USDJPY under pressure: uncertainty about Japan and China intensifies

The USDJPY rate is slightly declining after rising for two trading sessions. Find out more in our analysis for 15 October 2024.

USDJPY forecast: key trading points

- Bank of Japan Governor Kazuo Ueda signals reluctance to raise interest rates, increasing pressure on the yen

- The US Federal Reserve adopts a more moderate approach to interest rate adjustments

- The stimulus plan proposed by the Chinese government left investors unsure about its scope

- USDJPY forecast for 15 October 2024: 150.30, 151.30, and 153.22

Fundamental analysis

The USDJPY rate rebounded from the 149.55 resistance level. Buyers have been attempting to breach it for five trading sessions. Pressure on the Japanese yen persists, given that the Federal Reserve is expected to adopt a more moderate approach to rate cuts at the upcoming meetings.

The yen came under additional pressure after China’s fiscal stimulus plan, announced over the weekend, failed to restore market confidence. Minister of Finance Lan Fo’an stated that state-owned banks will receive additional capital investments to improve stability and serve the real economy more effectively. Measures are also being developed to support the real estate market. However, Fo’an did not disclose the exact amount of spending or details of the stimulus measures, failing to convince market participants and raising additional questions about the size of the support package.

Domestically, dovish signals from Bank of Japan Governor Kazuo Ueda and opposition to further interest rate hikes by new Prime Minister Shigeru Ishiba exerted additional pressure on the USDJPY rate. Earlier this month, Ishiba stated that the current economic conditions may not justify further rate hikes. However, other high-ranking Japanese officials later softened the prime minister’s comments. As part of today’s USDJPY forecast, uncertainty about Japan’s interest rate decision continues to pressure the pair.

USDJPY technical analysis

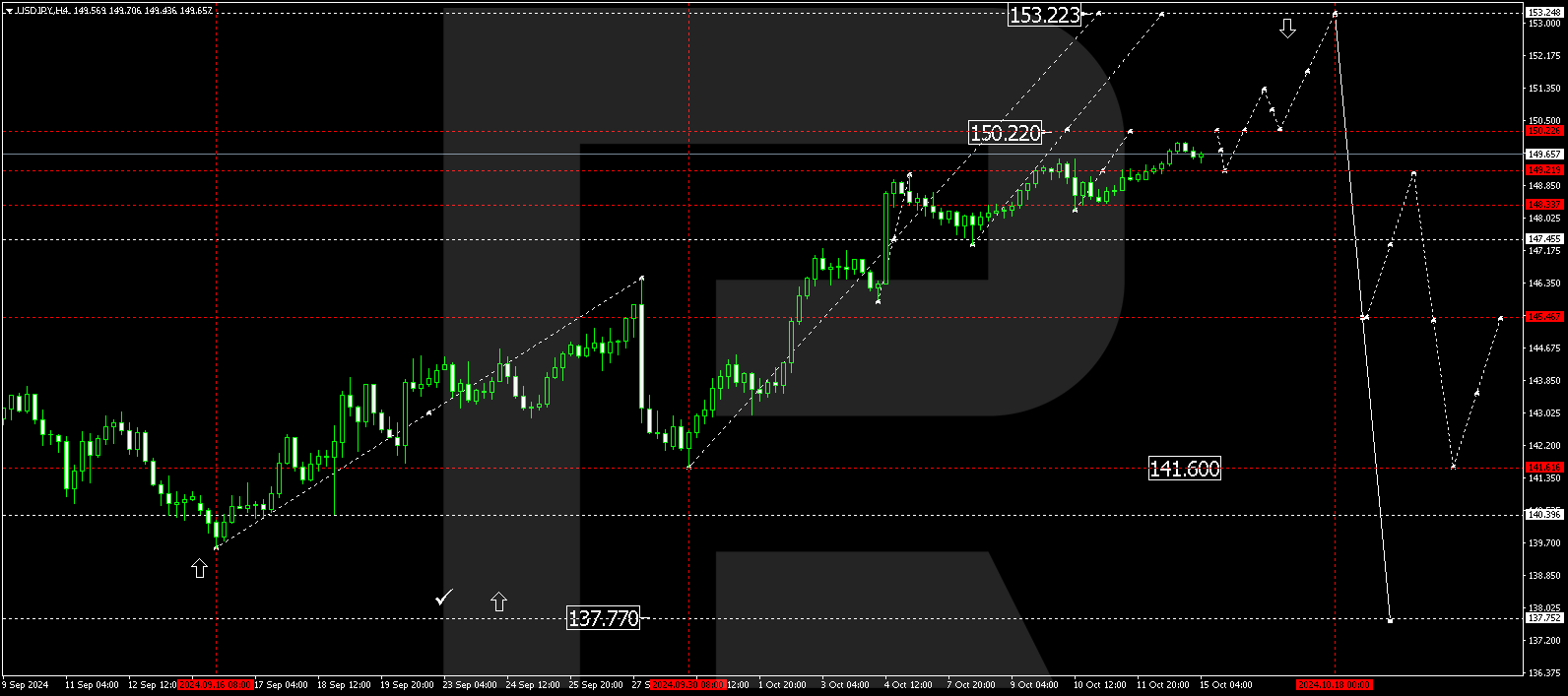

The USDJPY H4 chart shows the market has broken above the consolidation range at 149.30. A growth structure is expected to develop today, 15 October 2024, aiming for 150.20. After reaching this level, the USDJPY rate could decline to 149.30 (testing from above). Subsequently, the growth wave could develop towards 151.30 and potentially further towards 153.22, the local target.

Summary

The USDJPY rate remains under pressure amid uncertainty about the BoJ’s monetary policy and the yen’s weakness due to China’s fiscal stimulus package. Technical indicators in today’s USDJPY forecast suggest further growth towards the 150.30, 151.30, and 153.22 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.