USDJPY awaits the Fed decision

The USDJPY pair is forming a correction ahead of the Fed’s interest rate decision, with the price testing the 156.00 level. Discover more in our analysis for 9 December 2025.

USDJPY forecast: key trading points

- US JOLTS job openings: previously at 7.227 million, projected at 7.200 million

- Markets await the Fed’s interest rate decision

- USDJPY forecast for 9 December 2025: 156.70 and 155.35

Fundamental analysis

The number of job vacancies in the US labour market, known as JOLTS job openings, is generally a positive factor for the US dollar. It is a monthly report that covers open positions in sectors such as trade, manufacturing, and office services. This indicator reflects the number of vacancies remaining unfilled on the last business day of the month.

The report is published by the US Bureau of Labor Statistics and is based on the Job Openings and Labor Turnover Survey (JOLTS), in which employers assess staff levels, vacancies, hiring, and layoffs at their enterprises. The data is analysed and published monthly with breakdowns by industry and region.

Today’s USDJPY forecast suggests that the actual value may decrease to 7.200 million. A reduction in job openings is interpreted as a positive factor for the US dollar.

Expectations surrounding the Fed’s interest rate decision add some instability, but given that markets have long priced in a likely rate cut, increased volatility after the release may not materialise.

USDJPY technical analysis

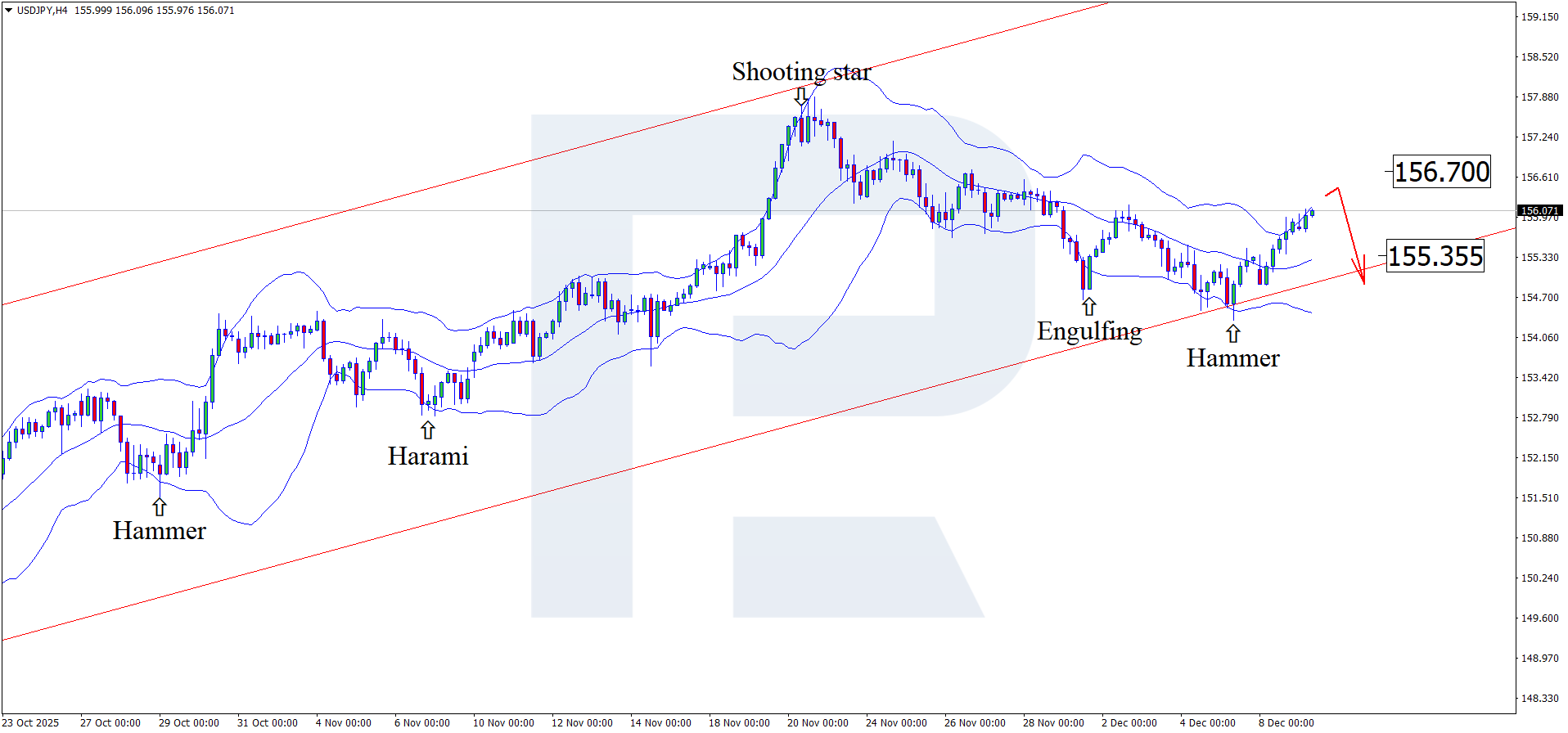

On the H4 chart, the USDJPY pair has formed a Hammer reversal pattern near the lower Bollinger Band and is now trading around 156.00. At this stage, the price may continue its upward wave following the pattern’s signal, with an upside target at 156.70.

At the same time, the USDJPY forecast also considers an alternative scenario in which the price dips towards 155.35 without testing the resistance level.

Summary

A decline in US job openings partially supports the USD. The USDJPY technical analysis suggests a corrective move towards 156.70 before a decline.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.