USDJPY rises for the second day: market preference for the US dollar takes priority

The USDJPY pair is increasing, with renewed interest in the US dollar gaining traction. Find out more in our analysis for 12 November 2024.

USDJPY forecast: key trading points

- The USDJPY pair is rising

- Investors are concerned about the prospects for the Bank of Japan interest rate hikes

- USDJPY forecast for 12 November 2024: 155.00 and 155.15

Fundamental analysis

The USDJPY rate is on the rise, moving steadily towards 153.72.

Investor interest in the US dollar has revived, supported by market expectations of a future rise in US inflation. Sustained economic growth and an aggressive trade policy under Donald Trump’s presidency may push up prices in the country.

In Japan, discussions following the outcome of the BoJ’s October meeting revealed divergent views among policymakers on the timing of the next interest rate increase. Some monetary policymakers voiced concerns that rising global economic uncertainty may prevent the Japanese central bank from raising rates.

However, the Bank of Japan’s baseline forecast remains intact, suggesting that the BoJ may hike its benchmark interest rate to 1.0% annually in the second half of 2025.

The USDJPY forecast remains favourable.

USDJPY technical analysis

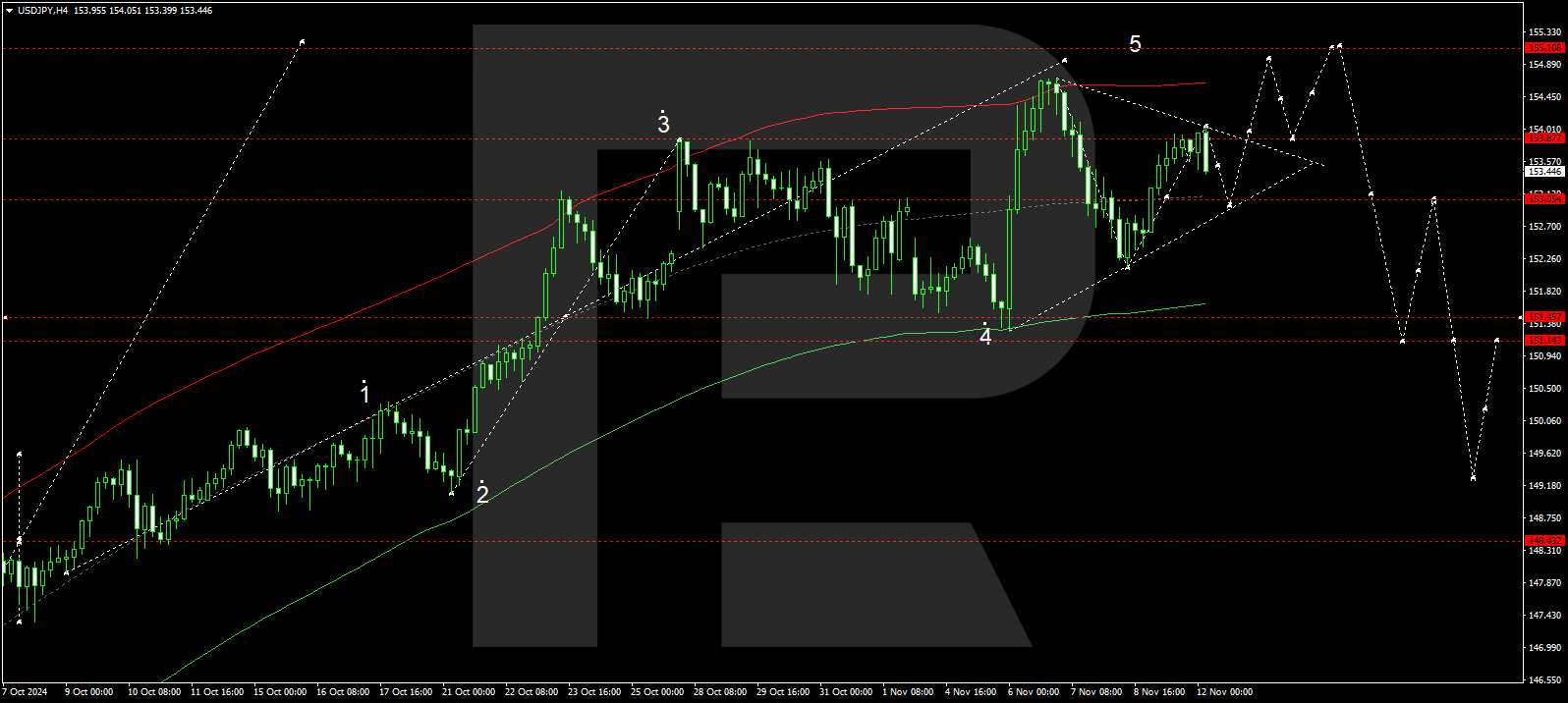

The USDJPY H4 chart shows that the market has completed a wave, reaching 154.05. A decline to 153.05 (testing from above) is expected today, 12 November 2024. After reaching this level, the price could rise to 155.00 and potentially continue the wave to the local target of 155.15. A broad consolidation range has formed at the top of the growth wave at 153.05.

The Elliott Wave structure and growth wave matrix, with a pivot point at 151.44, technically confirm this scenario for the USDJPY rate. The market is currently testing the upper boundary of a price envelope, with the growth wave expected to end at 155.15. If the price rebounds from the envelope’s upper boundary, a corrective matrix is expected to develop, aiming for its lower boundary at 151.44 as the initial target.

Summary

The USDJPY pair remains positive, buoyed by market sentiment favouring the US dollar. Technical indicators for today’s USDJPY forecast suggest that the growth wave may extend to the 155.00 and 155.15 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.