Downward pressure on USDJPY intensifies: BoJ hints at policy tightening

USDJPY continues to decline as the Japanese yen strengthens amid signals from the Bank of Japan pointing to a potential tightening of monetary policy. The current price is 155.72. Details — in our analysis for 24 December 2025.

USDJPY forecast: key takeaways

- Minutes from the BoJ meeting indicated the regulator’s readiness for further monetary policy tightening

- Members of the Bank of Japan’s board agreed that real interest rates remain low

- USDJPY forecast for 24 December 2025: 154.45

Fundamental analysis

USDJPY has been declining for the third consecutive trading session after reversing from the key resistance level at 157.65. The Japanese yen is receiving support following the release of the minutes from the Bank of Japan’s October meeting, which signaled the regulator’s readiness to continue tightening monetary policy.

BoJ officials expressed concern that a weaker yen could intensify inflationary pressure through rising import costs. Although the central bank kept the interest rate unchanged at 0.5% at the end of October, discussions during the meeting showed that conditions for a further rate hike continue to take shape.

Members of the Bank of Japan’s board generally agreed that real interest rates remain low. If positive economic growth prospects are confirmed, the central bank intends to continue raising rates. The USDJPY forecast for today suggests that downward pressure on the pair will persist, with risks of further decline.

USDJPY technical analysis

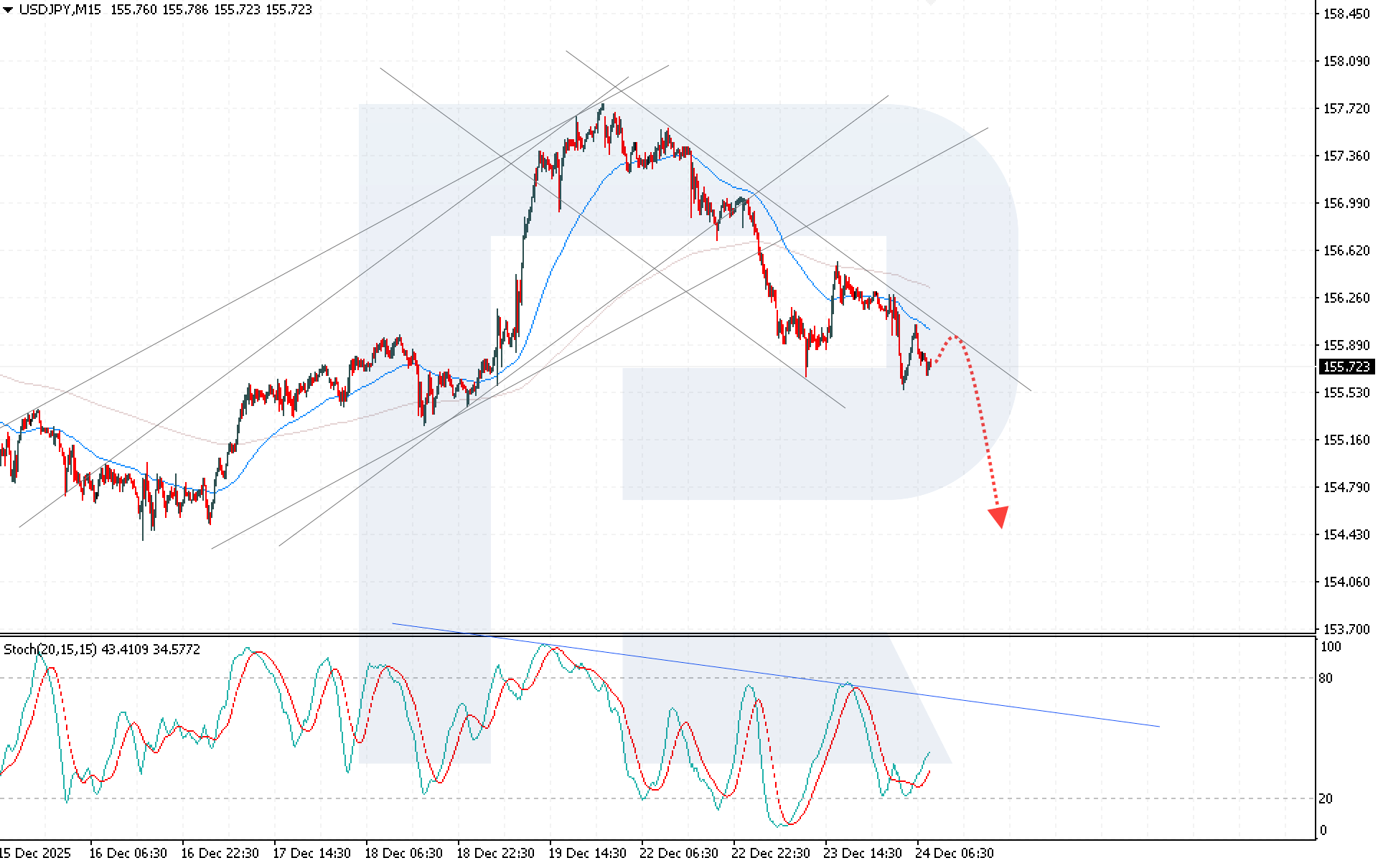

USDJPY quotes continue to move lower within a formed bearish channel. Sellers are confidently holding the price below the EMA-65, indicating the persistence of bearish momentum. The USDJPY forecast for today points to a continuation of the decline toward the 154.45 level.

Additional confirmation of the bearish scenario comes from the Stochastic Oscillator: its signal lines have turned after rebounding from the oversold area and are approaching the descending resistance line, indicating renewed selling pressure.

A sustained break below the 155.55 support level would strengthen sellers’ positions and confirm the potential for further development of the downward move.

Summary

The USDJPY pair continues to face pressure amid signals from the Bank of Japan pointing to a possible continuation of monetary policy tightening, which keeps the risk of further declines elevated. Technical analysis of USDJPY indicates the persistence of a bearish trend and a high probability of continued price declines toward 154.45.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.