Conversely, index growth indicates a stronger economy.

Fundamental analysis for 20 March 2025 takes into account that the index forecast is rather optimistic, suggesting growth to -0.2% from the previous -0.3%. The expected increase is not big, but together with other US economic indicators, it will give the US dollar an opportunity to regain ground.

USDJPY technical analysis

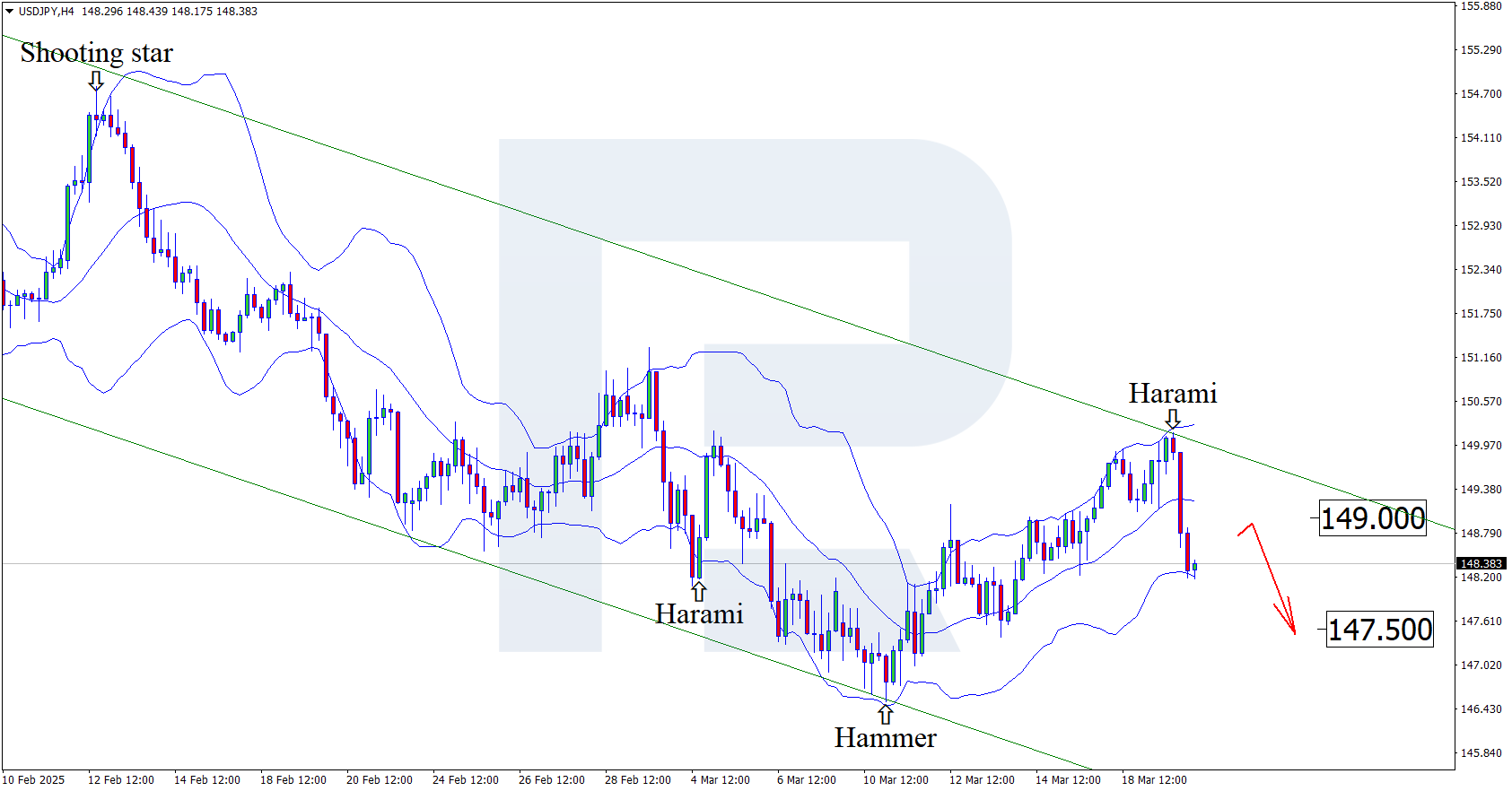

Having tested the upper Bollinger band, the USDJPY price has formed a Harami reversal pattern on the H4 chart. At this stage, it is moving downwards following the pattern signal. Since the quotes have rebounded from the resistance level and continue to move within the descending channel, they are expected to decline further to the support level.

The downside target is the 147.50 level. A breakout below this level could pave the way for a more substantial downward movement.

However, the USDJPY forecast for today also takes into account another scenario, where the price corrects towards 149.00 before a decline.

Summary

The Japanese yen is strengthening despite the public holiday in Japan amid expectations of a BoJ interest rate hike and the Fed’s decision. The US sees a decline in the purchasing power in the secondary housing market, which may add to pressure on the US dollar. The USDJPY technical analysis suggests a continued downtrend, with the price testing the 147.50 support level after the correction is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.