USDJPY declines: why the yen continues to strengthen despite strong US data

Positive US economic data, including Nonfarm Payrolls, failed to support the USD. The USDJPY pair continues to decline and may reach the 151.50 level. Discover more in our analysis for 12 February 2026.

USDJPY forecast: key takeaways

- US continuing jobless claims: previously at 1.844 million, projected at 1.850 million

- Nonfarm Payrolls: previously at 48 thousand, currently at 130 thousand

- USDJPY forecast for 12 February 2026: 151.50

Fundamental analysis

The outlook for 12 February 2026 does not appear optimistic for the USD. The USDJPY pair has been forming a downward wave for the fourth consecutive session and may continue to decline, currently trading around 153.10.

US continuing jobless claims reflect the total number of individuals who have reapplied for unemployment benefits. Fundamental analysis for 12 February 2026 suggests that claims may rise to 1.850 million from the previous 1.844 million, which does not look positive for the US dollar. The actual figure may differ from the forecast, but if it comes in worse than the previous reading, it would negatively impact the USD.

A key factor supporting the yen is a certain anomaly: the yen is strengthening even as US economic indicators improve, and the dollar received support from strong NFP data.

The yen may continue to appreciate in the near term despite rumours of a possible intervention planned by the Bank of Japan with support from the Federal Reserve.

Technical outlook

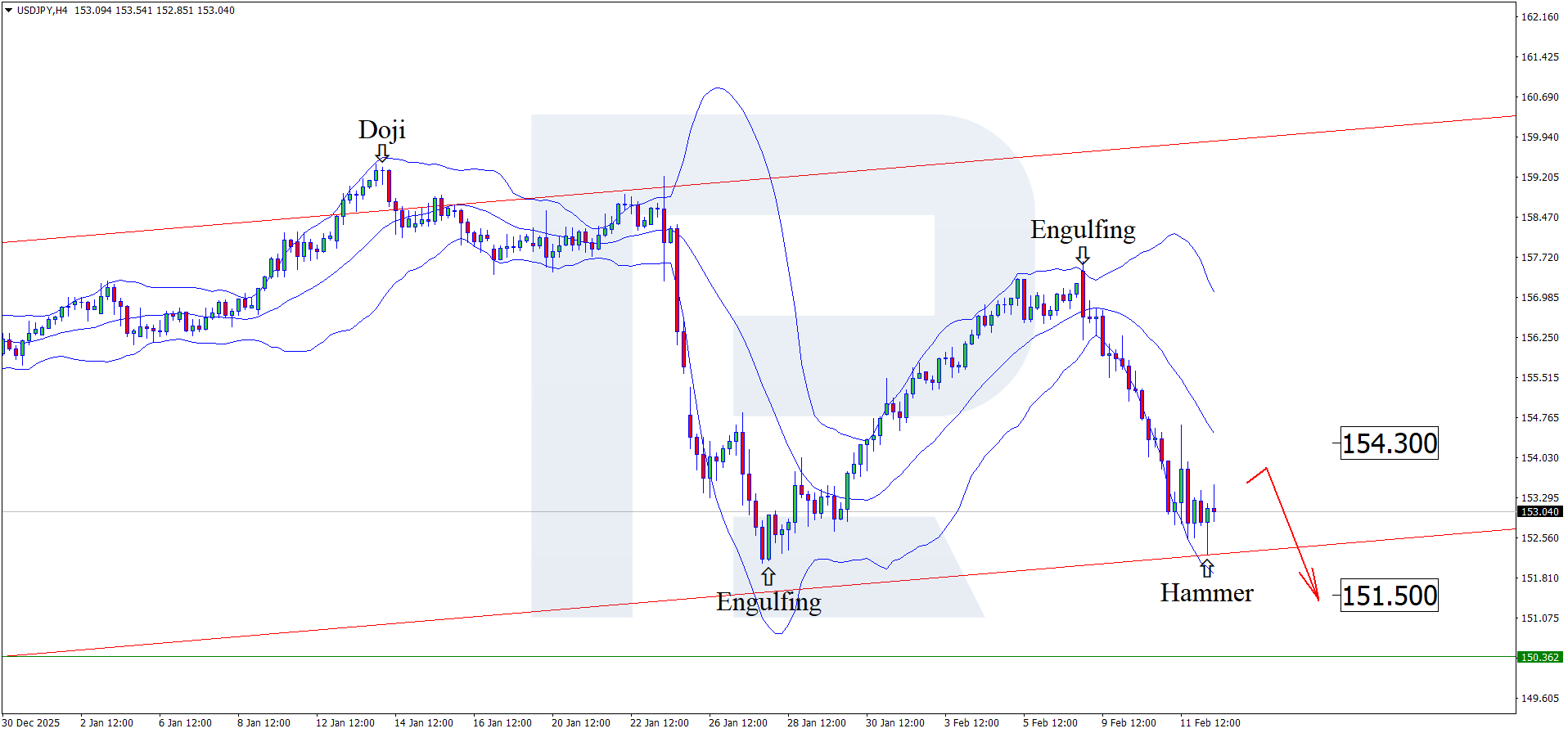

On the H4 chart, the USDJPY pair has formed a Hammer reversal pattern near the lower Bollinger Band and is currently trading around 153.00. At this stage, the pair may form a corrective wave following the pattern’s signal, with a potential rebound target at 154.30.

However, the USDJPY forecast also considers an alternative scenario, in which the pair declines directly towards 151.50 without a correction.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 154.30 and 157.30

- Key support levels: 151.50 and 150.30

USDJPY trading scenarios for today

Main scenario (Sell Stop)

A breakout below the lower boundary of the ascending channel and consolidation below 152.10 will strengthen the bearish momentum and open the way towards the next target at 150.35. The risk-to-reward ratio exceeds 1:2 as the price moves towards the lower boundary of the nearest demand zone.

- Sell Stop: 151.50

- Take Profit: 150.35

- Stop Loss: 152.00

Alternative scenario (Buy Stop)

A return above 156.30 would be the first signal of easing bearish pressure and would indicate a potential corrective recovery towards 157.70. However, this scenario is considered a temporary rebound within the broader downtrend.

- Take Profit: 157.70

- Stop Loss: 155.60

Risk factors

The bearish USDJPY scenario is supported by expectations of increased fiscal stimulus in Japan and the weakness of the US dollar as the likelihood of Federal Reserve rate cuts grows. As long as the price remains below 153.00, sellers retain control, with the risk of a deeper decline towards 151.30.

Summary

The USD continues to lose ground despite positive news. Technical analysis of USDJPY suggests further downside, with the first target at 151.50.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.