USDJPY is at a three-month high: the yen is under pressure from the US dollar

The USDJPY pair is appreciating rapidly, with the yen under pressure from the strong US dollar. Find out more in our analysis for 7 November 2024.

USDJPY forecast: key trading points

- The USDJPY pair has reached a three-month peak

- The market does not rule out the possibility of financial interventions by the Bank of Japan to support the yen

- USDJPY forecast for 7 November 2024: 153.00

Fundamental analysis

The USDJPY rate continues to rally on Thursday, advancing to 154.08.

The yen weakened by nearly 2.0% yesterday as the US dollar surged following Republican Donald Trump’s victory in the US presidential election.

Real wages in Japan fell by 0.1% in September as consumer inflation rose to 2.9%, while nominal wages grew by 2.8%. This complicates the Bank of Japan’s efforts to raise the interest rate.

Investors are concerned about potential financial interventions by the Bank of Japan due to the yen’s rapid depreciation.

The USDJPY forecast remains optimistic.

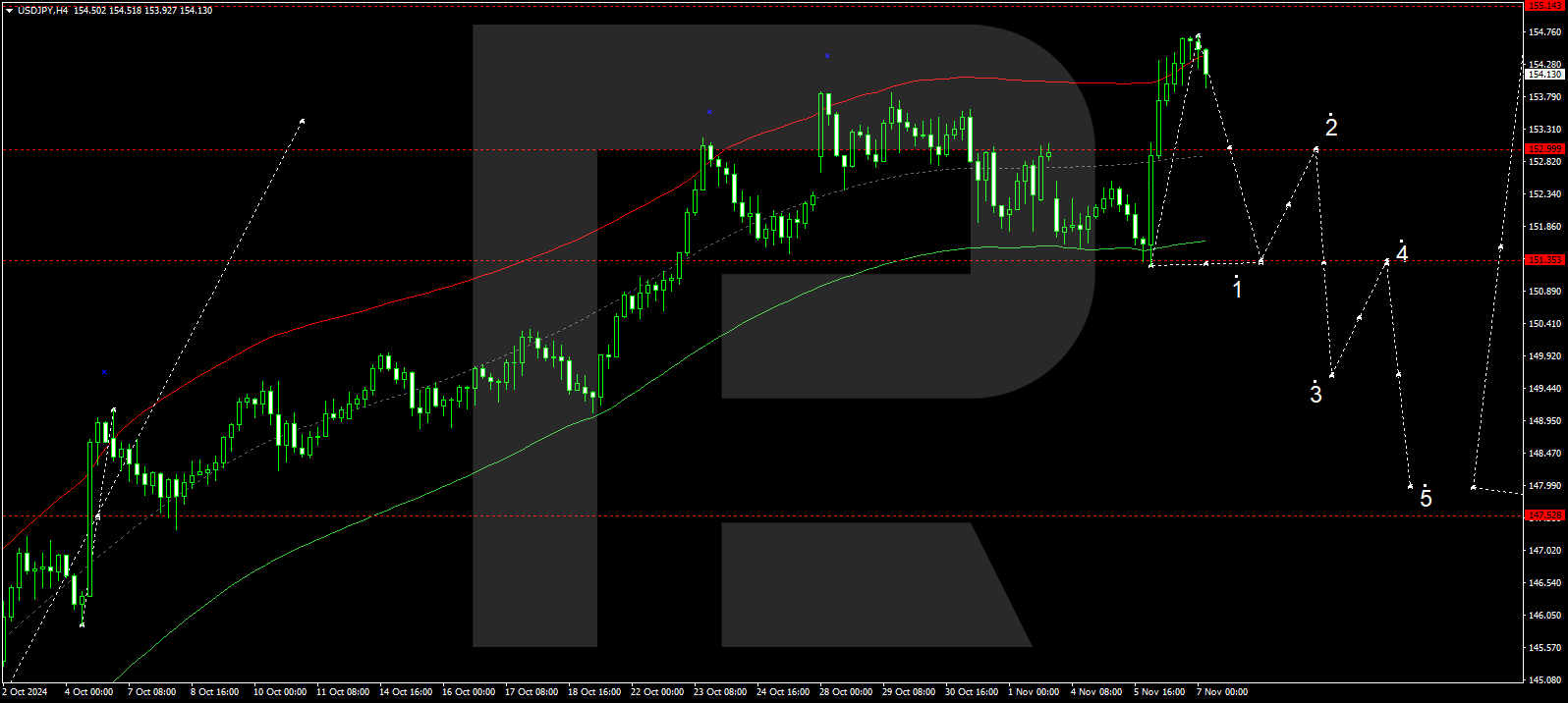

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a growth wave, reaching 154.70, a local target. A consolidation range is forming below this level today, 7 November 2024. A breakout below the range could initiate a downward wave towards 151.35, the first target in the corrective phase. After reaching this level, the price may rise to 153.00. Subsequently, another decline could unfold, aiming for 149.60, with the correction potentially continuing towards at least 148.00.

The Elliott Wave structure and corrective wave matrix, with a pivot point at 151.35, technically confirm this scenario for the USDJPY rate. The market has rebounded from the upper boundary of a price envelope. A downward wave could follow, targeting its centre – 153.00. With a breakout below this level, the downward movement might continue towards the lower boundary of the price envelope at 151.35.

Summary

The USDJPY pair is surging, driven by the strong US dollar. Technical indicators for today’s USDJPY forecast suggest that a corrective wave could develop, aiming for the 153.00 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.