USDJPY: the US dollar continues to exert pressure on the yen

The decrease in US nonfarm payrolls and the forecast for the unemployment rate are weighing on the US dollar. Find out more in our analysis for 1 November 2024.

USDJPY forecast: key trading points

- Japan’s manufacturing PMI: previously at 49.7, currently at 49.2

- US nonfarm payrolls: previously at 254,000, projected at 106,000

- US unemployment rate: previously at 4.1%, projected at 4.1%

- USDJPY forecast for 1 November 2024: 151.00 and 150.80

Fundamental analysis

The manufacturing PMI measures the activity of purchasing managers in the manufacturing industry. It reflects the state of the industrial sector and the dynamics of manufacturing processes in the country. Traders closely monitor changes in this index, as purchasing managers are the first to receive information about their companies’ performance. This makes the PMI an important indicator for assessing the overall economic situation. Readings above 50.0 indicate increased production, while values below it, point to a downturn.

Japan’s index previously stood at 49.7, while the current reading has decreased by 0.5 points to 49.2. The indicator shows an insignificant decline in production, which may be a negative factor for the yen.

The forecast for 1 November 2024 suggests a decrease in the US nonfarm payrolls to the projected reading of 106,000. This could represent an over 50% decline from the previous value, which will help strengthen the Japanese yen’s position against the USD.

Fundamental analysis for 1 November 2024 shows that the US unemployment rate may remain flat at 4.1%. Together with the decrease in nonfarm payrolls, this could negatively impact the US currency.

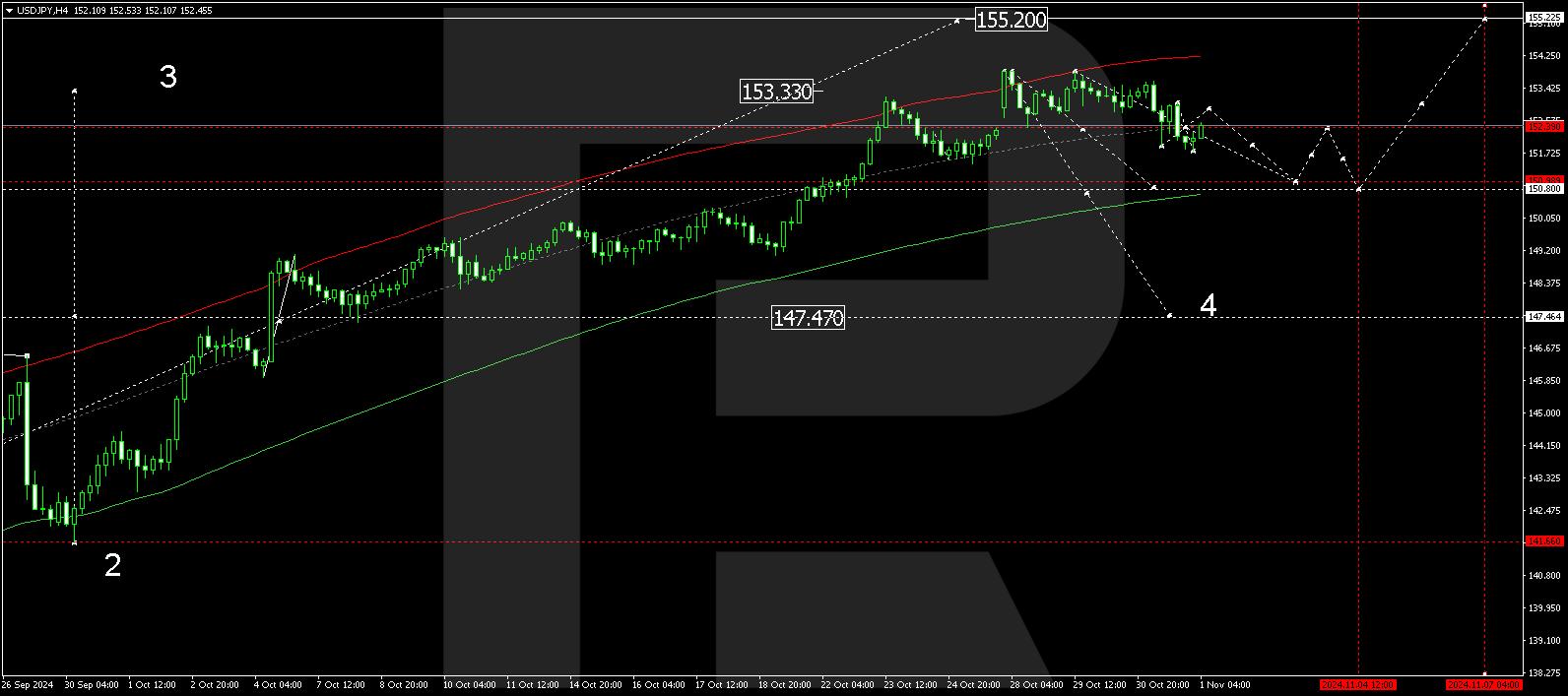

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues to develop a narrow consolidation range around 153.39 without a clear trend. The price may break below the range today, 1 November 2024, aiming for 151.00 and potentially down to 150.80. A further correction is likely. After reaching this level, the price could rise to 151.80 (testing from below). Another corrective wave could then develop, targeting 149.10.

The Elliott Wave structure and corrective wave matrix, with a pivot point at 152.39, technically confirm this scenario for the USDJPY rate. A consolidation range is forming around the central line of the price envelope. A breakout below the range could extend the correction towards the lower boundary.

Summary

The technical and fundamental analyses for today’s USDJPY forecast suggest a potential corrective wave towards the 151.00 and 150.80 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.