The rate was raised, but the yen didn’t react: USDJPY continues to rise

The Bank of Japan raised the interest rate to 0.75%, but this has so far failed to support the yen. USDJPY quotes are trading around the 156.00 level. Details — in our analysis for 19 December 2025.

USDJPY forecast: key takeaways

- Bank of Japan interest rate decision: previous value – 0.5%, actual – 0.75%

- US Core PCE Price Index: previous value – 2.8%, forecast – 2.7%

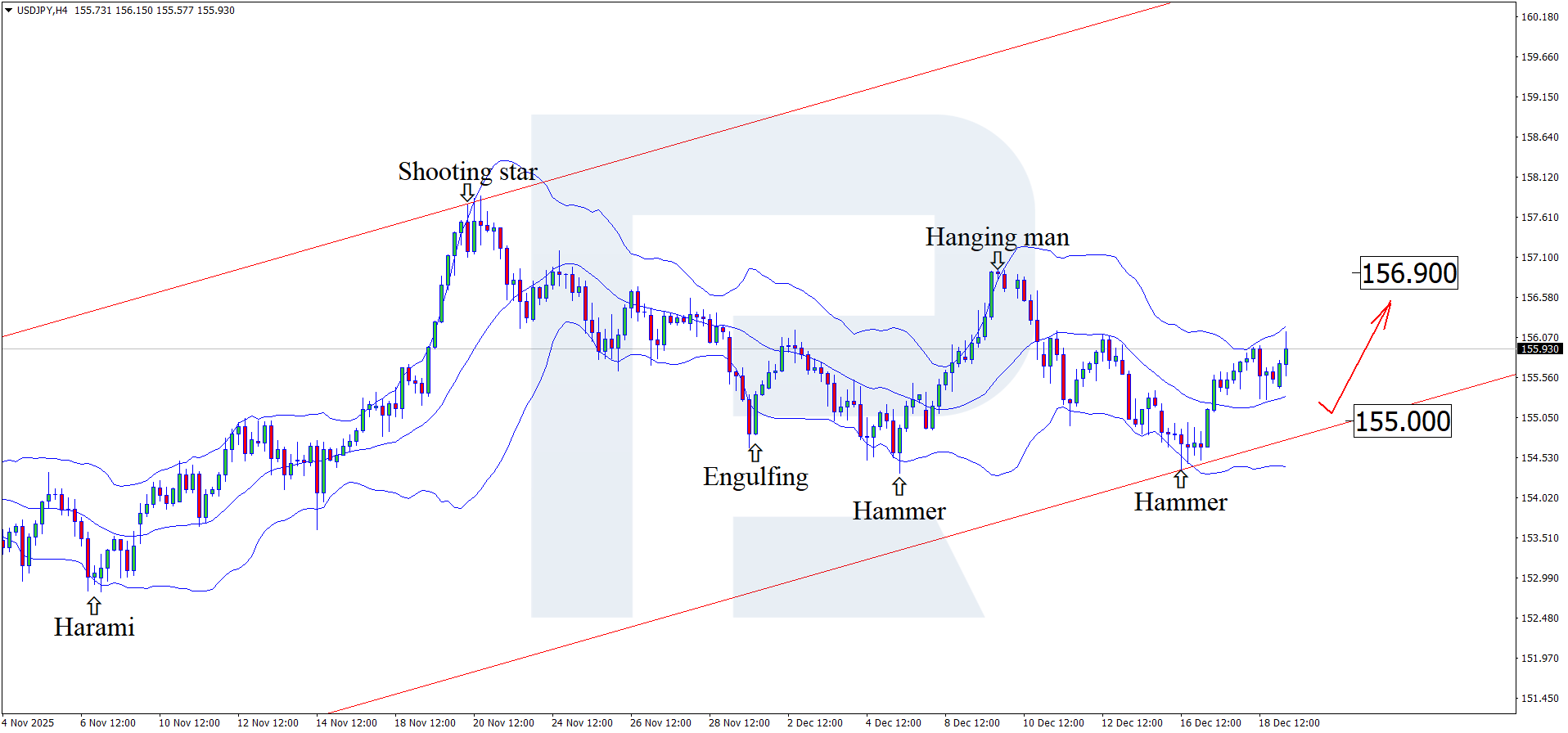

- USDJPY forecast for 19 December 2025: 156.90 and 155.00

Fundamental analysis

The outlook for 19 December 2025 does not appear optimistic for the JPY. The USDJPY pair is forming an upward wave and is trading around the 156.00 level.

The Japanese yen continues to lose ground despite the tightening of monetary policy by the Bank of Japan (BoJ), which raised the interest rate to the expected level of 0.75%. The previous rate hike took place on 24 January 2025, after which the BoJ kept the rate unchanged at 0.5% for six consecutive meetings. By the end of the year, the rate has finally been increased, which may eventually improve the chances of yen strengthening and boost demand for JPY.

The US Core Personal Consumption Expenditures Price Index (Core PCE Price Index) reflects changes in the cost of a basket of goods and services actually consumed by households in the United States. This indicator is widely known as the PCE deflator and is used to assess underlying inflation trends in the economy.

Unlike several other inflation measures, Core PCE is based on a broader consumption framework. It includes both actual household spending and imputed costs, covering durable and non-durable goods as well as a wide range of services. At the same time, food and energy prices are excluded due to their high volatility, which may distort the overall inflation picture.

The USDJPY forecast for today takes into account that US Core PCE may decline to 2.7% from the previous 2.8%. While the projected decrease is not critical, weaker-than-expected data could pressure the US dollar and trigger a pullback in USDJPY.

USDJPY technical analysis

On the H4 chart, USDJPY has formed a Hammer reversal pattern near the lower Bollinger Band and is currently trading around the 156.00 level. At this stage, the pair may continue its upward wave as part of the pattern’s completion, with the growth target at 156.90.

At the same time, the USDJPY forecast also considers an alternative scenario in which prices decline toward the 155.00 level.

Summary

Despite the tightening of monetary policy by the Bank of Japan, the yen continues to lose ground. Technical analysis of USDJPY suggests a potential rise toward the 156.90 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.