USDJPY plummets, driven by Japanese spending and a weak US dollar

The USDJPY pair fell to 153.64 on Wednesday, with the yen supported by Japan’s spending reforms. Discover more in our analysis for 11 February 2026.

USDJPY forecast: key takeaways

- The USDJPY pair is rapidly losing ground due to factors supporting the yen

- Weak US statistics have strengthened the trend

- USDJPY forecast for 11 February 2026: 152.40

Fundamental analysis

The USDJPY rate continues to decline, moving towards 153.64. The Japanese yen has gained nearly 2% over the past two sessions, driven by optimism surrounding Prime Minister Sanae Takaichi’s economic program. The approach could accelerate economic growth and create room for further Bank of Japan rate hikes.

Following a decisive victory in the general election, Takaichi received a mandate to increase budget spending and cut taxes, and also reiterated her intention to suspend the 8% sales tax on food products for two years.

Markets currently assume that the proposed measures will not lead to a significant deterioration in the country’s fiscal position. This has supported Japanese stocks and the yen and has also helped to stabilise government bonds.

An additional strengthening factor has been concerns that Japanese authorities may intervene to curb speculative selling in the currency market.

An external driver was the weaker US dollar following the release of soft macroeconomic data, which increased expectations of Federal Reserve rate cuts.

The USDJPY forecast is negative.

Technical outlook

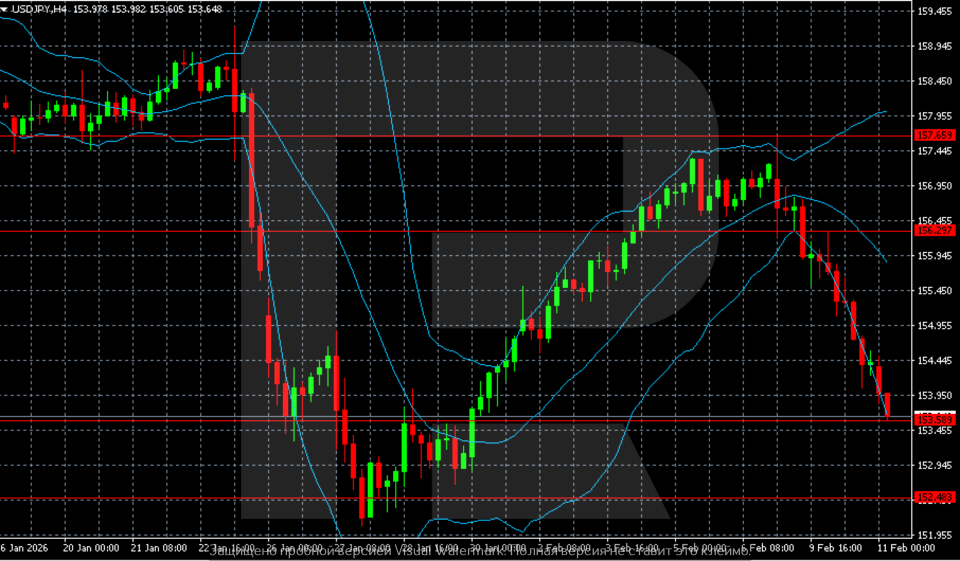

On the H4 chart, after rising in early February, the USDJPY pair formed a local high near 157.60–157.70, where strong resistance is located. A confident decline began from this area.

The price moved below the middle Bollinger Band, and the bands expanded downwards, indicating strengthening bearish momentum and rising volatility. The recent candlesticks are predominantly bearish, with the price reaching new local lows.

Currently, quotes are testing support around 153.50–153.60, with the next demand zone located near 152.40–152.50. As long as the price remains below 156.30, the structure remains bearish. A move back above 156.30 would be the first signal of weakening downward pressure.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 156.30 and 157.70

- Key support levels: 153.50 and 152.40

USDJPY trading scenarios for today

Main scenario (Sell Stop)

Sustained pressure below 156.30 confirms the dominance of the bearish structure. A breakout and consolidation below the 153.50–153.60 zone will strengthen downward momentum and open the way to the next target at 152.40. The risk-to-reward ratio exceeds 1:3 if the move develops towards the lower boundary of the nearest demand zone.

- Take Profit: 152.40

- Stop Loss: 154.20

Alternative scenario (Buy Stop)

A return above 156.30 will be the first sign of easing pressure and indicate the likelihood of a corrective recovery towards 157.70. However, this scenario is viewed as a temporary rebound within the broader downtrend.

- Take Profit: 157.70

- Stop Loss: 155.60

Risk factors

The bearish scenario for the USDJPY pair is supported by expectations of increased fiscal stimulus in Japan and the weakness of the US dollar as the likelihood of Federal Reserve rate cuts grows. As long as the price remains below 156.30, sellers keep the upper hand, with the risk of a deeper decline towards 152.40.

Summary

The USDJPY pair is plunging on expectations of the impact of increased budget spending in Japan. The USDJPY forecast for today, 11 February 2026, does not rule out a decline towards 152.40.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.