USDJPY remains stable: investors prepare for the Japanese elections

The USDJPY pair has halted its surge. The market preserves strength ahead of political developments. Find out more in our analysis for 25 October 2024.

USDJPY forecast: key trading points

- The USDJPY pair experienced reduced volatility

- Investors await the outcome of the Japanese elections over the weekend

- USDJPY forecast for 25 October 2024: 150.75

Fundamental analysis

The USDJPY rate stabilised around 151.70 on Friday.

Investors are holding back ahead of Japan’s general election this weekend. The baseline forecast suggests that a coalition government could lose its parliamentary majority.

These expectations introduce high uncertainty, further complicating the Bank of Japan’s efforts to normalise monetary conditions.

Tokyo’s core inflation eased to a six-month low in October, reaching 1.8%, below the BoJ’s 2.0% target. According to Japan’s Minister of Finance, a weak yen has diverse effects on the economy, although he refrained from commenting on specific prices and data.

The USDJPY forecast appears cautious.

USDJPY technical analysis

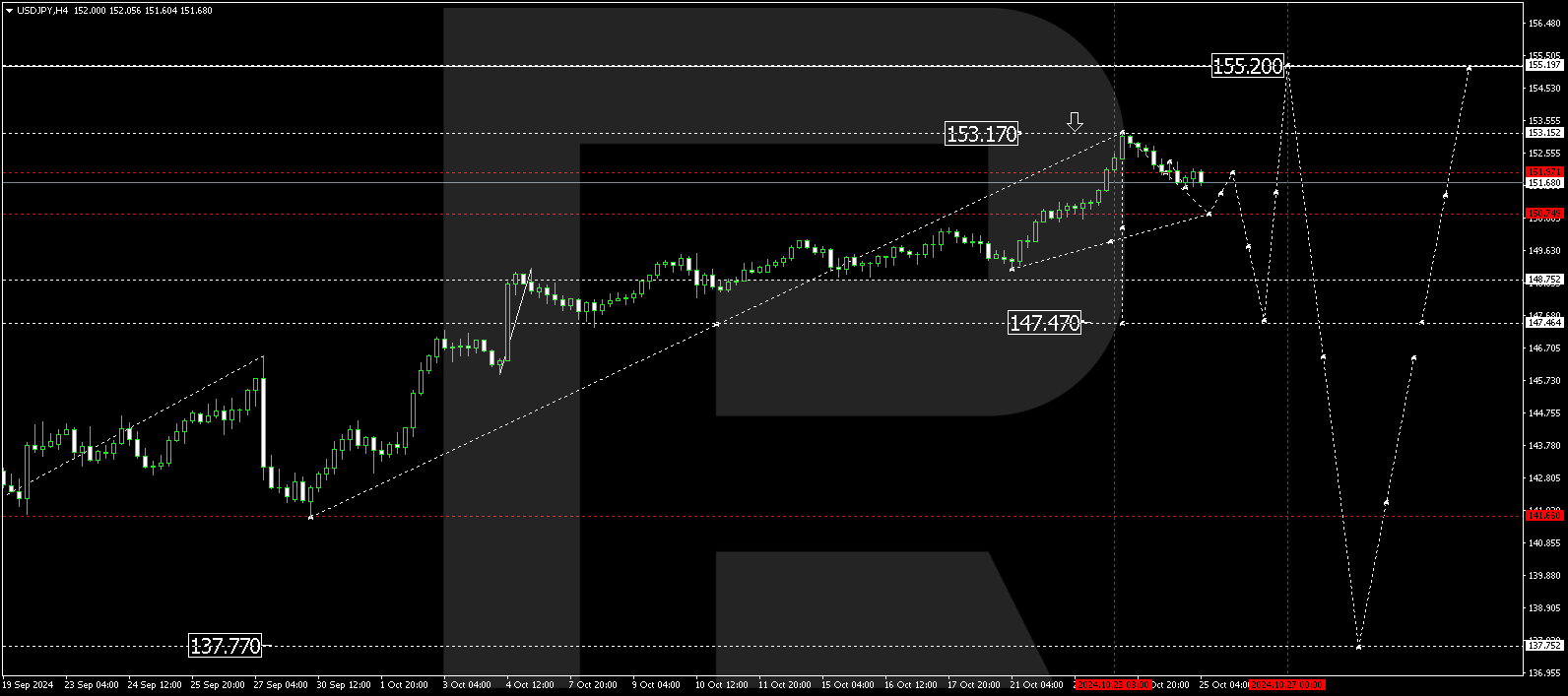

The USDJPY H4 chart indicates that the market continues its downward momentum towards 150.75, the first target. The price is expected to reach this target today, 25 October 2024, before beginning a correction towards 151.97 (testing from below). A consolidation range is forming around the 151.97 level in the USDJPY rate. Once the price hits this level, another downward wave is expected, targeting 148.75 and potentially 147.47.

Summary

The USDJPY pair has undergone a correction and paused. Technical indicators in today’s USDJPY forecast suggest the potential for a continued downward wave towards the 150.75 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.