USDJPY rally continues: the yen remains under pressure

The USDJPY pair strengthened to a nine-month high of 154.03 as investors await a new economic stimulus package. Find more details in our analysis for 10 November 2025.

USDJPY forecast: key trading points

- Market focus: the USDJPY pair rose to a nine-month high amid an uncertain rate outlook

- Current trend: the market expects Japan’s cabinet to announce an economic stimulus package

- USDJPY forecast for 10 November 2025: 154.50

Fundamental analysis

The USDJPY rate climbed to 154.03, nearing a nine-month peak. The move comes amid expectations of a large-scale stimulus package from Japan’s new government and the continuation of a loose monetary policy. According to a draft plan, Prime Minister Sanae Takaichi’s cabinet intends to urge the Bank of Japan to give equal weight to economic growth and price stability.

The final version of the package, due to be approved on 21 November, includes tax incentives and investment support for 17 key industries.

The Bank of Japan’s October report notes that the key factor for future policy decisions remains steady wage growth. However, the timing of a possible rate hike remains uncertain, with markets currently suggesting it could occur as early as December.

The USDJPY outlook is positive.

USDJPY technical analysis

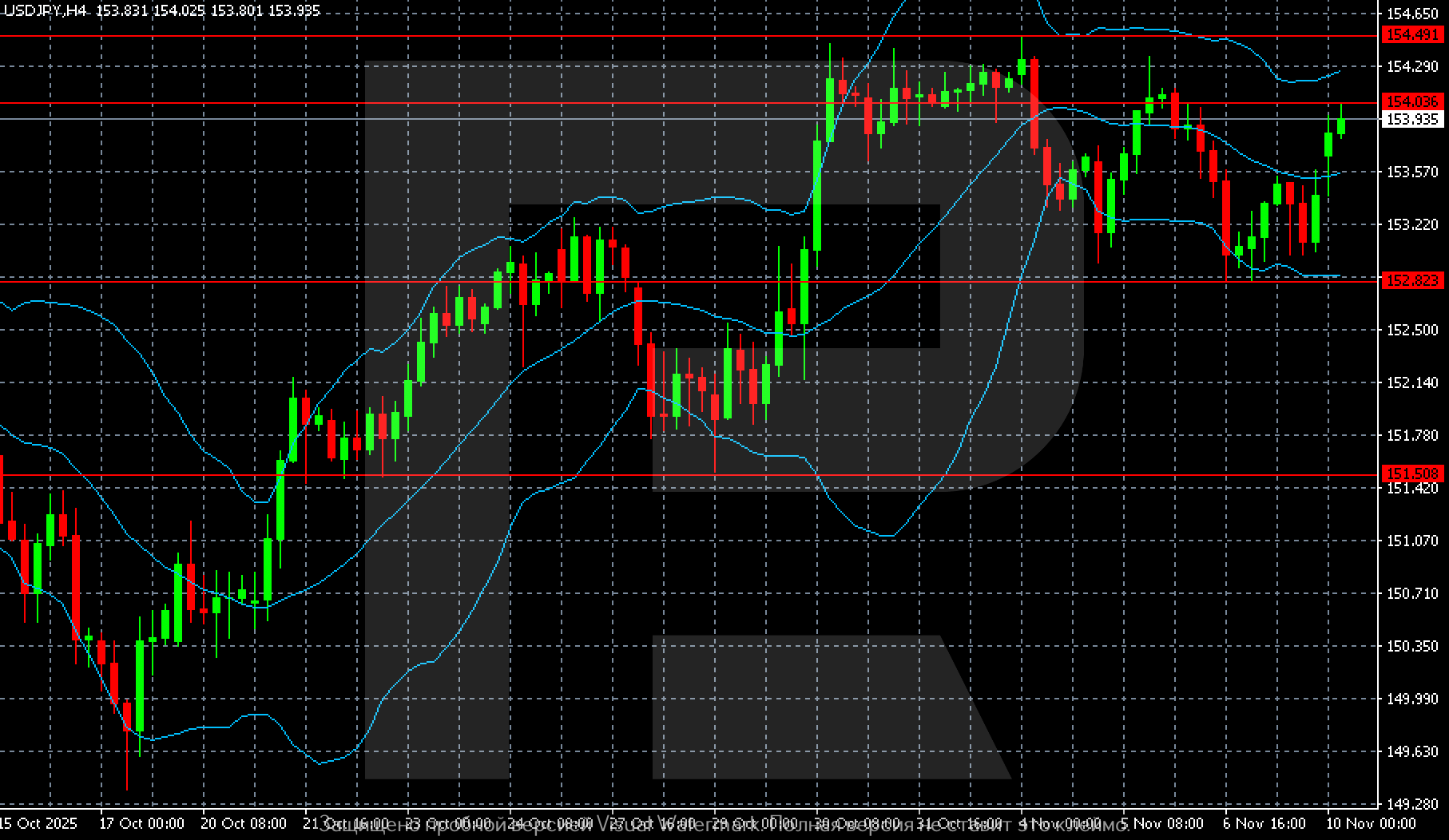

On the H4 chart, the USDJPY pair is consolidating near 153.90–154.00, close to nine-month highs. Following a sharp rally from 151.50 in early November, the price has tested the 154.50 resistance level several times but has yet to break above it.

The nearest support level lies in the 152.80 area, followed by 151.50, the previous local low. Bollinger Bands are narrowing, reflecting decreased volatility after the recent upward impulse. Indicators confirm a consolidation phase: the price is moving along the middle Bollinger Band, signalling equilibrium between buyers and sellers.

A breakout above 154.50 would open the way towards 155.00–155.40, while a drop below 152.80 would indicate a deeper correction towards 151.50.

Summary

The USDJPY technical outlook remains moderately bullish, with the uptrend remaining intact. The USDJPY forecast for today, 10 November 2025, anticipates an attempt to break above 154.50.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.