The final chord of 2025: can the BoJ trigger a USDJPY sell-off

The USDJPY pair continues to decline, with quotes hovering around the 155.00 level. Details — in our analysis for 15 December 2025.

USDJPY forecast: key trading points

- The yen is awaiting the interest rate decision

- Rising unemployment in the US could further weaken the USD

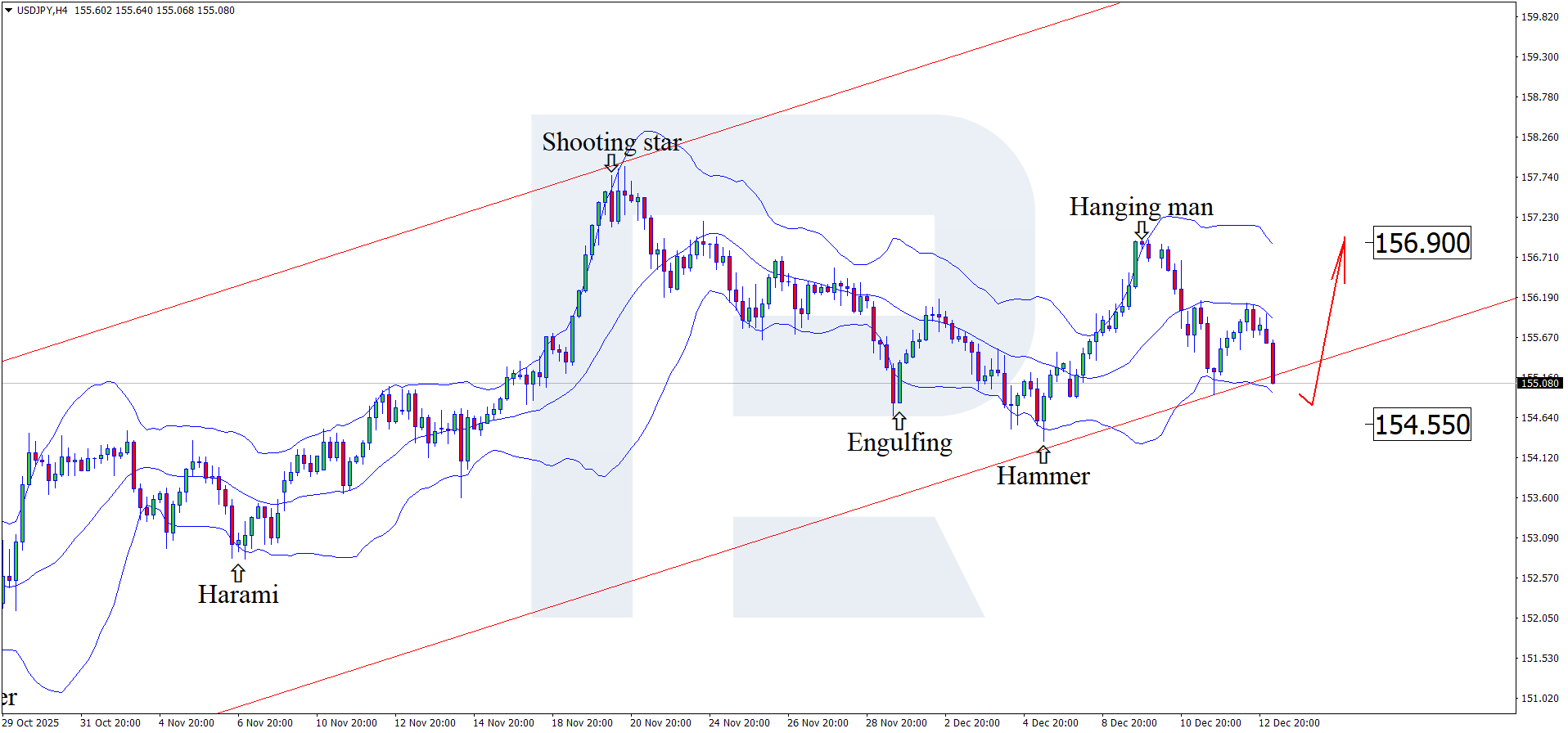

- USDJPY forecast for 15 December 2025: 154.55 and 156.90

Fundamental analysis

The outlook for 15 December 2025 appears fairly optimistic for the JPY. The USDJPY pair is forming a corrective wave and is trading near the 155.00 level.

The Japanese yen is strengthening amid incoming data and growing expectations that the Bank of Japan will shift toward a more restrictive monetary policy, which is increasing demand for the JPY. Investors are focused on upcoming BoJ decisions, actions by the world’s major central banks, as well as key US economic data scheduled for release this week.

The USDJPY forecast takes into account that if unemployment in the United States continues to rise, this — combined with other economic indicators — could further weaken the USD against the yen.

On Friday, 19 December, the Bank of Japan will publish its interest rate decision. Current forecasts suggest that the rate may remain unchanged at 0.5%. However, the Bank of Japan could deliver a surprise and raise the rate toward the end of 2025, thereby strengthening the yen.

USDJPY technical analysis

On the H4 chart, USDJPY formed a Hanging Man reversal pattern near the upper Bollinger Band and is trading around the 155.00 level. At this stage, the pair may continue its downward wave as part of the pattern’s signal, with the downside target at 154.55.

At the same time, today’s USDJPY forecast also considers an alternative scenario, in which quotes rise toward the 156.90 level without testing the support area.

Summary

Ahead of economic data from the US and Japan, the yen continues to strengthen. Technical analysis of USDJPY suggests a decline in quotes toward the support level at 154.55.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.