USDJPY: the yen continues its attempts to strengthen

Japan’s household spending is gradually increasing, along with other fundamental indicators, positively impacting the yen. Discover more in our analysis for 8 November 2024.

USDJPY forecast: key trading points

Fundamental analysis

Japan’s household spending index reflects the amount of inflation-adjusted household money spent over the previous reporting period, compared to the corresponding month of the previous year. This includes spending on health care, utility bills, food, accommodation, essential goods, etc. The reading came in at -1.1%. Although the figure remains negative, it has improved from the previous one, which may provide some support for the yen.

Japan’s Leading Economic Index assesses the overall economic climate, combining 12 indicators, including machinery orders and stock exchange prices. A reading below 50.0 shows that most indicators are negative, while a reading above 50.0 suggests positive developments across most indicators.

Fundamental analysis for 8 November 2024 shows that the index currently stands at 109.4, reflecting a rise from the previous period. A high index reading may be one factor contributing to a strengthening yen against the US dollar.

According to the forecast for 8 November 2024, the University of Michigan’s US inflation expectations are anticipated to remain steady at 2.7%. Contrary to earlier expectations, this figure has remained stable at this level for several months, signalling that the US economy is gradually stabilising.

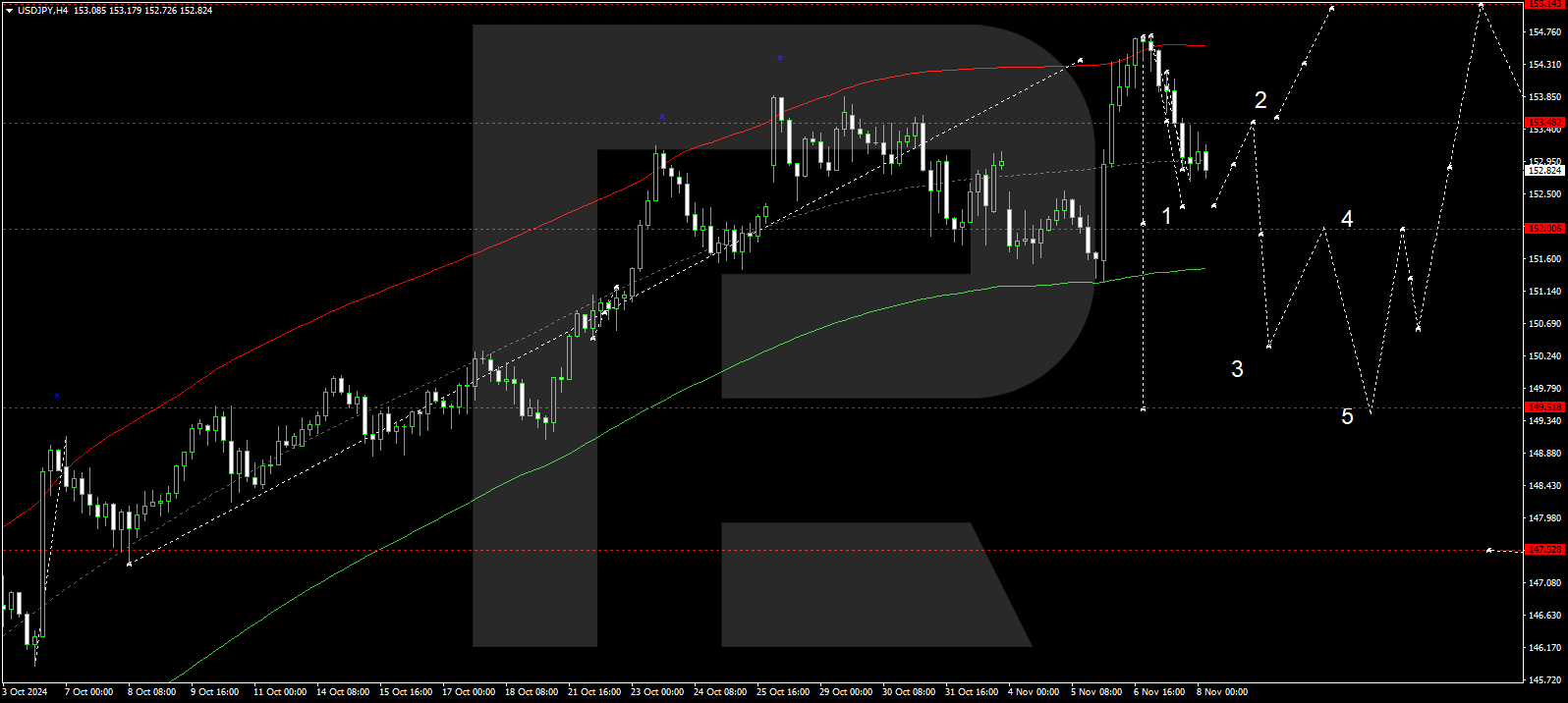

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues to develop a corrective wave towards the first target of 152.32, expected to be reached today, 8 November 2024. The price may rise to 153.48, forming a consolidation range between these levels. A breakout below this range will open the potential for a continued correction towards 150.35 and possibly further down to 149.50. In case of an upward breakout, the price could reach 155.15. Subsequently, a more substantial corrective wave might begin, targeting 147.47.

The Elliott Wave structure and corrective wave matrix, with a pivot point at 152.00, technically confirm this scenario for the USDJPY rate. The market is currently at the central line of a price envelope, where a consolidation range is expected to develop. A break below this range could lead the USDJPY rate towards the envelope’s lower boundary.

Summary

Alongside the technical analysis for today’s USDJPY forecast, the increase in Japan’s economic indicators suggests a potential decline to the 152.32 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.