USDJPY to edge higher as rate debates do not help the yen

The USDJPY pair is poised to climb, hovering near 154.46 as Prime Minister Sanae Takaichi calls for keeping interest rates low. Find out more in our analysis for 14 November 2025.

USDJPY forecast: key trading points

- Market focus: the USDJPY pair is ready to resume growth after a brief correction

- Current trend: Japanese authorities urge the BoJ to maintain low interest rates

- USDJPY forecast for 14 November 2025: 154.70 and 154.80

Fundamental analysis

The USDJPY rate remains volatile, trading near 154.46 at the end of the week.

The initial optimism following the reopening of the US government quickly faded amid concerns about overvalued artificial intelligence-related companies and more cautious expectations for a Federal Reserve rate cut.

Domestically, pressure increased after comments from Prime Minister Sanae Takaichi, who urged the Bank of Japan to keep rates low despite signals from the regulator hinting at a potential rate hike in the near future.

The USDJPY outlook is neutral.

USDJPY technical analysis

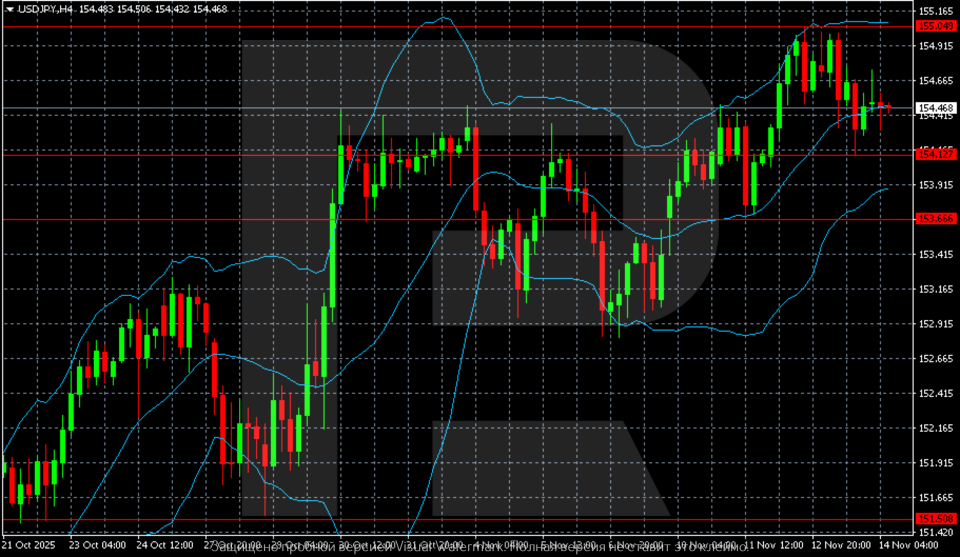

On the H4 chart, the USDJPY pair remains within an uptrend, although recent sessions have seen a moderate correction after testing the local high around 155.00–155.05.

A series of small declining candlesticks from this area indicates profit-taking and a weakening momentum. The nearest support zone lies around 154.10–154.15, where the price has repeatedly found footing within Bollinger Bands. A stronger support level is located near 153.65, aligning with the lower boundary of the recent consolidation range.

The overall structure remains bullish, with the price hovering in the upper half of Bollinger Bands, and the middle line moving higher. A return above 154.70–154.80 would increase the likelihood of another test of the 155.00 level, while a breakout below 153.65 could open the way for a deeper correction.

Summary

The USDJPY pair may resume growth. The USDJPY forecast for today, 14 November 2025, suggests an advance to 154.70 and potentially to 154.80.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.