The Swiss franc stabilises: it is time for a correction

The USDCHF pair has initiated a correction, moving away from a three-month high. Find out more in our analysis for 19 November 2024.

USDCHF forecast: key trading points

- The USDCHF pair is declining after reaching a three-month high

- The market appears ready for a pause, although the fundamental factor of a strong USD persists

- USDCHF forecast for 19 November 2024: 0.8989

Fundamental analysis

The USDCHF rate fell to 0.8829 on Tuesday.

This development is encouraging for the Swiss franc. Switzerland’s currency, which recently reached three-month lows, is now poised for a correction.

A resilient and confident US dollar is the primary negative catalyst for the CHF. There was pressure earlier, but it intensified significantly when Donald Trump was elected the next US President. Switzerland’s domestic news has proven insufficient to counteract this pressure.

The USDCHF forecast indicates the potential for a correction.

USDCHF technical analysis

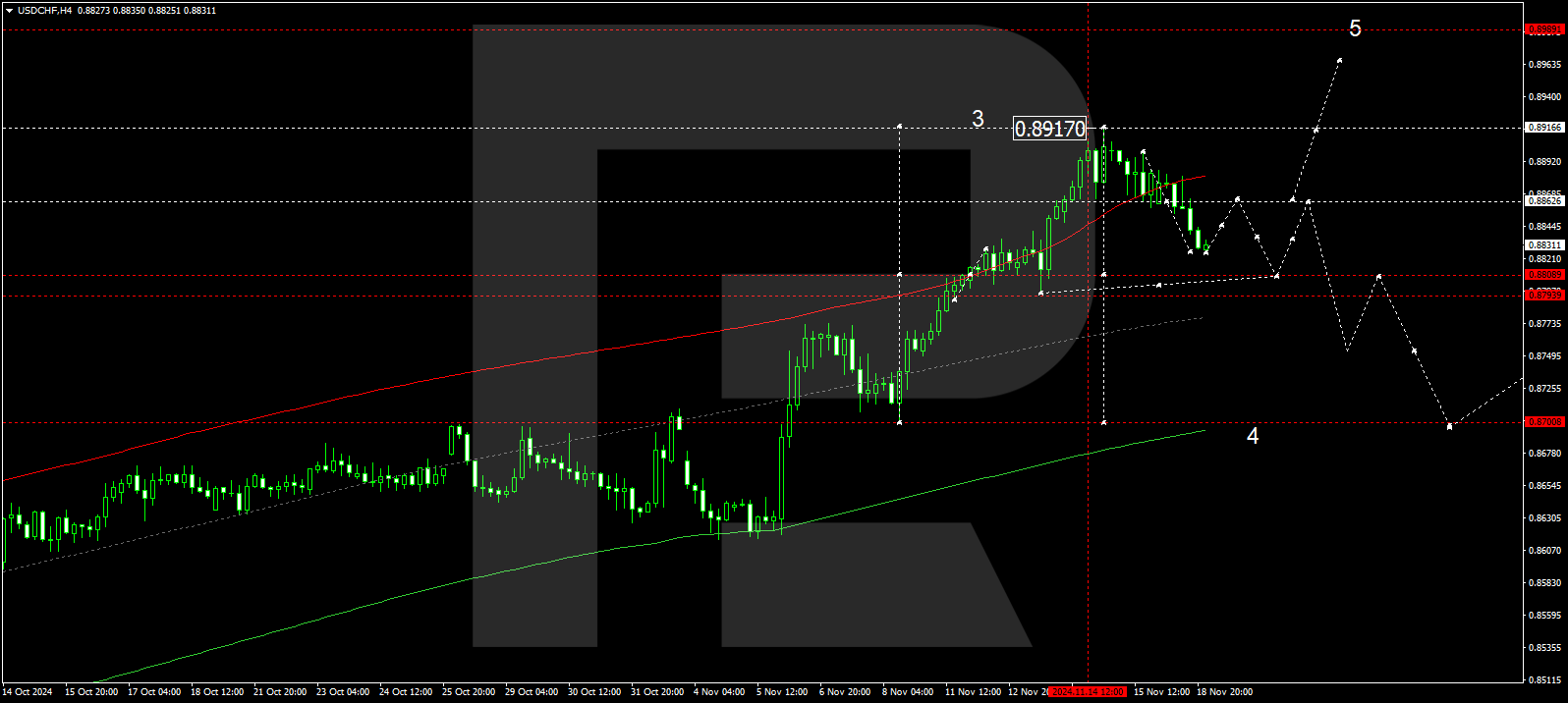

The USDCHF H4 chart shows that the market has completed a correction towards 0.8825. A technical retest of the 0.8866 level is possible today, 19 November 2024. The market is expected to define the boundaries of a consolidation range. A breakout to the downside could extend the correction towards 0.8700, while an upward breakout could open the potential for further growth to 0.8989.

The Elliott Wave structure and wave matrix, with a pivot point at 0.8700, technically support this scenario. This level is considered critical for a growth wave in the USDCHF rate. The market has reached a local target around the upper boundary of a price envelope at 0.8917, then formed a corrective wave to the envelope’s central line at 0.8825. A new consolidation range might develop around this level. A downward breakout could extend the correction to the envelope’s lower boundary at 0.8700, while a breakout above the range could initiate a growth wave towards the envelope’s upper boundary at 0.8989.

Summary

The USDCHF pair is undergoing a corrective decline following its recent surge. Technical indicators for today’s USDCHF forecast suggest the correction may conclude with a growth wave towards the 0.8989 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.