Fed vs BoJ: policy divergence impacts USDJPY

The yen has made another attempt to strengthen against the USD, with USDJPY quotes trading around the 156.00 level. Details — in our analysis for 30 December 2025.

USDJPY forecast: key takeaways

- U.S. Initial Jobless Claims: previous value — 214K, forecast — 227K

- The market is awaiting January macroeconomic data

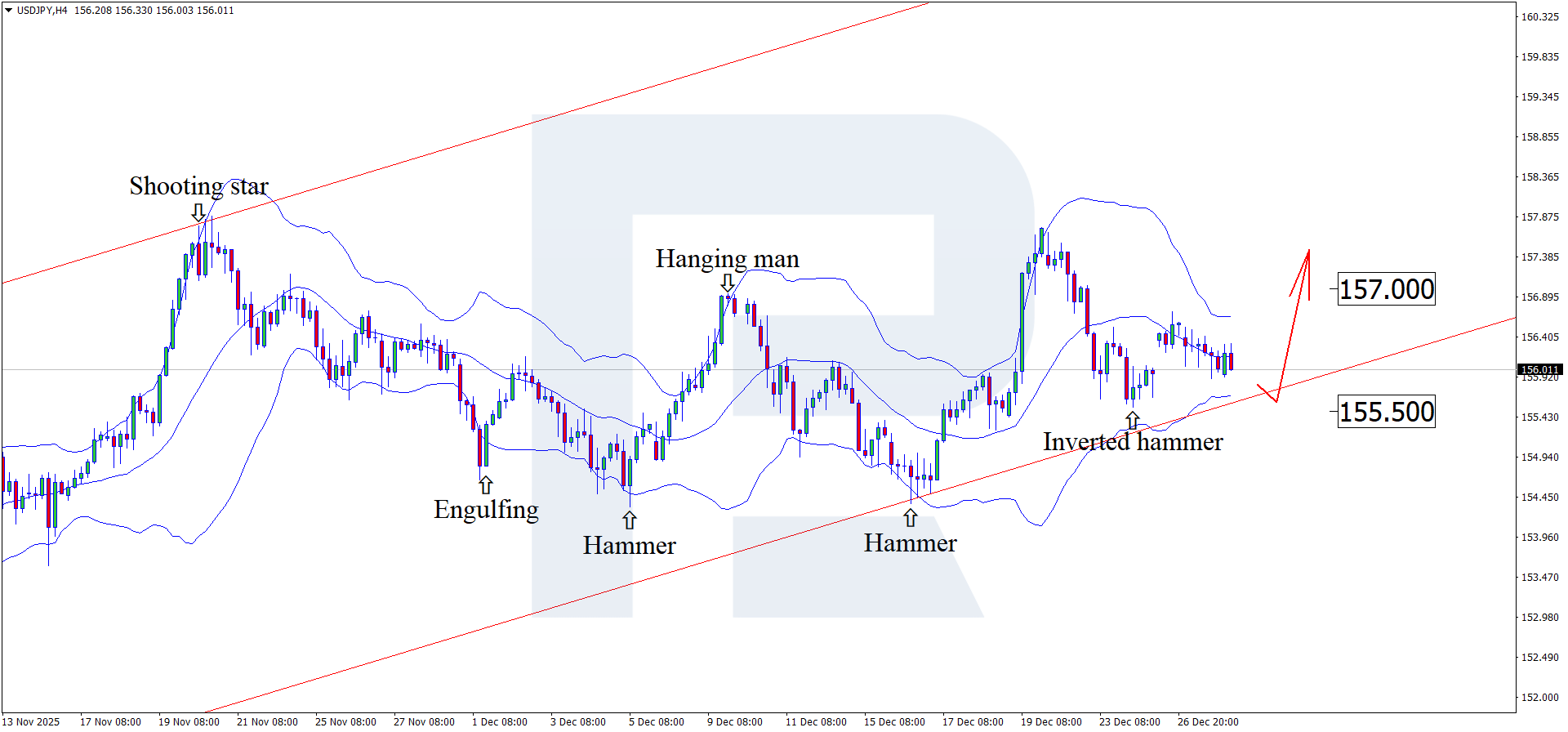

- USDJPY forecast for 30 December 2025: 155.50 or 157.00

Fundamental analysis

The outlook for 30 December 2025 appears optimistic for the JPY. The USDJPY pair is forming a corrective wave and is trading around the 156.00 level.

According to forecasts, U.S. Initial Jobless Claims may rise to 227K, compared to the previous reading of 214K. While the increase is modest, an actual figure worse than expected could further weaken the USD and trigger continued downside in USDJPY.

Key drivers influencing USDJPY dynamics:

- The market is operating in a low-liquidity environment: most institutional participants have already completed active trading. Under such conditions, USDJPY becomes sensitive to isolated large transactions, increasing the risk of sharp but technically driven moves without fundamental confirmation.

- The key factor for the pair is the contrast in monetary policy stances. The Federal Reserve is perceived by the market as a regulator preparing for easing in 2026, while the Bank of Japan, despite its cautious approach, has already taken steps toward tightening. This limits the upside potential of USDJPY and supports demand for the yen during pullbacks.

- USDJPY remains closely correlated with U.S. Treasury yields. Any decline in yields increases pressure on the dollar and creates conditions for JPY strengthening, especially amid a lack of fresh economic data.

- Ahead of year-end, investors are reducing risk exposure and partially returning to the yen as a safe-haven currency. This does not form a sustainable trend but increases the probability of downward waves in USDJPY.

- The market has effectively entered a wait-and-see mode ahead of January U.S. data and signals from the Fed. Until new guidance emerges, USDJPY movements may remain unpredictable.

USDJPY technical analysis

On the H4 chart, USDJPY formed an Inverted Hammer reversal pattern near the lower Bollinger Band and is currently trading around the 156.00 level. At this stage, the pair may continue developing an upward wave as part of the pattern’s realization, with 157.00 acting as the upside target.

At the same time, the USDJPY forecast also considers an alternative scenario, in which quotes decline toward 155.50 before resuming growth.

Summary

Amid declining trading volumes ahead of the calendar year-end, the yen continues attempts to strengthen. Technical analysis of USDJPY suggests a correction toward the 155.50 support level before a potential recovery.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.