USDJPY: the strong US labour market supports growth in the pair

The USDJPY rate is approaching the 149.35 resistance level amid uncertainty regarding the BoJ policy. Discover more in our analysis for 7 October 2024.

USDJPY forecast: key trading points

- The number of US jobs increased by 254,000 in September, marking the highest gain over the past six months

- The likelihood of a 50-basis-point Federal Reserve interest rate cut decreased to 4.3%

- Japan’s Leading Economic Index fell to its lowest level since October 2020

- USDJPY forecast for 7 October 2024: 145.95, 144.30, and 142.68

Fundamental analysis

The USDJPY rate has decreased significantly since last week’s surge. The yen came under pressure due to statements from Prime Minister Shigeru Ishiba and Economy Minister Ryosei Akazawa, who called for caution regarding further BoJ interest rate hikes, considering the current economic conditions.

The additional weakening of the yen is caused by the strong US employment report released on Friday. The US economy added 254,000 jobs in September, showing the most substantial growth over the past six months and reducing market expectations of a potential significant interest rate cut by the US Federal Reserve. The likelihood of a 50-basis-point cut in November decreased to 4.3%, while the odds of a softer 25-basis-point reduction increased to 95.7%. Such expectations in today’s USDJPY forecast may prompt buyers to break above the 149.35 resistance level.

Japan’s Leading Economic Index, which evaluates the prospects for the months ahead, decreased to 106.7 points in August 2024 from 109.3 in July, reaching its lowest level since October 2020. Japan’s Coincident Index, which includes data such as production output, employment, and retail sales, dropped to 113.5 in August from 117.2 a month earlier, marking the lowest reading since February.

Traders are currently focusing on the upcoming wage data in Japan, which may impact inflationary expectations and the BoJ’s monetary policy.

USDJPY technical analysis

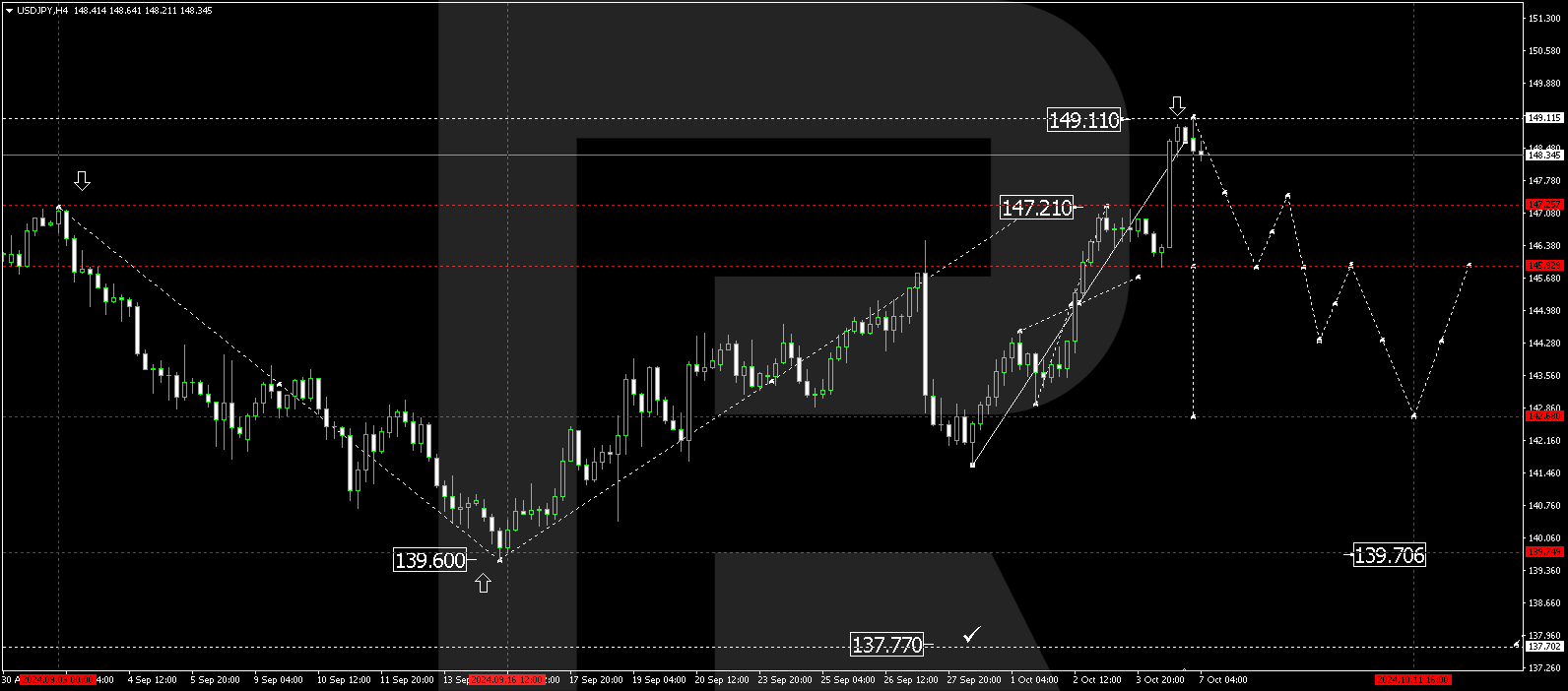

The USDJPY H4 chart shows that the market has formed a consolidation range below 147.21 and has broken upwards, extending it towards 149.11. The USDJPY rate is expected to decline to the range’s lower boundary at 145.95 today, 7 October 2024. A breakout below this level will open the potential for a movement towards 144.30. A breakout below the 145.95 level may be considered a signal for the trend continuing towards 142.68, with the first target of the downward wave at 137.77.

Summary

The current data confirms the economic slowdown in Japan, exerting pressure on the yen and limiting the BoJ’s interest rate hike prospects. At the same time, the strong US labour market reduces the likelihood of a sharp Federal Reserve interest rate cut, supporting the strengthening of the USDJPY rate. Technical indicators in today’s USDJPY forecast suggest a downward wave towards the 145.95, 144.30, and 142.68 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.