USDJPY maintains bullish structure despite correction

The USDJPY pair is entering a correction phase amid political changes in Japan, with the rate currently at 156.42. Find more details in our analysis for 9 February 2026.

USDJPY forecast: key takeaways

- The yen strengthened amid political factors

- Japan’s economic outlook index rose to 50.1 from 49.5 in December

- USDJPY forecast for 9 February 2026: 158.35

Fundamental analysis

The USDJPY pair turned lower after rising for six consecutive trading sessions. Buyers failed to break above the 157.35 resistance level, after which initiative shifted to sellers, who are attempting to consolidate below the 156.45 support level, forming technical conditions for a corrective move. The Japanese yen strengthened on political factors after the ruling Liberal Democratic Party, led by Prime Minister Takaichi, won a historic victory, securing two-thirds of the seats in the lower house of parliament.

The election outcome strengthened expectations of a more accommodative fiscal policy. These expectations reduced uncertainty in Japan’s financial markets and stabilised investor sentiment, which had been under pressure in recent weeks due to risks associated with rising public debt.

The corporate trends index showed improvement due to expanding activity in the non-manufacturing sector, while the labour market continued to weaken. The economic outlook index rose to 50.1 from 49.5 in December, reflecting expectations for an economic recovery amid persistent inflation risks.

Technical outlook

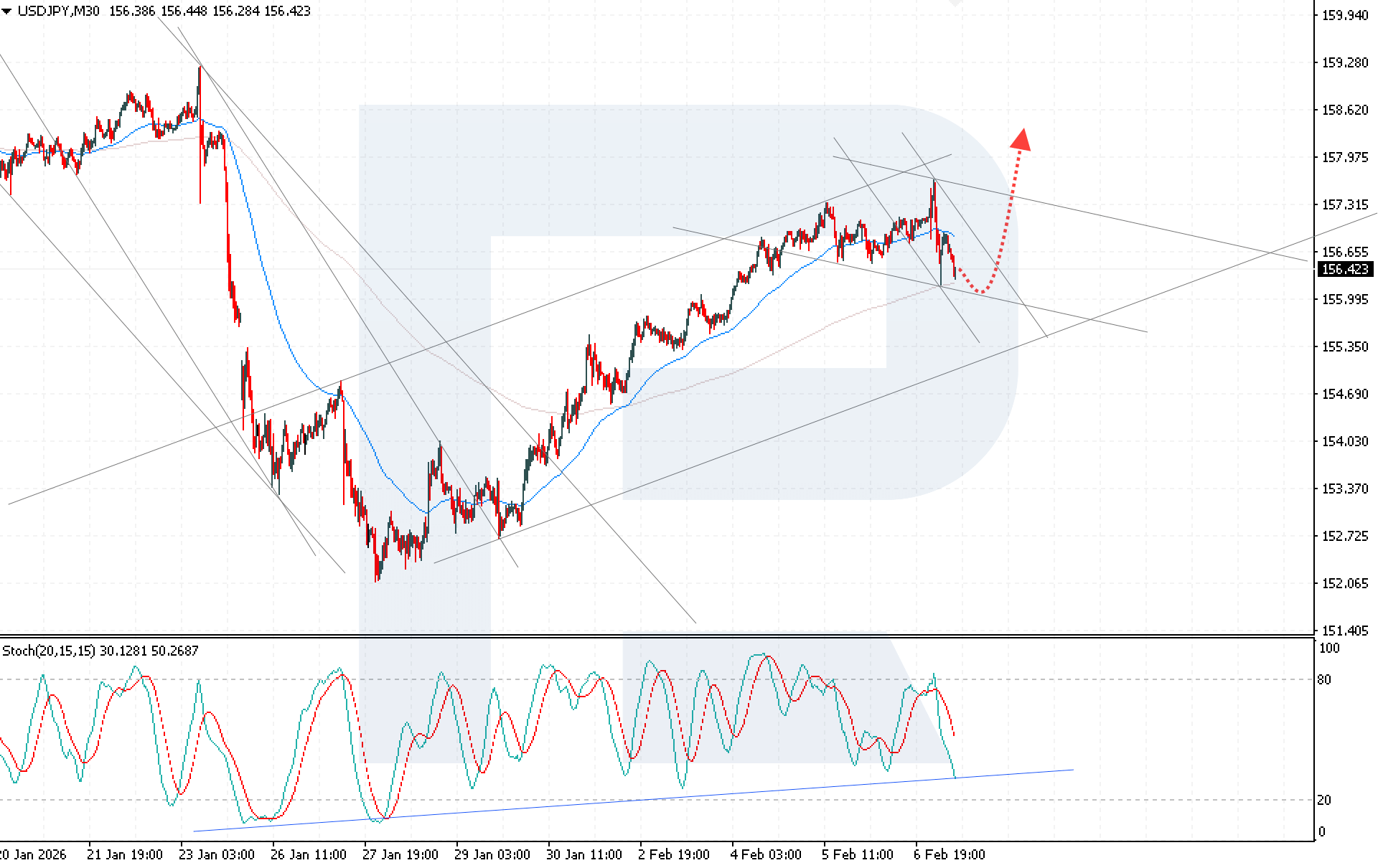

USDJPY quotes are developing a corrective move, but buyers are keeping the price within the bullish channel. Despite ongoing pressure from sellers, the pair remains above the EMA-285, preserving a medium-term bullish technical picture.

The USDJPY forecast for today suggests renewed growth after a rebound from the lower boundary of the descending corrective channel, with a target in the 158.35 area. The Stochastic Oscillator further confirms the bullish scenario. Its signal lines have bounced from overbought territory and are moving towards the support line, increasing the likelihood of an upward momentum.

The key technical condition for this scenario is consolidation above the 156.75 resistance level. This signal would confirm a breakout above the upper boundary of the corrective channel and significantly increase the probability of reaching the target of 158.35.

USDJPY overview

- Asset: USDJPY

- Timeframe: M30 (Intraday)

- Trend: bullish

- Key resistance levels: 157.35 and 158.65

- Key support levels: 156.45 and 155.35

USDJPY trading scenarios for today

Main scenario (Buy Stop)

A resumption of growth with consolidation above 156.75 would confirm a breakout above the upper boundary of the corrective channel and indicate renewed bullish momentum. The risk-to-reward ratio exceeds 1:3. The growth potential is about 160 pips with a risk of around 50 pips.

- Take Profit: 158.35

- Stop Loss: 156.25

Alternative scenario (Sell Stop)

A breakout below the lower boundary of the descending channel with consolidation below 155.85 would indicate increasing bearish pressure and trigger a deeper correction in the pair.

- Take Profit: 154.65

- Stop Loss: 156.25

Risk factors

Increasing corrective pressure as prices consolidate below the 156.45 level could trigger a deeper decline and a breakdown of the bullish technical structure. An additional risk to the bullish momentum is fundamental support for the yen amid political stability and expectations of loose fiscal policy in Japan.

Summary

Fundamental factors are providing short-term support to the yen and increasing the risks of a deeper correction. However, USDJPY technical analysis indicates that the potential for renewed growth remains if the price consolidates above 156.75, with a target at the 158.35 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.